Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported July 2023 prices and pooling data, Aug. 11-14. In a summer repeat, uniform or blend prices continued to decline, and Class IV milk pooling volume stayed low.

After the author spent some vacation time in Alaska watching glaciers and whales, here’s Progressive Dairy’s delayed review of the numbers to provide some additional transparency to your milk check.

Uniform prices, PPDs

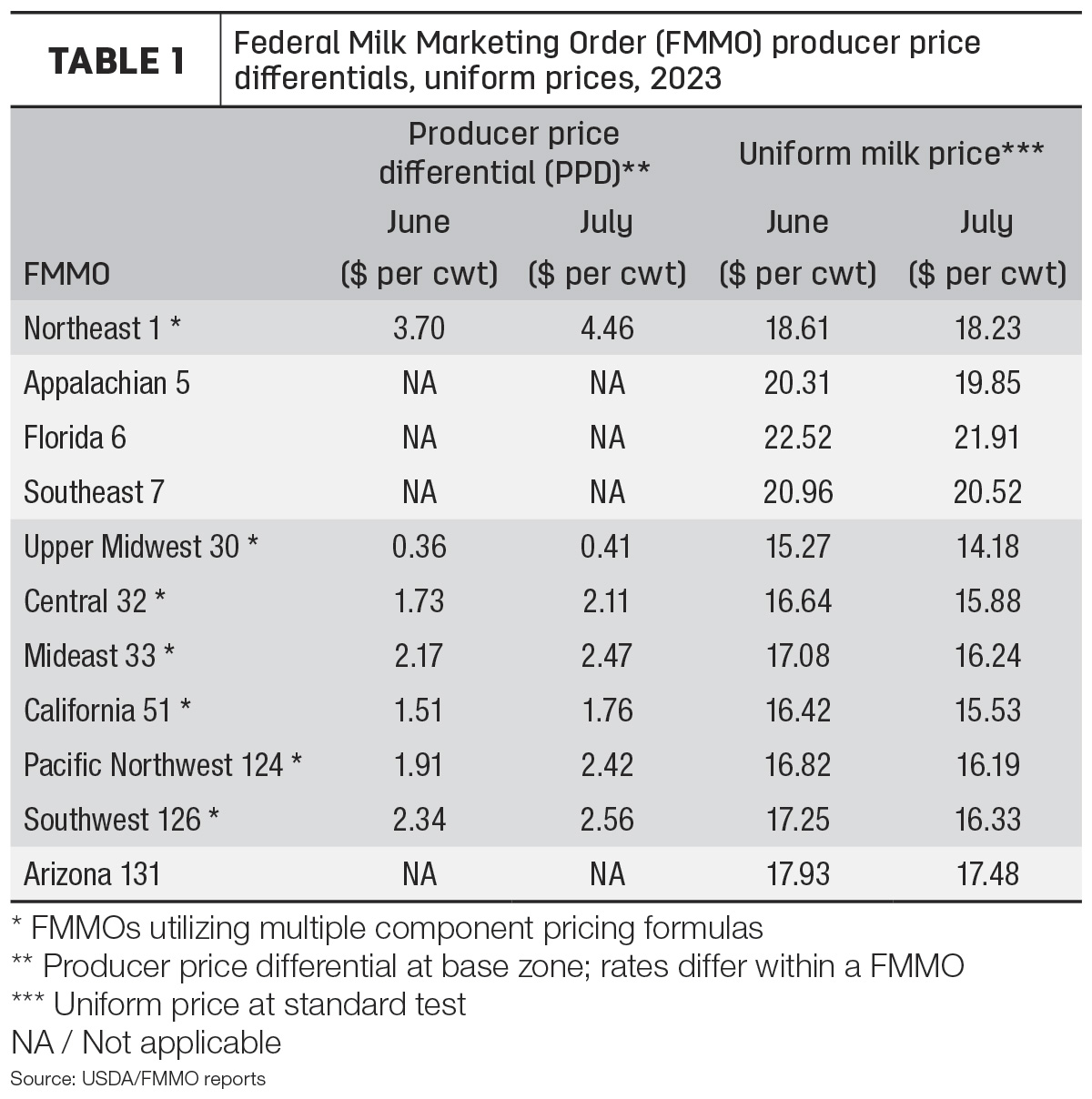

Compared with June, July 2023 statistically uniform milk prices were down 38 cents to $1.09 per hundredweight (cwt) across all 11 FMMOs (Table 1). For Upper Midwest 30, Central 32 and California 51 – those with highest Class III milk utilization rates – the uniform prices were the lowest since early 2021.

The highest uniform price for the month was in Florida FMMO 6 at $21.91 per cwt, with the low in the Upper Midwest 30 at just $14.18 per cwt.

July baseline producer price differentials (PPDs) were slightly higher across all applicable FMMOs (Table 1), with a high of $4.46 per cwt in the Northeast FMMO 1 to a low of 41 cents in the Upper Midwest 30. PPDs have zone differentials, so actual amounts will vary within each FMMO.

Class prices for July

- Class I base price: At $17.32 per cwt, it was down 69 cents from June and $8.55 less than July 2022. It was the lowest Class I base price since October 2021.

- Class I base with zone differentials: A high of $22.72 per cwt in the Florida FMMO 6 to a low of $19.12 per cwt in the Upper Midwest FMMO 30

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($5.33 per cwt) and advanced Class IV skim milk pricing factor ($8.94 per cwt) is $3.61 per cwt, the widest spread since October 2022.

Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would have resulted in a Class I base price of $18.34 per cwt, about $1.02 more than the actual price determined using the “average-of plus 74 cents” formula.

- Class II milk price: At $19.12 per cwt, the July Class II milk price was up 29 cents from June but $7.54 less than July 2022.

- Class III milk price: At $13.77 per cwt, the Class III milk price fell $1.14 from June and was $8.75 less than July 2022. It’s the lowest since May 2020.

- Class IV milk price: At $18.26 per cwt, the July 2023 Class IV milk price was unchanged from June but is $7.53 less than July 2022.

- Class III-IV milk price spread: Affecting FMMO pooling, the July 2023 Class IV milk price was $4.49 more than the month’s Class III milk price, the widest spread since last September and providing continued incentives for Class IV depooling.

Component values, tests

Contributing to the July milk class price calculations – and the wide Class III-Class IV spread – the butterfat value increased slightly while the value of protein fell to the lowest level since February 2019.

The value of butterfat rose nearly 4 cents to about $2.80 per pound, the highest since December 2022. It’s still the seventh consecutive month the value of butterfat was below $3 per pound.

The value of milk protein fell 31.5 cents from June to about $1.20 per pound, the lowest since December 2018-February 2019.

The value of nonfat solids dipped 1.5 cents to about 97.5 cents per pound, while the value of other solids dropped almost 6 cents, to just under 7 cents per pound, the lowest since April 2018.

Affecting statistical uniform prices “at test,” seasonal declines meant July average butterfat and protein tests in pooled milk were lower than June in FMMOs providing preliminary data.

With its high average butterfat (4.12%) and protein (3.27%) tests, producers in the Pacific Northwest FMMO 124 had the potential to see the at-test price at $18.26 per cwt, about $2.07 above the statistically uniform price. In California 51, the at-test average was $17.25 per cwt, $1.725 above the statistically uniform price. In Central 32, the at-test average was $17.25 per cwt, $1.37 above the statistically uniform price.

Impact on pooling

With one more day of production compared with June, overall July FMMO milk pool volume was up about 163 million pounds in July at 12.8 billion pounds. The USDA released July milk production estimates on Aug. 21, estimating U.S. production at 18.92 billion pounds (Read: Cow, milk reductions evident in USDA July estimates). That means about 68% of July U.S. production was pooled through FMMOs during the month.

July Class I pooling was down about 52 million pounds from June and at 3.08 billion pounds represented about 24% of total milk pooled. Class II pooling was up 58 million pounds, to 1.26 billion pounds, representing about 9.9% of the total pooled.

Compared to a month earlier, July brought a little more Class III milk to the pool, while pooling of higher-value Class IV milk didn’t change much. At 7.46 billion pounds, Class III pooling represented about 58.3% of the total pool (Table 2), the highest percentage in several years. Class IV pooling across all FMMOs increased 29.7 million pounds from June and represented about 7.8% of the total milk pooled (Table 2), similar to June pooling data. Class IV volume and percentage pooled remain close to the lowest levels since December 2022.

Looking ahead

August 2023 uniform prices and pooling totals will be announced around Sept. 11-14. Based on FMMO advanced prices and current futures prices, milk prices should start to recover somewhat, although it will be a struggle:

- Class I base price: Already announced, the August advanced Class I base price is $16.62 per cwt, down 70 cents from July and $8.51 less than August 2022. It’s the lowest level since September 2021.

- Class I base with zone differentials: Adding zone differentials, August Class I prices will average approximately $19.44 per cwt across all FMMOs, ranging from a high of $22.02 per cwt in the Florida FMMO 6 to a low of $18.42 per cwt in the Upper Midwest FMMO 30.

- Class I mover formula: Analyzing the Class I mover, the spread in the monthly advanced Class III skim milk pricing factor ($4 per cwt) and advanced Class IV skim milk pricing factor ($8.95 per cwt) is $4.95 per cwt, the widest spread since October 2022. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $18.28 per cwt, about $1.66 more than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: August Class II, III and IV milk prices will be announced on Aug. 30. As of the close of trading on Aug. 21, the August Chicago Mercantile Exchange (CME) Class III milk futures price closed at $17.28 per cwt, a nice $3.50 jump from July and the highest since April. The August Class IV milk futures price closed at $18.90 per cwt, up 64 cents cents from July.

- Class III-IV milk price spread: Based on those futures prices, the gap between Class III-Class IV prices closes to $1.62 per cwt, meaning Class IV milk handler depooling incentives shrink substantially in August but don’t go away.

As always, markets change, usually faster than glaciers move.