Here is a brief look at the news affecting dairy producers during the final week of August 2023:

Digest highlights

- Ag loan interest rates continue to rise

- DMI releases annual report

- IDFA: Parents want ‘flavored’ school milk choice

- Dairy leaders named as U.S. trade advisers

- Senate proposal caps farm program payments

- Southwest ag credit co-ops to merge

Ag loan interest rates continue to rise

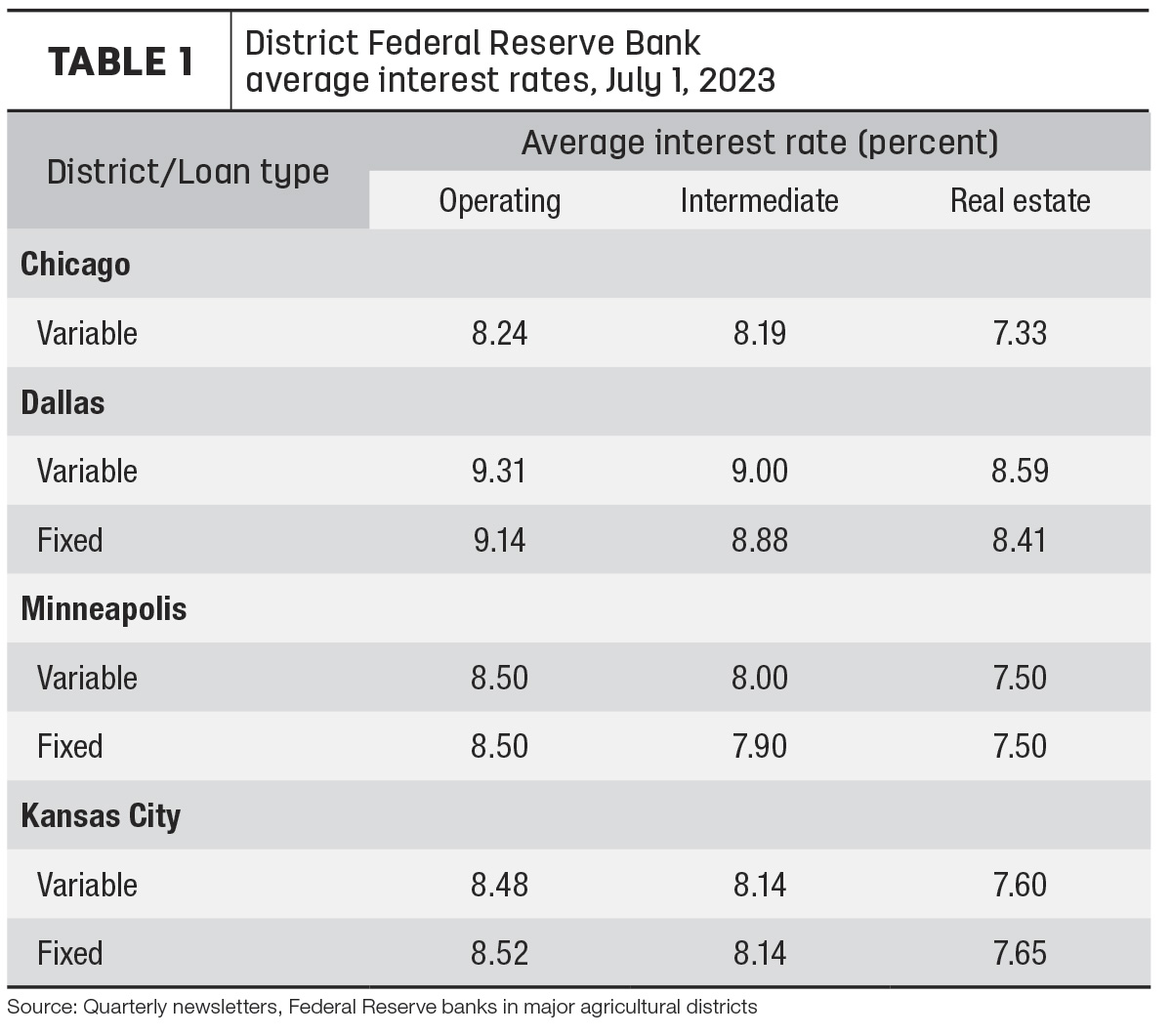

Quarterly lender surveys from Chicago, Dallas, Kansas City and Minneapolis Federal Reserve districts show interest rates on all agricultural loans rose to start the second half of 2023 and, in most cases, were the highest since 2007.

That increase is likely to continue. During its last meeting, July 25-26, the Federal Reserve Board raised interest rates by 0.25%, boosting the federal funds rate to 5.5%.

Speaking at an annual economic symposium hosted by the Federal Reserve Bank of Kansas City, Aug. 25, in Jackson Hole, Wyoming, Jerome Powell, chief of the Federal Reserve, left open the option to boost interest rates again to rein in inflation. The next meeting of the Federal Reserve Board’s Federal Open Market Committee (FOMC) is scheduled for Sept. 19-20. Two additional meetings are scheduled in 2023: Oct. 31-Nov. 1 and Dec. 12-13.

“Although inflation has moved down from its peak – a welcome development – it remains too high,” Powell said. “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

“Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth as well as some softening in labor market conditions,” Powell continued. “We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time.”

Reviewing quarterly lender surveys in predominantly agricultural districts, changes in average ag loan interest rates included (Table 1):

- Chicago: Interest rates on variable-rate operating and intermediate loans were up about than 3.5% compared to the start of 2022, with interest on variable-rate real estate loans up about 2.9%. All rates were the highest since the third quarter of 2007.

- Dallas: Average interest rates on both variable- and fixed-rate operating and intermediate loans moved above 9% to start the second half of 2023, with real estate loans at 8.59% (variable) and 8.41% (fixed). In most cases, average rates are the highest since the second half of 2007.

- Kansas City: Districtwide, average interest rates on variable operating and intermediate loans rose about 0.4% from the previous quarter; variable-rate real estate loan rates rose more than 0.6%. All interest rates were similar to those charged during the second half of 2007.

- Minneapolis: Average fixed and variable rates on operating, machinery and real estate loans all increased further in the second quarter after a sizeable increase in the previous quarter.

Read also: Economic update: A matter of interest

DMI releases annual report

Dairy Management Inc. (DMI), the planning and management organization that oversees the national dairy checkoff program, posted its 2022 annual report.

The summary highlights strategies and programs carried out in 2022, including: accelerating incremental dairy sales growth, building trust in dairy, dairy foods and dairy farming with youth and other important consumer audiences, and positioning dairy in a global food system.

Separately, the checkoff’s 2023 program budget summary and 2021-22 audited financial statements are also available on the website’s Governance page.

Excluding USDA oversight costs, general and administrative costs represented about $4.4 million in 2022, about 3.2% of total expenses.

For the year ending Dec. 31, 2022, total revenues for the year were estimated at $124.7 million, down slightly from 2021. Expenses total $131.8 million, up nearly $25 million from the prior year.

IDFA: Parents want ‘flavored’ school milk choice

More parents want flavored milk options for their children at school, according to a survey supported by the International Dairy Foods Association (IDFA).

Between March 2023 and June 2023, Morning Consult polling data shows parents with children in public schools maintained high levels of agreement that nonfat and low-fat flavored milk should remain an option for school meals. In June 2023, nine in 10 parents with children in public schools (89%) agreed that nonfat and low-fat flavored milk should remain an option, and three-fourths of parents (77%) expressed that low-fat flavored milk is healthy.

Last April, IDFA partnered with 37 school milk processors representing more than 90% of the school milk volume in the U.S. to launch the Healthy School Milk Commitment. They pledge to provide healthy, nutritious school milk options with no more than 10 grams of added sugar per 8 fluid ounce serving by the 2025-26 school year. Since then, processors have begun to reformulate products in anticipation of the 2025 school year, and added sugar levels have already fallen to 7.5 grams per serving (weighted average) as of July.

Visit the IDFA website to learn more about the Healthy School Milk Commitment.

Dairy leaders named as U.S. trade advisers

U.S. Secretary of Agriculture Thomas Vilsack and U.S. Trade Representative Katherine Tai appointed 130 new private sector representatives to serve on seven agricultural trade advisory committees (ATAC). The new group of advisers will join the 70 existing committee members whose terms have not expired. The newly appointed committee members will serve until August 2027.

Specific to dairy, new and returning advisory committee members include:

- ATAC Agricultural Policy Advisory Committee: Michael Dykes, IDFA; Jim Mulhern, National Milk Producers Federation (NMPF); and Robert Bishop, Livestock Exports Association of America

- ATAC for Trade in Animals and Animal Products: Jaime Castaneda, NMPF; Cassandra Kuball, Edge Dairy Cooperative; Michael Lichte, Dairy Farmers of America; Ken Meyers, MCT Dairies; Patricia Smith, Dairy America; Chad Vincent, Dairy Farmers of Wisconsin; and Martin Sieber, U.S. Livestock Genetics Export

- ATAC for Trade in Processed Foods: Shawna Morris, U.S. Dairy Export Council; and Rebecca Rasdall, IDFA

Senate proposal caps farm program payments

A proposal to place a hard cap on USDA farm program payments and add restrictions to payment eligibility has been introduced in the Senate. U.S. Sens. Chuck Grassley (R-Iowa) and Sherrod Brown (D-Ohio) introduced the Farm Program Integrity Act. The proposal would create a hard cap of $250,000 in total commodity support for any one farm operation and require beneficiaries of the system spend at least 50% of each year engaged in farm labor or management. According to proponents, 10% of farm operations currently receive 70% of all yearly farm payment subsidies.

Southwest ag credit co-ops to merge

Farm Credit of New Mexico and American AgCredit Farm Credit cooperatives will merge effective Oct. 1, 2023, pending final Farm Credit Administration (FCA) approval. The voting stockholders of Farm Credit of New Mexico revoted for the proposed merger after a reconsideration process established by FCA.

The merger brings together American AgCredit, which provides financial services to agricultural and rural customers in California, Colorado, Hawaii, Kansas, New Mexico, Nevada and Oklahoma, and Farm Credit of New Mexico, the state’s largest agricultural lender. Curt Hudnutt, current CEO of American AgCredit, will lead the merged American AgCredit, which will have more than 900 employees.