Dairy Revenue Protection (Dairy-RP)

In case you missed it, Curtis Bosma, vice president of producer services with HighGround Dairy, shared “The 5 best practices for Dairy-RP” in the July 19, 2021, issue of Progressive Dairy magazine. Read the article in the online edition.

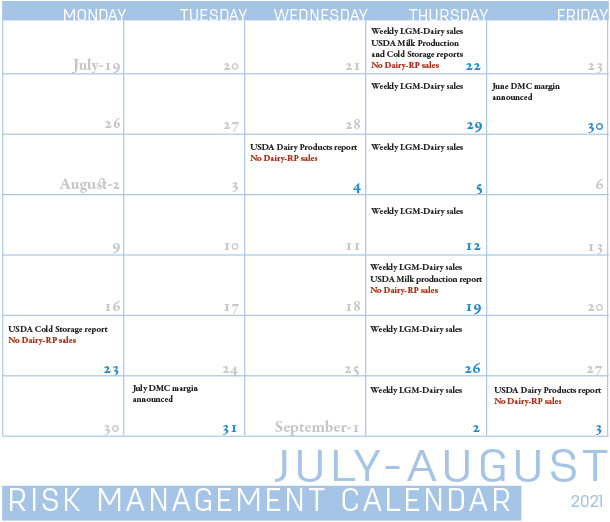

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. Dairy-RP is available every day except holidays and USDA report days that could impact markets (see calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

Click here or on the calendar above to view it at full size in a new window.

Livestock Gross Margin for Dairy (LGM-Dairy)

In July, the USDA’s Risk Management Agency (RMA) opened weekly sales periods for the Livestock Gross Margin for Dairy (LGM-Dairy) program

The price discovery period for LGM-Dairy is Tuesday-Thursday each week. LGM-Dairy factors are calculated using the average closing prices for Chicago Mercantile Exchange (CME) Class III milk, corn and soybean meal futures on those days. The policy sales period will begin on Thursday starting at 4:30 p.m., with sales ending at 9 a.m. (both times Central time) on Friday.

Unlike Dairy-RP, which is not available on the day of USDA’s major dairy reports (Milk Production, Cold Storage or Dairy Products), LGM-Dairy is available each week, even if a sales period falls on the day of a USDA report.

Coverage is available out 12 months, excluding the first month. You need to select coverage in two-month increments to get a USDA RMA premium subsidy.

Premium subsidies range from 18% to 50%. For example, a zero deductible policy has an 18% premium subsidy. A deductible of 50 cents per cwt has a 28% subsidy, and the $1 per cwt deductible has a 48% subsidy. Premiums are due at the end of the coverage period. There are no transaction fees.

LGM-Dairy and Dairy-RP insurance policies are sold and delivered solely through private crop insurance agents. A list of crop insurance agents is available online using the RMA Agent Locator.

DMC supplemental payments, monthly update

We should learn more about supplemental Dairy Margin Coverage (DMC) payments for small and medium producers soon. U.S. Ag Secretary Tom Vilsack previously pledged to provide additional details by mid-August. Last December’s COVID-19 relief bill included language directing the USDA to allow smaller dairy producers to update their milk production history baselines and receive a supplemental DMC payment on a portion of any increased milk production, up to the Tier I cap of 5 million pounds of milk per year. It is anticipated supplemental payments to eligible producers will be retroactive to January 2021 and run through the end of 2023.

- The May DMC milk income over feed cost margin was $6.89 per hundredweight (cwt), a nickel decline from April and the fourth straight month in which the margin was below $7 per cwt. With high feed costs and tight margins, DMC indemnity payments had been distributed every month (January-May) of 2021, totaling $550.7 million as of July 12. Read: DMC margin below $7 for fourth straight month.

- The June 2021 DMC margin and potential indemnity payments will be announced July 30. Based on the USDA DMC Decision Tool, current feed cost estimates indicate an all-milk price near $22 per cwt will still trigger indemnity payments for June and July milk marketings, and price triggers could remain at or above $21 per cwt through November.

- Virginia will reimburse dairy farmers for annual DMC program premium payments. Reimbursements are limited to premiums paid on milk enrolled in Tier I of DMC. Fiscal year program funding is $1 million and will be distributed on a first-come, first-serve basis. Applications will be available this fall and are due by Feb. 1, 2022. Approximately 254 Virginia producers were enrolled in DMC in 2021, covering about 81% of the state’s annual milk production.

Milk, PPDs and more

- The USDA’s June Milk Production report is scheduled for release in the afternoon of July 22 (after the deadline for this article). Check the Progressive Dairy website later that day for a summary.

- Something dairy producers can’t protect against are Federal Milk Marketing Order (FMMO) negative producer price differentials (PPDs). The good news is base PPDs in all seven applicable FMMOs turned positive in June. Read: Back in the pool: Positive PPDs return with Class III milk (for now).

Apparently, not all that “positivity” made it to dairy farmer mailboxes. Progressive Dairy heard from an Iowa producer marketing milk in the Central FMMO #32 whose June settlement check showed a -$2.08 per cwt PPD.

PPDs have zone differentials and vary slightly within each FMMO, so a few marketing zones in California #51, the Upper Midwest #30 and Central #32 FMMOs saw fairly small negative PPDs on June milk marketings – but not near the level of -$2 per cwt – revealing again that PPD impacts on producer milk checks are based on individual milk handlers.

Through the first three months of 2021, the USDA’s “mailbox” prices averaged about $1.25 per cwt less than average “all-milk” prices (used in risk management programs) for the same months. For a look at how USDA’s state and regional all milk prices and mailbox prices compared in the first quarter of 2021, read Weekly Digest: Mailbox and all-milk prices maintain spread.

Other resources

- Zach Myers, Pennsylvania Center for Dairy Excellence (CDE) risk education manager, hosts his monthly “Protecting Your Profits” webinar on July 28, beginning at noon (Eastern time). Advance registration is not necessary. To participate in the webinar, click here or phone (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke