Although USDA National Agricultural Statistics Service (NASS) commercial slaughter estimates for the month of December 2023 will be published later this month, the USDA Agricultural Marketing Service (AMS) has published the Actual Slaughter Under Federal Inspection report through the end of the year, which allows for comparison of year-to-year slaughter. In 2023, all classes of slaughter were down from the prior year. However, the proportion of heifers and cows in the slaughter mix was higher than anticipated a year ago.

The expectation was that as drought from 2020-22 largely receded, pasture conditions improved and calf prices rose, producers would be more willing to retain heifers and cows to maintain or expand their herds. Figure 1 shows heifer and beef cow slaughter as a percent of total cattle slaughter under federal inspection. At 42.1%, last year was the second-highest average weekly percentage since the series began in 1986, behind the record set last year at 42.3%.

Reflecting preliminary slaughter data for the month of December, fourth-quarter 2023 production is raised from last month. The change reflects a marginal increase in fed cattle and bull slaughter from last month’s forecast. That increase was partially offset by less cow slaughter. The largest impact to the forecast was an adjustment in carcass weights.

Heavier carcass weights likely reflect a relatively large proportion of steers and heifers in the slaughter mix and general weight gains by steers and heifers coming out of feedlots. As a result, total commercial beef production in 2023 is estimated to have been 26.967 billion pounds, a decline of almost 5% from 2022.

Heavier carcass weights likely reflect a relatively large proportion of steers and heifers in the slaughter mix and general weight gains by steers and heifers coming out of feedlots. As a result, total commercial beef production in 2023 is estimated to have been 26.967 billion pounds, a decline of almost 5% from 2022.

Production forecast raised for 2024

According to the latest Cattle on Feed report published by NASS, the Dec. 1 feedlot inventory is estimated at 12.006 million head, almost 3% above 11.693 million head for Dec. 1, 2022. Feedlot net placements in November were nearly 2% lower year over year at 1.814 million head. Marketings in November tallied 1.751 million head, down over 7% from a year ago. The relatively large decline in marketings kept most feedlots fuller than a year ago. In the three largest cattle-feeding states, on Dec. 1, 2023, the number of cattle on feed in Texas and Kansas is up 4% and 7%, respectively, from last year, while Nebraska is down 1%.

On Jan. 31, 2024, the USDA NASS will release the semiannual Cattle report. This report will provide estimates of cows and heifers available for breeding, as well as insight into calves available for placement in feedlots in early 2024 that will be marketed later in the year.

For 2024, the beef production forecast is raised 120 million pounds from last month to 26.11 billion pounds, a decline of just over 3% from 2023. In the first half of 2024, the production forecast is largely raised on higher anticipated fed cattle marketings based on higher-than-expected placements in November and December. In addition, relatively heavy cattle weights reported in December are carried into 2024.

Cattle prices start 2024 higher than last year

In December, the weighted-average price for feeder steers weighing 750-800 pounds at the Oklahoma City National Stockyards was $220.73 per hundredweight (cwt), a $6.10 decline from November. In the first sale of the new year on Jan. 8, 2024, feeder steers averaged $215.79 per cwt, a decline of almost $8 from the previous sale on Dec. 18, 2023, but more than $37 above the same week last year.

For 2023, feeder steers averaged $218.69 per cwt, a 32% increase from 2022. Although the second- and third-quarter price forecasts were raised slightly, the 2024 annual price forecast is unchanged at $242 per cwt, 11% higher than 2023. This acknowledges the strong placements in the last part of 2023 and expectations for tightening supplies of feeder cattle outside feedlots throughout 2024. The Cattle report to be released on Jan. 31, 2024, will provide a picture of the supplies of feeder cattle outside feedlots available to be placed throughout this year.

The December average price for fed steers in the 5-area marketing region was $170.69 per cwt, $8.07 lower than November. In 2023, fed steers reached $175.54 per cwt, a 22% increase from 2022. In the first week of 2024, prices averaged $174.01 per cwt, more than $16 above the same week last year. The 2024 price forecasts are unchanged from last month, with the annual price at $178 per cwt, almost 2% higher than 2023.

Adjustments made to 2023 and 2024 beef trade estimates

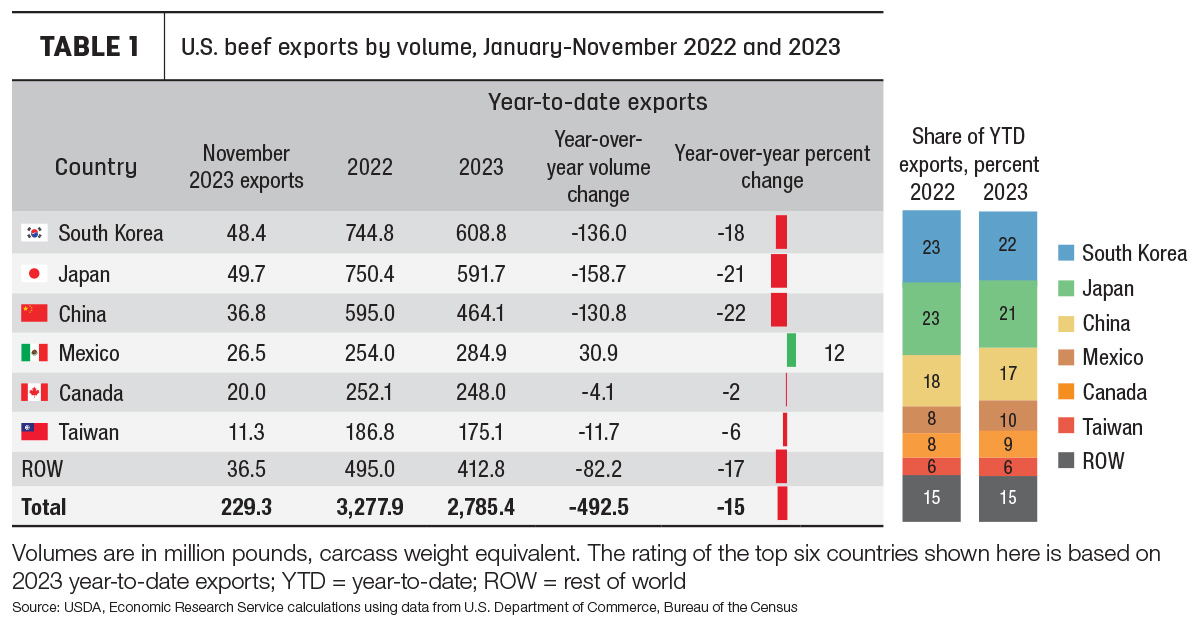

Adjustments were made to the 2023 trade estimates as we wait for one more month of data to round out the year. Tables 1 and 2 provide a breakdown of monthly and January-November beef trade with the top trading partners. Monthly beef exports in November were slightly lower than expected, specifically to Taiwan and other smaller Asian markets. The fourth-quarter export estimate and the resulting annual number are lowered 15 million pounds to 700 million and 3.015 billion pounds, respectively.

Beef imports in November totaled 291 million pounds, the third-highest for the month behind 2004 and 2021. Imports from Oceania were particularly strong. The expectations for fourth-quarter imports are raised 45 million pounds to 885 million, resulting in an estimate of 3.708 billion pounds for 2023.

2024 U.S. beef trade through the lens of domestic production and consumption

Beef trade forecasts for 2024 were adjusted to reflect the current pace of trade as well as expectations for domestic production and demand. On the export side, the annual forecast is lowered 60 million pounds to 2.785 billion, with the decrease concentrated in the second half of the year when the expected decline in beef production picks up, limiting exportable supplies. Exports as a percent of production in 2024 are expected to be around 10.7%. In 2023, exports as a percent of production are estimated at 11.2%; Figure 2 shows the anticipated year-over-year declines after seeing growth – although inconsistently – over the past decade.

Reported exports to the U.S. from Australia and Brazil picked up in November and December, with Australia shipping nearly 200% more year over year in November. Brazil’s reported beef exports to the U.S. in December were 60% higher than 2022 but 30% lower than 2021. These shipments are likely to show up in the U.S. import data in the first few months of 2024. Imports are expected to frontload first-quarter 2024 once again as countries without a specific quota or free trade agreement fill the tariff-rate quota designated for “other” countries. This quota is set at 65.005 million kilograms; once filled, beef imports from the countries subject to this tariff-rate quota will be subject to a higher tariff. As of Jan. 8, the “other” quota for 2024 was already almost 39% full according to the U.S. Customs and Border Protection Quota Status report. Reflecting the stronger imports from South America and Oceania, the import forecast for 2024 is raised 70 million pounds to 3.77 billion. Figure 2 also shows the expected growth in imports as a percent of total disappearance (a proxy for consumption). Imports as a percent of total disappearance are expected to hit 13.8% in 2024, slightly higher than the previous peak in 2015.