The end of January brings the enrollment deadline for the 2023 Dairy Margin Coverage (DMC) program and milk production data to settle fourth-quarter 2022 Dairy Revenue Protection (Dairy-RP) policies.

Here’s an update on tools available through the USDA and/or USDA’s Risk Management Agency (RMA).

Dairy Margin Coverage program

The 2023 DMC program enrollment and coverage election period closes on Jan. 31 at USDA Farm Service Agency offices.

After payments were triggered on August and September milk marketings, the October and November DMC margins moved above the top indemnity trigger level of $9.50 per hundredweight (cwt).

The December DMC margin will be announced on Jan. 31, and it appears indemnity payments will not be triggered. Based on DMC decision tool calculations as of Jan. 16, the forecast margin was $10.11 per cwt.

The outlook changes for 2023, however. As of Jan. 16, the DMC decision tool estimated margins below $9.50 per cwt for every month, January through September, falling near $7 per cwt, February through May.

Dairy Revenue Protection

Dairy producers managing risk through the Dairy-RP program are currently eligible to cover revenue from second-quarter 2023 through second-quarter 2024.

The USDA’s next Milk Production report, released Jan. 25, will include fourth-quarter 2022 milk production estimates used to calculate potential indemnity payments for that quarter.

Coverage for the first quarter of 2023 closed last Dec. 15, with about 25% of U.S. milk production enrolled.

Coverage for the second quarter of 2023 closes on March 15.

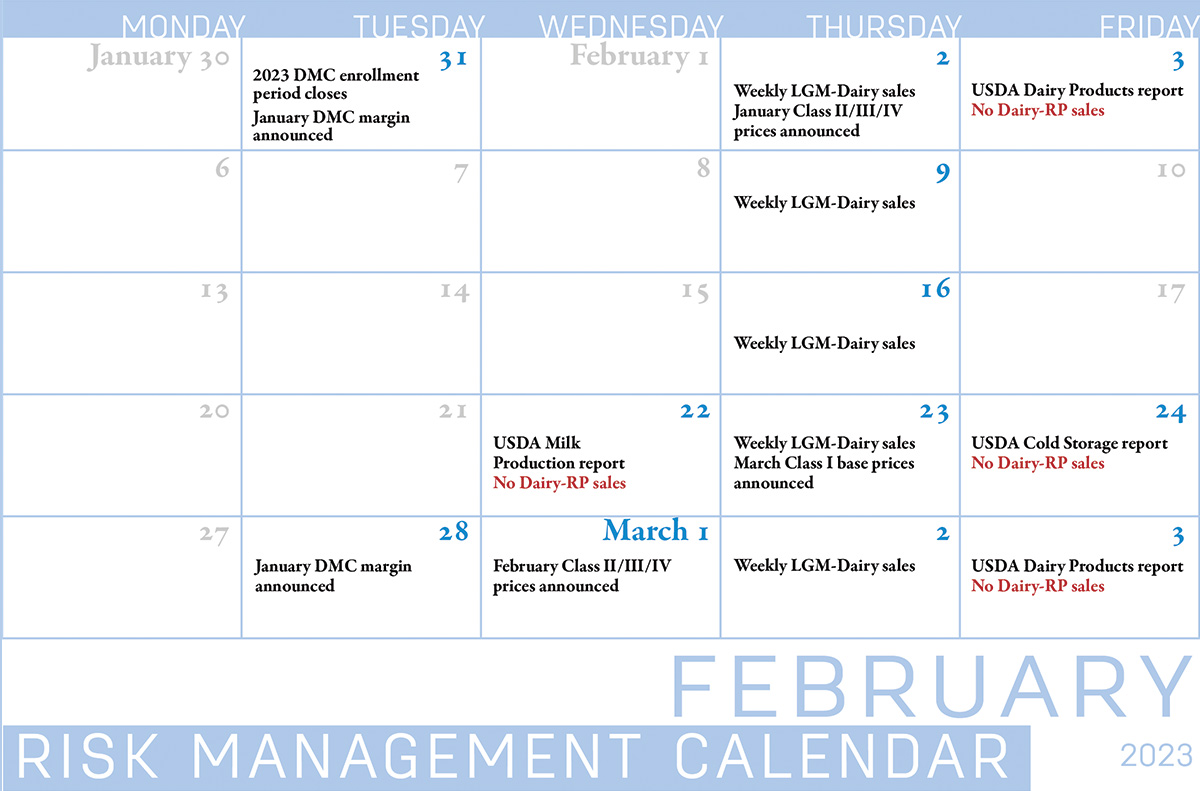

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the insurance period during the final week of January contains the months of February through December. Coverage begins the second month of the insurance period, so the coverage period for this example is March through December.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Protecting Your Profits webinar

Pennsylvania’s Center for Dairy Excellence (CDE) is hosting a special edition of its monthly “Protecting Your Profits” webinar on Jan. 25, 12-1 p.m. (Eastern time).

The event will feature Rob Goodling, agricultural business consultant with Horizon Farm Credit, who will provide an overview of dairy markets in 2022 and his thoughts on the market outlook heading into 2023. The webinar will also review current data and updates about the milk marketplace to guide decision-making and risk management strategies.

Individuals can join the discussion via conference call, webinar or podcast format.

To participate, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

USDA reports

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Jan. 12, reduced both 2022 and 2023 U.S. milk production estimates from the previous month. Despite less production, the USDA also lowered price projections slightly. Final price forecasts for 2022 were: Class III – $21.94 per cwt, Class IV – $24.47 per cwt and all-milk – $25.55 per cwt.

For 2023, the price forecasts for all components were lower with expectations of weak domestic demand and price pressure in international markets. Compared to earlier estimates, the projected 2023 Class III price was reduced 95 cents to $18.85 per cwt, while the Class IV price forecast was cut 85 cents to $19.25 per cwt. The projected 2023 all-milk price was reduced 90 cents to $21.60 per cwt.

Progressive Dairy will also summarize the USDA’s December Milk Production report by Jan. 26.