The U.S. beef sector continues to see drought conditions impacting the movement and timing of cattle placement in feedlots, as well as the number of beef cows culled, which will likely continue into early 2023.

The latest National Agricultural Statistics Service (NASS) Cattle on Feed report showed a Sept. 1 feedlot inventory of 11.279 million head, the second-largest for the month since the series began in 1996, and 0.4% higher than 11.234 million head in the same month last year.

Feedlot net placements in August were up less than 1% year-over-year at 2.059 million head but well above industry analyst expectations. Marketings in August were 2.004 million head, up over 6% year-over-year with one more weekday in the month. On a weekday basis, the pace of marketings in August was up almost 2% from last year’s pace but lower than 2020 for the month.

Based on actual and estimated slaughter through September, the beef production forecast for third-quarter 2022 is adjusted higher by 25 million pounds, principally on higher non-fed cattle slaughter that more than offsets a decline in fed cattle slaughter. Further, average carcass weights since the last report were heavier than expected, which added to the increase in production.

In fourth-quarter 2022, production is projected to increase by 105 million pounds. The more rapid pace of culling beef cows was carried over into the quarter, raising expected cow slaughter. In addition, anticipated fed cattle marketings are raised on a relatively strong pace of fed cattle slaughter in early October, as well as expectations of a higher proportion of fed cattle marketed from feedlots with under 1,000-head capacity. As a result, total 2022 beef production is raised 130 million pounds from the previous month to 28.1 billion pounds, an increase of less than 1% from 2021.

The large placement of cattle in August, and expectations that dry conditions will reduce grazing opportunities, supports raising anticipated placements in second-half 2022. This resulted in raising expected fed cattle marketings in early 2023 and projected first-half 2023 beef production. Consequently, as cattle placed in late 2022 are expected to be drawn from those that might have been placed in early 2022, expected marketings are lowered in late 2023.

However, the increase in anticipated marketings in first-half 2023 more than offsets the decline in second-half 2023. Accordingly, the 2023 beef production forecast is raised slightly by 30 million pounds to 26.4 billion pounds, which remains more than 6% below the 2022 projection.

2022 feeder cattle prices lowered on larger placements

The price for feeder steers 750 to 800 pounds at the Oklahoma National Stockyards averaged $173.48 per hundredweight (cwt) in September, down nearly $1 from the prior month but up about $22 from last year. The most recent available price from Oct. 10 reports sales of yearling feeder steers at $170.71 per cwt, up only 40 cents from the previously reported week. Despite firm feedlot demand expected for the remainder of 2022, current price data and higher projected feed prices than last month, the fourth-quarter 2022 price forecast for feeder steers is lowered $4 to $173 per cwt.

Based on a weaker outlook than the previous month for winter grazing on small grains, expected feeder calf placements were raised for the remainder of 2022, tempering expectations for supplies of stocker cattle entering feedlots in early 2023. The price projection in first-quarter 2023 is raised $3 to $175 per cwt. However, feed prices are forecast to be slightly higher for the 2022-23 crop year, and expected feeder calf price increases in the second half of the year were moderated.

Composite wholesale beef prices have declined from the midsummer peak of $266.23 per cwt the week ending July 29 to $246.02 per cwt the week ending Oct. 7. Despite weaker trending wholesale beef prices, the relatively strong pace of fed cattle slaughter in September appears to have carried over into October. Over the same period, weekly fed steer prices have climbed higher, likely reflecting demand for cattle to support the pace of slaughter during that time.

However, the pace of slaughter is expected to fall below year-ago levels in the remainder of the year. For the week ending Oct. 9, the negotiated price for fed steers in the 5-area marketing region reached $146.23 per cwt, the second-highest weekly average this year. Accounting for current price data and a stronger year-over-year pace of fed cattle slaughter in early October, the fourth-quarter 2022 price is projected $1 above the previous month to $148 per cwt. The annual 2023 fed steer price forecast is unchanged from the previous month at $154 per cwt.

Export forecast for 2023 raised on stronger expected demand from Asia

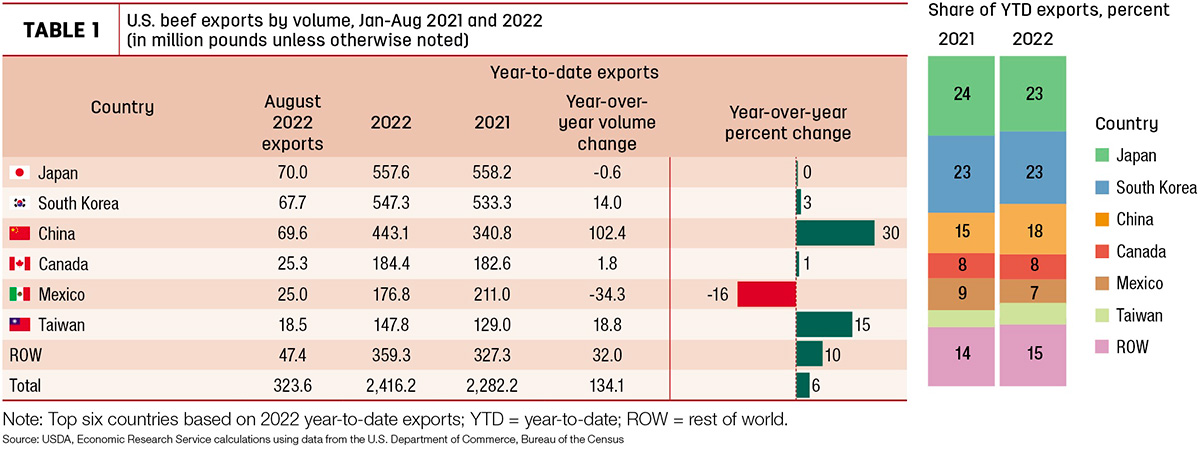

Continuing this year’s trend of new monthly export records, exports in August were nearly 324 million pounds, also setting a new overall record ahead of last year’s 322 million pounds in August. Further, year-to-date exports through August are at a record 2.4 billion pounds, nearly 6% above last year and 19% above the five-year average. Year-to-date exports for most major markets are higher year-over-year, as Table 1 shows. Exports to China have increased 30% over last year, raising China’s share of U.S. exports to 18%. Exports to Mexico are below a year ago, as are year-to-date exports to Japan.

The value of exports in August totaled 973 million dollars, less than 1% below last year but 35% above the five-year average. The record-setting pace of exports this year despite high prices is evidence of strong foreign demand for U.S. beef. The unit value of exports to the top 10 Asian markets for January through August was $4.12 per pound. The value per pound of total U.S. exports through August this year was $4.03.

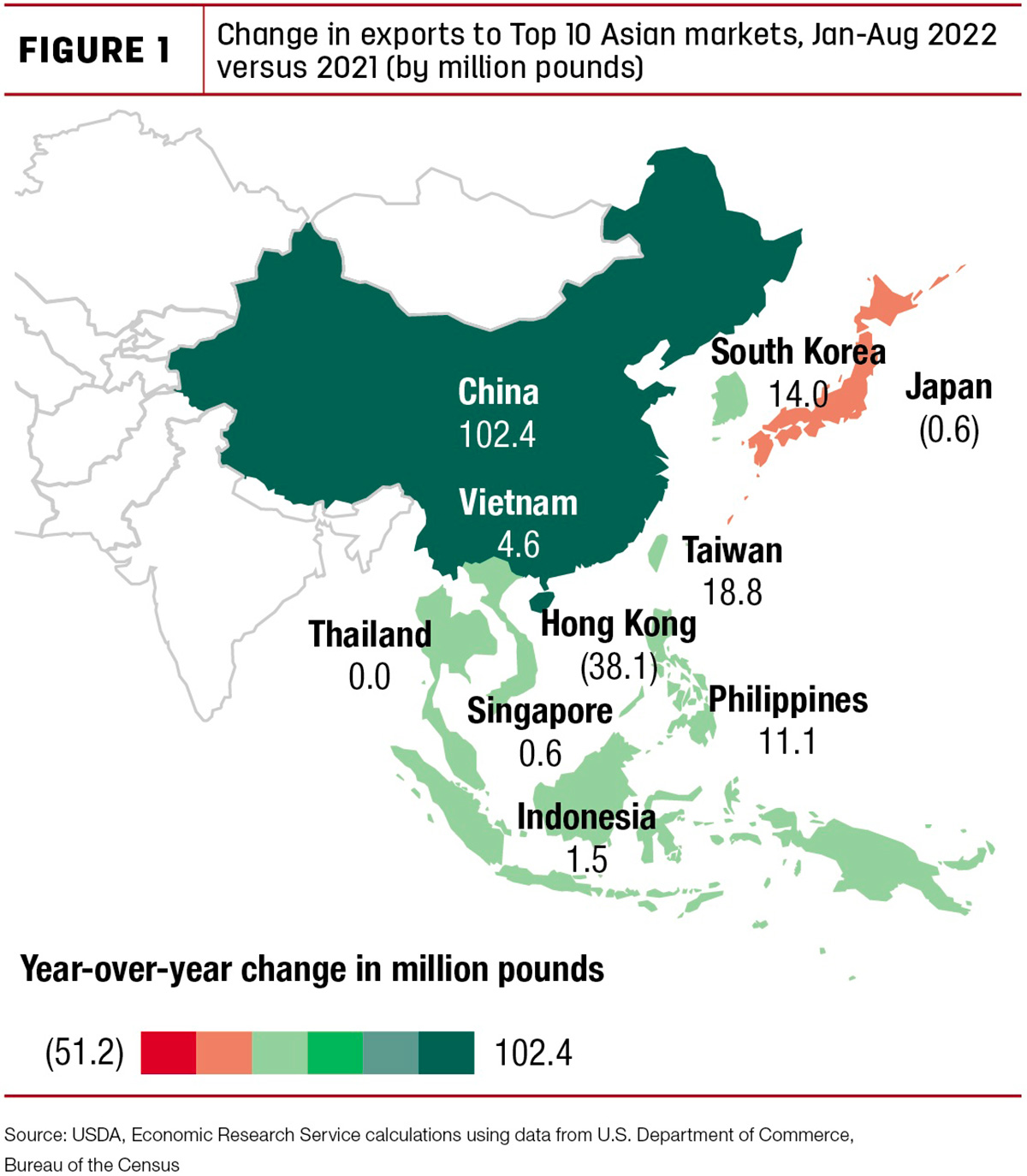

Demand for U.S. beef in East and Southeast Asia has been especially strong this year. The increase in exports to the top 10 Asian markets has accounted for 85% of the year-over-year increase in exports through August. The change in exports to these markets is shown in Figure 1. The increase in exports to China alone has accounted for 76% of the overall increase and was more than enough to offset the decrease in exports to Hong Kong and Japan. Exports to South Korea, Taiwan and the Philippines have also shown significant increases.

The U.S. beef export forecast for third-quarter 2022 is raised 10 million pounds to 925 million based on August trade data showing stronger-than-expected shipments to China. The fourth-quarter projection is unchanged, making the annual forecast 3.571 billion pounds. Based on expected global demand for next year, the forecast for first-quarter 2023 is raised 50 million pounds to 740 million. The second-quarter forecast is raised 15 million pounds to 775 million and the third quarter is lowered slightly to 785 million pounds. This essentially shifts some exports out of the second half of the year into the first half based on higher expected supplies in the first half. The annual forecast is raised to 3.07 billion pounds.

2023 import forecast raised on increase in expected global supplies

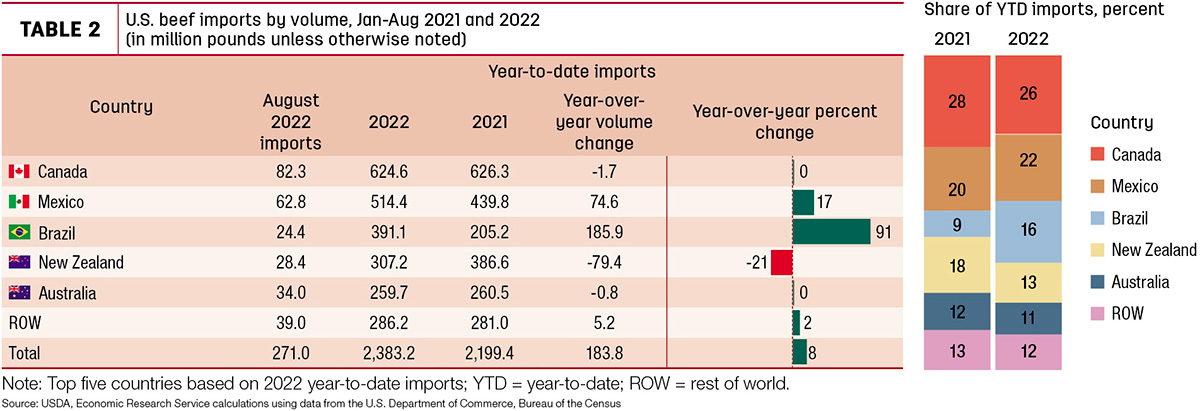

U.S. beef imports in August were 271 million pounds, 18% below 2021 (Table 2). Year-to-date imports were 2.4 billion pounds, 8% above last year and 10% above the five-year average. Imports from Mexico in August were the second highest for the month. Year-to-date imports from Mexico are up 17%, and Mexico’s share of imports to the U.S. has increased 2 percentage points, making it the only country to increase its share besides Brazil. Imports from Brazil dropped after the tariff rate quota was filled in the early part of the year. August imports from Brazil were 31% lower year-over-year but still above the five-year average now that fresh, chilled and frozen beef imports are allowed from Brazil after the U.S. lifted a ban in 2020.

Total year-to-date imports are 8% above last year and 10% above the five-year average. However, the record first quarter was followed by a steep tapering, and the slower pace of imports is expected to continue for the rest of the year. The third-quarter 2022 forecast is decreased 25 million pounds to 800 million, a year-over-year decrease of about 13%. The fourth quarter remains unchanged at 745 million pounds, which would be a year-over-year decrease of 14%. The 2022 annual forecast is 3.389 billion pounds.

According to the recently released Livestock and Poultry: World Markets and Trade report from the USDA's Foreign Agricultural Service, beef production in Australia and Brazil is expected to rise in 2023. However, Chinese beef imports are expected to lower, decreasing demand for global exports. Therefore, the increase in available exports from Australia and Brazil, combined with lower expected imports from China, increases the supplies available for the U.S. to import. The first-quarter forecast is raised 30 million pounds to 730 million, the second quarter is raised 70 million pounds to 870 million, and the forecast for the second half of the year is increased 50 million pounds. The projection for total imports in 2023 is increased 150 million pounds to 3.35 billion pounds.