With the end of another quarter near, dairy producers managing risk through the Dairy Revenue Protection (Dairy-RP) program face a coverage deadline.

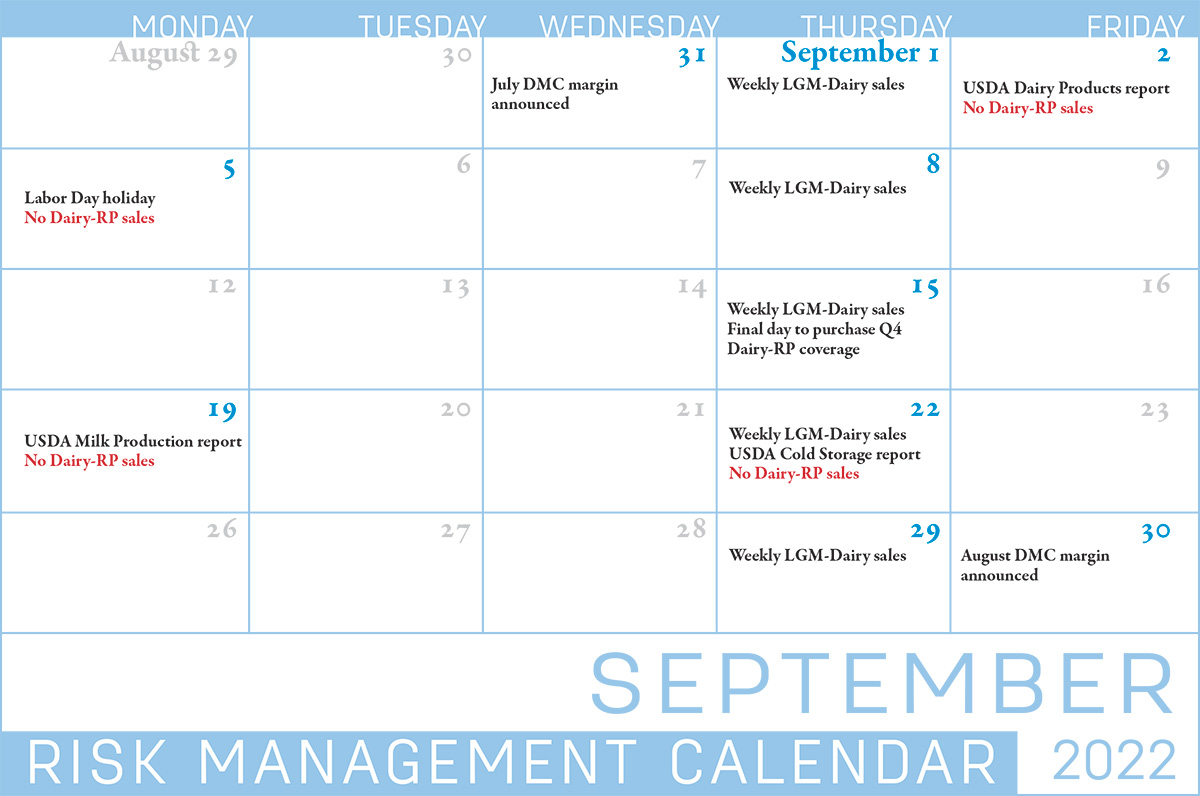

At any one time, Dairy-RP sales are open for as many as five future quarters. Near term, a sales period closes 15 days before the beginning of a quarter. For example, the period to purchase Dairy-RP coverage for the fourth quarter of 2022 (October-December) closes on Sept. 15.

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar), are released. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

LGM-Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the insurance period for the Jan. 29 sales closing date contains the months of February through December. Coverage begins the second month of the insurance period, so the coverage period for this example is March through December.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report.

DMC margin shrinking

Milk prices plateaued but feed costs continued to rise in June, cutting into monthly dairy producer milk income over feed cost margins calculated under the Dairy Margin Coverage (DMC) program. The June DMC margin was $11.92 per hundredweight (cwt), down 59 cents from May but above the top Tier I insurable level of $9.50 per cwt for a seventh consecutive month.

The July margin will be announced on Aug. 31. With the recent weakness in milk futures prices, the USDA’s DMC decision tool indicates indemnity payments could be triggered for August and September milk marketings at the Tier I/$9.50 per cwt coverage level.

Read: Milk price plateau cuts into June DMC margin.

Reminder: 2022 DMC premiums are due

With monthly DMC program triggers well above the $9.50 per cwt coverage level, there have been no indemnity payments distributed through the USDA’s Farm Service Agency (FSA) through June 2022. So, while in the past producers were able to deduct annual DMC premiums from indemnity payments, that’s not the case this year. Consequently, many producers have not yet paid calendar year 2022 DMC and Supplemental DMC premiums as the deadline of Sept. 1 approaches.

W. Scott Marlow, USDA deputy administrator of farm programs with the FSA, instructed county and state offices to notify dairy operations, via letter, with a payment deadline reminder and the amount of outstanding premium balance due.

Failure to pay the DMC premium will halt future indemnity payments and may affect a dairy operation’s ability to participate in the DMC program in future years. Contact your county FSA office for further information.

The sign-up period for the 2023 DMC program has not yet been announced.

July uniform prices announced

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported July 2022 uniform milk prices, producer price differentials (PPDs) and milk pooling data, Aug. 9-12. Uniform or blend prices moved lower than the month before for the first time since August 2021, while the wide spread between Class III-IV milk prices continued to affect pooling. For a look at Progressive Dairy’s monthly review of the numbers to provide some additional transparency on your milk check, read: July FMMO uniform prices lower and Class IV depooling continues.

USDA milk production report, outlook

The USDA’s preliminary July milk production estimate was released on Aug. 22. Monthly U.S. milk production inched above year-ago levels, but USDA’s cow numbers were scaled back from June preliminary estimates. Growth in milk production per cow remains subdued. Read: U.S. milk production growth remains flat.

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Aug. 12, revised 2022-23 U.S. milk production estimates higher due to larger cow inventories and increases in milk output per cow. Projected average all-milk prices were lowered for both years. For more, read: USDA raises 2022-23 milk production forecasts, putting a dent in price projections.

Compared to last month, the USDA raised the 2022 milk production forecast by 800 million pounds, to 226.8 billion pounds. If realized, 2022 production would be up 500 million pounds from 2021.

Compared to a month ago, the projected 2022 annual average Class III price was reduced $1.20, to $21.60 per cwt. The projected Class IV price was cut 75 cents, to $23.95 per cwt. The 2022 all-milk price forecast was cut 95 cents from last month to $25.20 per cwt.

For 2023, the USDA projected milk production at 229.2 billion pounds, 900 million pounds more than last month’s forecast. If realized, 2023 production would be up about 1% from the 2022 estimate.

With lower product prices, the Class III milk price was forecast at $19.70 per cwt, down $1.15 from last month’s projection. The Class IV milk price was forecast $1.95 lower, to $20.35 per cwt. The all-milk price was forecast $1.65 lower, to $22.50 per cwt.

At the close of CME trading on Aug. 23, Class III prices for the second half of 2022 averaged $21.06 per cwt, for an annual average of $22.01 per cwt. Class IV futures prices for the second half of 2022 averaged $24 per cwt, yielding an annual average of $24.34 per cwt.

Based on futures prices as of Aug. 23, Class III prices would average $20.09 per cwt in 2023, with Class IV prices averaging $20.41 per cwt.

Other resources

Zach Myers, risk education manager with the Pennsylvania Center for Dairy Excellence (CDE), hosted a “Protecting Your Profits” webinar, Aug. 24. Myers highlighted the latest Class III and IV futures milk price forecasts and shared updates on DMC margins and the Dairy-RP program. Each webinar is available via podcast or phone and is archived for viewing later.