In the first quarter of 2022, federally inspected (FI) nonfed cattle slaughter reached volumes not seen since the mid-1980s, based on USDA Agricultural Marketing Service (AMS) estimated and actual weekly slaughter data through the week ending April 2, 2022. During this period, weekly FI nonfed cattle slaughter averaged more than 8% above year-ago levels. Specifically, through the first 12 weeks, weekly FI slaughter of beef cows and bulls averaged 18% and 15%, respectively, above last year, while dairy cow slaughter declined 3%.

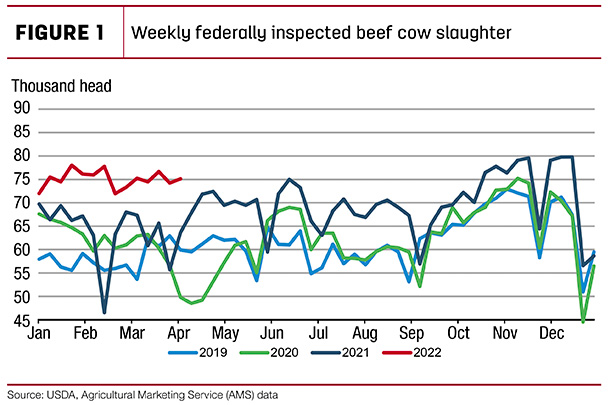

As Figure 1 shows, beef cow slaughter has outpaced year-ago levels.

Typically, cow slaughter would display this volume in the fourth quarter. However, higher feed costs, drought conditions plaguing much of the nation and historically high prices for cull cows have cow-calf producers making further cuts to their herds. The macroeconomic situation has also changed from last year with higher fuel prices, feed costs and operating costs that may be affecting producer decisions as well.

As reported by the U.S. Drought Monitor on March 29, 2022, over 69% of the country was experiencing some level of drought, compared with about 63% the same week last year (see Figure 2).

This put over 61% of the U.S. cattle inventory in an area experiencing drought, whereas only 35% of the national herd was affected a year ago. Further, 19% of the herd is in the worst two tiers versus just 10% in the same period last year. The last time this much drought covered the nation at this time of year was April 2, 2013, when almost 67% of the country experienced drought.

Although the price for other hay is relatively unchanged from January to February, prices are up 5% from a year ago (February 2021) with states reporting increases of 3% to 80% above last year. The Northern Plains and the Northwest are displaying the greatest increases in hay prices from last year.

At the beginning of 2022, the beef cow herd had undergone its third straight year of contraction and the fifth consecutive year of fewer beef replacement heifers reported. To the extent the availability of cows for slaughter remains low and demand for beef is relatively strong, 90% lean trimmings for processing are expected to be elevated. Trimmings prices have maintained historically high since July 2021. Beyond a brief period in May 2020, prices thus far in 2022 have not been this high since 2015.

Based on the economic and environmental factors noted, expectations for cow and bull slaughter were raised in each quarter of 2022. Despite the highest cow slaughter volume typically occurring at the end of the year, the volume in fourth-quarter 2022 will likely not surpass the first quarter. The 2022 price forecast for live cutter cows was raised to $79 per hundredweight (cwt). This is 22% above the 2021 average of $64.91 per cwt and the highest price since 2015.

Higher nonfed slaughter supports greater beef production

Beef production in the first quarter of 2022 was raised slightly on the latest actual and estimated FI slaughter through March. Since the previous month’s report, USDA AMS actual and estimated slaughter data reflected fewer fed cattle and more nonfed cattle in the slaughter mix than expected. Despite this change in slaughter proportions, steer and heifer carcass weights since mid-February averaged about 16 and 14 pounds heavier than in the same weeks last year. As a result, expected average carcass weights were raised for the first quarter.

To the extent that the pace of fed cattle slaughter in March was slower than expected, a portion of those animals were shifted into expectations for second-quarter slaughter. Further, as noted, the expectations for nonfed cattle slaughter were also raised in the second quarter, lifting production.

Beef production in the third quarter was also raised based on higher expected nonfed cattle slaughter, along with more marketings from larger-than-anticipated cattle placements in the first quarter. According to the most recent USDA National Agricultural Statistics Service (NASS) Cattle on Feed report, the number of cattle placed in feedlots with 1,000 or more head capacity in February was up more than 9% from last year. Placements outpaced marketings of cattle for slaughter, keeping feedlot inventories elevated, with the March 1 inventory being the largest since the series began in 1996. Although inventories are at historic levels, supplies of market-ready cattle are not as large as they were last year.

Finally, expected fourth-quarter beef production was reduced on fewer expected fed cattle slaughtered that more than offset nonfed cattle slaughter. As a result of the temporal shifts in fed cattle slaughter among the quarters and increased cow and bull slaughter, 2022 beef production was raised 140 million pounds to 27.7 billion pounds, less than 1% below 2021 production.

Cattle price forecasts raised in late 2022

March prices for fed steers in the 5-area marketing region averaged $139.17 per cwt, almost $25 above March 2021 prices, bringing the first-quarter average to $139.25 per cwt. In early second quarter, fed cattle prices were generally steady-to-lower at about $139 per cwt. Although market-ready cattle supplies on March 1 are below a year ago, they are above the average volume for this time of year. Further, because marketings in the first quarter were reduced, anticipated fed cattle marketings in the second and third quarters were raised. As a result, those quarters will likely remain under pressure, reflecting seasonally increasing supplies of market-ready cattle in feedlots at heavier-than- year-ago weights. Further reflecting the temporal shifts in fed cattle marketings, fed cattle prices in the fourth quarter were raised $1 to $143 per cwt for an unchanged annual forecast of $139.50 per cwt.

The March price for 750- to 800-pound feeder steers sold at the Oklahoma City National Stockyards was $153.09 per cwt, about $16 or 12% above last year. With higher placements in the first quarter, it is likely calves that might have remained on pastures later in the year were pulled forward. As a result, from the previous month, tighter anticipated feeder cattle supplies in second-half 2022 will likely support elevated prices. The third- and fourth-quarter prices were raised $4 and $6, respectively, to $165 and $172 per cwt. The 2022 price forecast for feeder steers is $163 per cwt, an 11% increase from 2021 prices.

Beef exports strong despite slowdown in top two markets

In February 2022, U.S. beef exports totaled 254 million pounds, about 2% higher than a year earlier and 10% above the five-year average. This was the second-highest beef export level for the month, only about half-a-percent lower than the record set in February 2020. Year-over-year increases in shipments to China, Taiwan, Canada and other markets offset decreases to South Korea, Japan, Hong Kong and Mexico.

Year-to-date exports to China are up over 95% year-over-year, leading to a significant increase in export share, as Table 1 shows.

Shipments to Taiwan increased almost 59% over the previous year, and exports to other markets also account for a larger share of total imports thus far in 2022. The remaining major destinations account for a smaller share of exports for the first two months this year.

Exports to the top two markets decreased year-over-year in February. South Korea remains the top destination for U.S. beef, despite a sharp month-over-month decline in exports in February.

Exports to Japan in February, while nearly unchanged from January, were 11% below last year; Japan is the second-largest export market so far this year. Year-to-date exports to Mexico, Canada and Hong Kong were also down year-over-year.

Exports are expected to seasonally increase in March, leaving the first-quarter forecast, as well as the remaining quarterly and annual forecasts, unchanged from the previous month.

Record-high February beef imports

U.S. beef imports in February totaled 279 million pounds, over 40% higher year-over-year and 31% above the five-year average. This was a record for the month of February. Imports from Brazil once again drove this notable increase, accounting for more than half of the year-over-year total beef import increase. Imports from Mexico were nearly 36% higher year-over-year and 41% higher than the five-year average. Imports from Australia and Canada also showed notable year-over-year increases at 44% and 13%, respectively.

Imports from Brazil have been elevated in recent months, with year-to-date imports increasing almost 128 million pounds, or 445%, over the same period last year. Nearly 83% of imports from Brazil so far this year are fresh beef, whereas historically most or all beef imports from Brazil have been heat-treated beef. Fresh beef enters the U.S. under a tariff-rate-quota system; once the quota is filled, fresh beef imports from Brazil will be subject to a higher tariff of 26.4% of the value of the imports. As of March 28, 2022, the quota open to countries without a specific quota – including Brazil – was almost 97% filled, according to “Year-to-Date Imports Under the WTO, Fresh, Chilled and Frozen” data provided on the USDA Economic Research Service webpage Livestock and Meat International Trade Data.

Table 2 shows that year-to-date imports from Mexico are also higher, up nearly 48% year-over-year. As a result, the year-to-date share of imports from Mexico has not declined from last year, even as the import share from Brazil has risen significantly.

The shares from the remainder of the top five suppliers have decreased year-over-year.

The first-quarter import forecast was increased 20 million pounds to 910 million pounds, reflecting recent data. Forecasts for the outlying quarters were left unchanged from the previous month, raising the annual import forecast to 3.44 billion pounds.