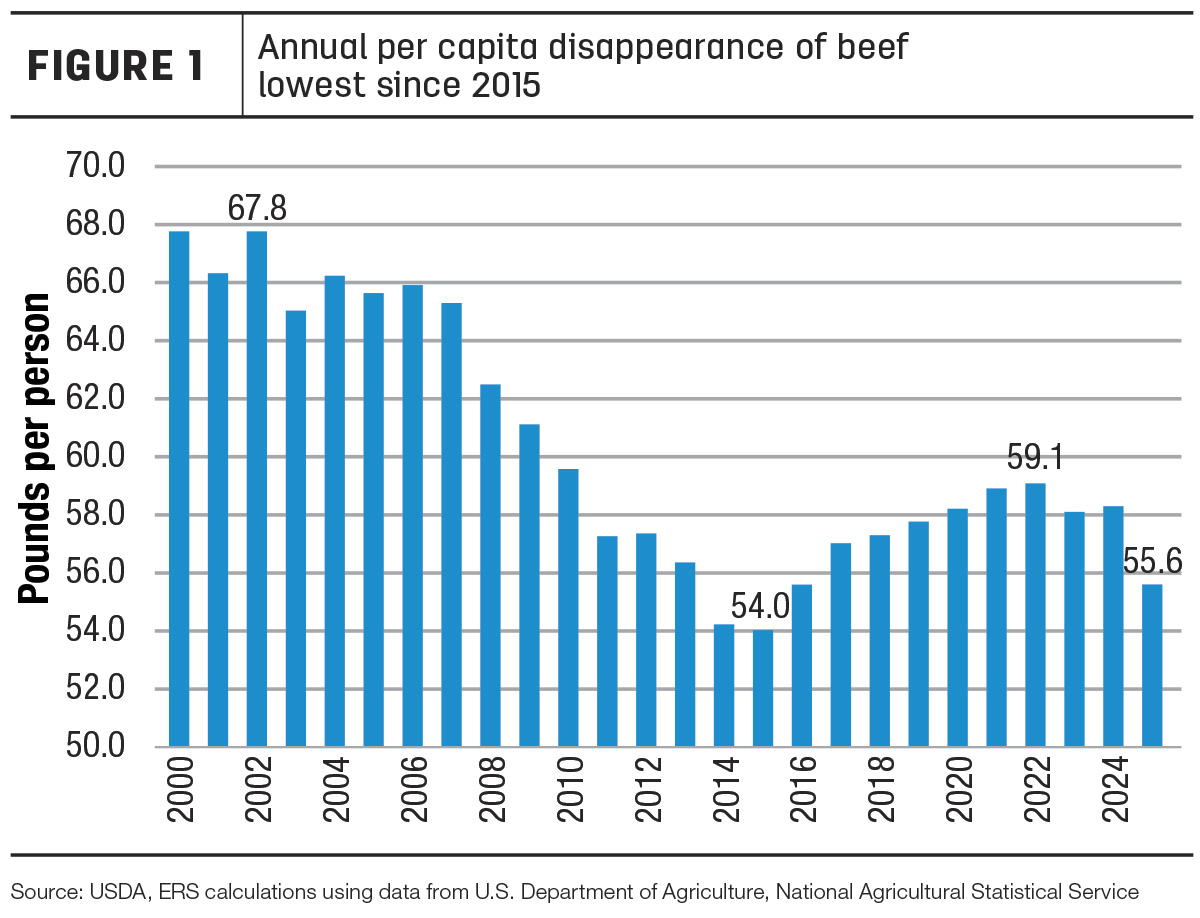

The 2025 outlook for beef production is forecast at 25.12 billion pounds, a 6% decline from 2024.

Next year will mark the third consecutive year of lower production following the record-large volume set in 2022 and will be lowest since 2015, when the sector began to rebuild following the 2009-13 drought.

Cattle supplies are expected to remain tight next year as evidenced by the ratio of heifers and cows in the slaughter mix currently remaining above a year ago and the five-year average, and the number of heifers on feed on April 1 was nearly equal to last year.

The relatively strong pace of beef cow slaughter, along with relatively large placements of heifers in feedlots in 2023 and into early 2024, will likely yield a smaller year-over-year calf crop in 2025, tightening future cattle supplies.

Total disappearance in 2025, measured on a per-capita retail weight basis, is expected to decline 5% from last year to 55.6 pounds (Figure 1). As production declines next year on the largest decline in cattle slaughter since 2013-14, it will be partially offset by record beef imports and eight-year-low exports.

2024 beef production raised mainly on heavier weights

The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), showed the April 1 feedlot inventory at 11.821 million head, over 1% above 11.647 million head in the same month last year. Placements and marketings were down more than surveyed industry analysts expected. Feedlot net placements in March were 13% lower year over year at 1.689 million head. Despite two extra slaughter days in the month compared to last year, marketings in March were 1.706 million head, down about 1% year over year. As a result, on April 1 the number of cattle on feed over 150 days rose 21% above year-ago levels. As a percent of total cattle on feed, this grouping is the largest since 2007. As wholesale beef prices continue to be more sluggish than expected at this time of year, packers are likely less willing to offer higher prices for fed cattle and feedlots appear to be willing to add poundage to the cattle while awaiting higher bids.

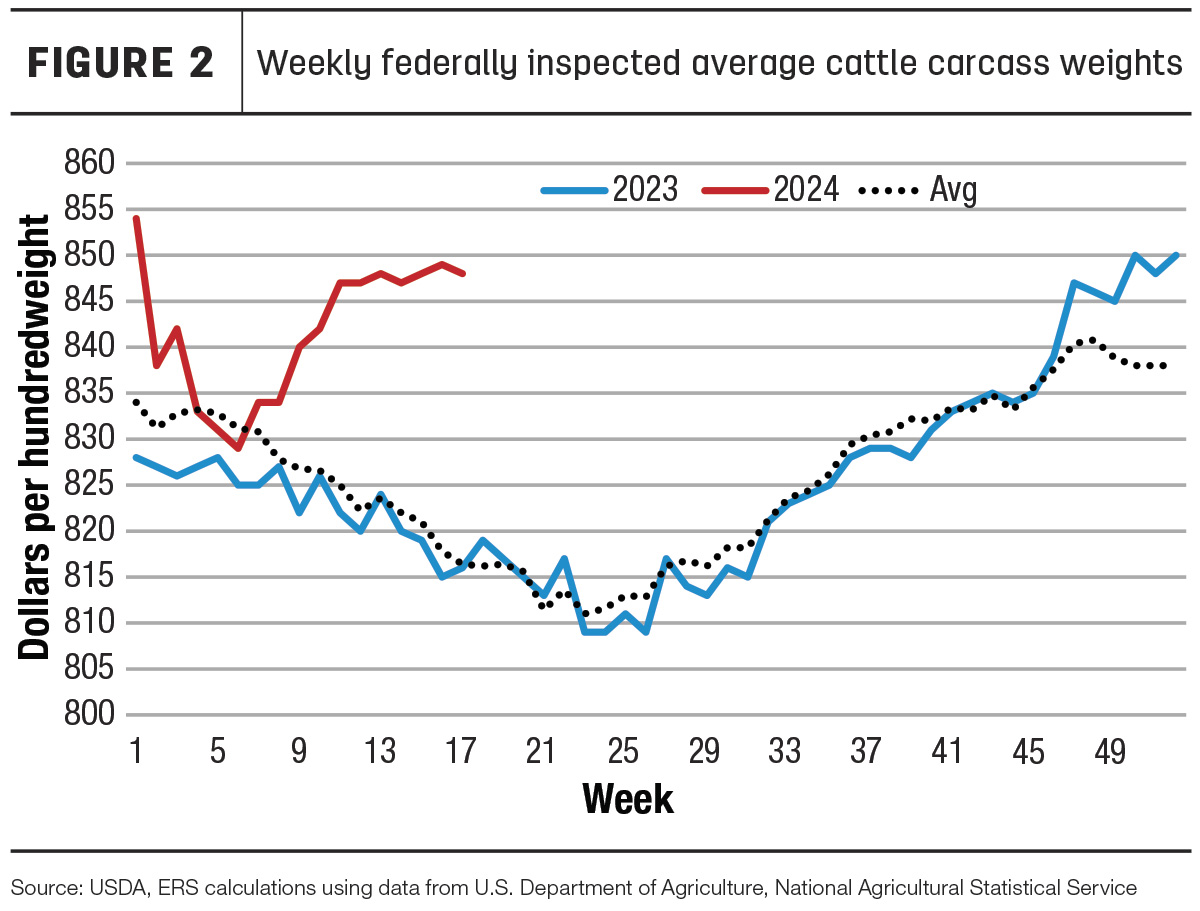

Typically, there is a decline in carcass weights from the seasonal peak in November to about the end of May when weights typically hit bottom. However, given the pace of marketings, carcass weights have moved counter-seasonally higher from the first to the second quarter, and after declining slightly from their recent peaks are expected to remain flat into the third quarter before trending seasonally higher in the fourth quarter (Figure 2).

These heavier expected carcass weights are the primary catalysts for raising total production this year. The forecast for second-quarter beef production is up 70 million pounds from last month as heavier carcass weights and increased cow and bull slaughter are expected to more than offset fewer fed cattle marketings. The third-quarter production forecast is raised 40 million pounds on heavier expected average carcass weights. In the fourth quarter, the production outlook is higher than last month by 35 million pounds as fed cattle marketings are shifted from the first half to the second half of 2024. For the year, the outlook for 2024 beef production is raised by 140 million pounds to 26.595 billion pounds.

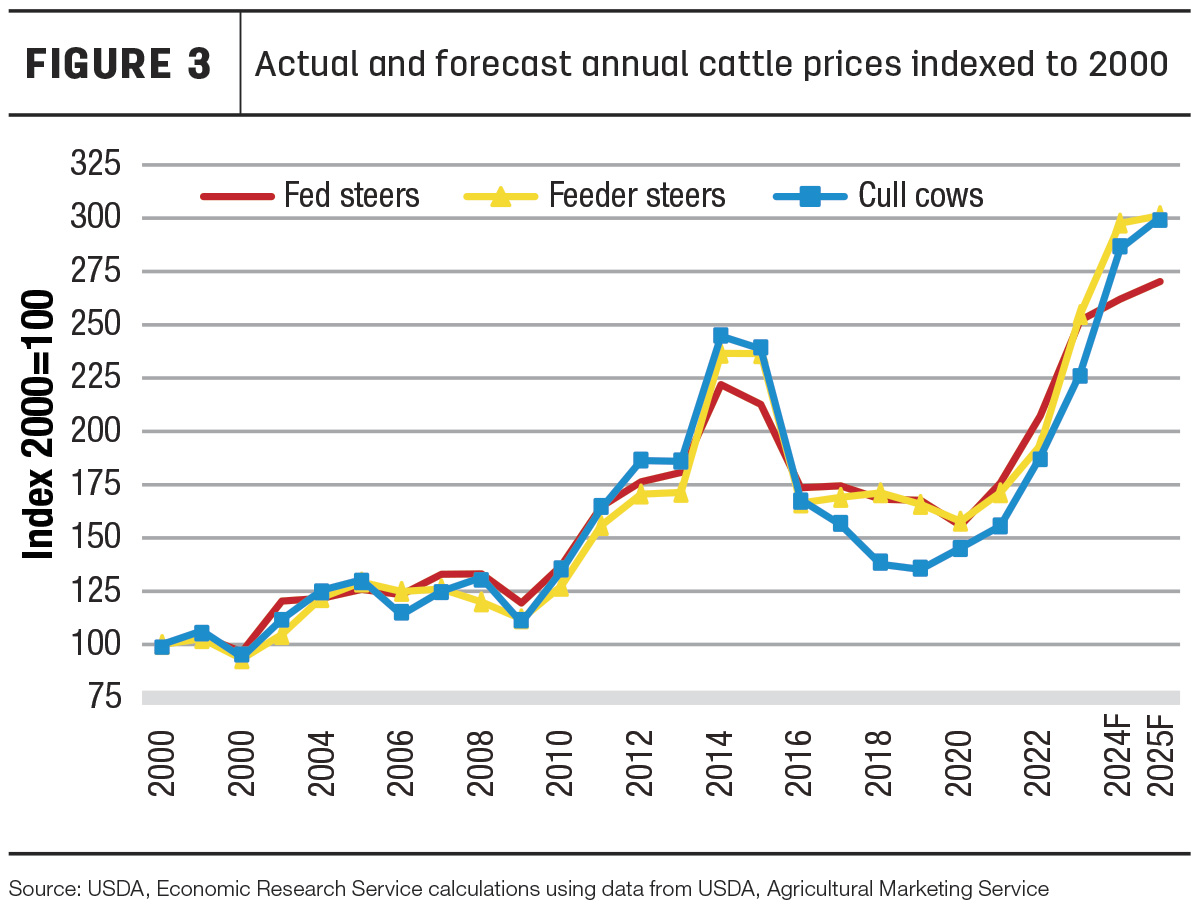

Cattle prices to edge slightly higher in 2025

In 2025, the outlook for cattle prices indicates a slight improvement compared to the massive gains that occurred over the past few years (see Figure 3). The forecast for fed steer prices in the 5-area marketing region is $188 per hundredweight (cwt), a year-over-year increase of 3%. Further tightening of cattle supplies available for placement in feedlots in late 2024 and into 2025 is anticipated to support improved prices next year.

The 2025 forecast for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards is $259 per cwt, an increase of 1% from 2024. Last, cull cow prices in 2025 are forecast at $125 per cwt, a year-over-year increase of 5%. The increase is based on the pace of cow slaughter this year and the assumption that relatively good returns for beef and dairy cattle producers are expected to spur retention of breeding animals.

2024 cattle prices lowered on slower marketing pace and demand uncertainty

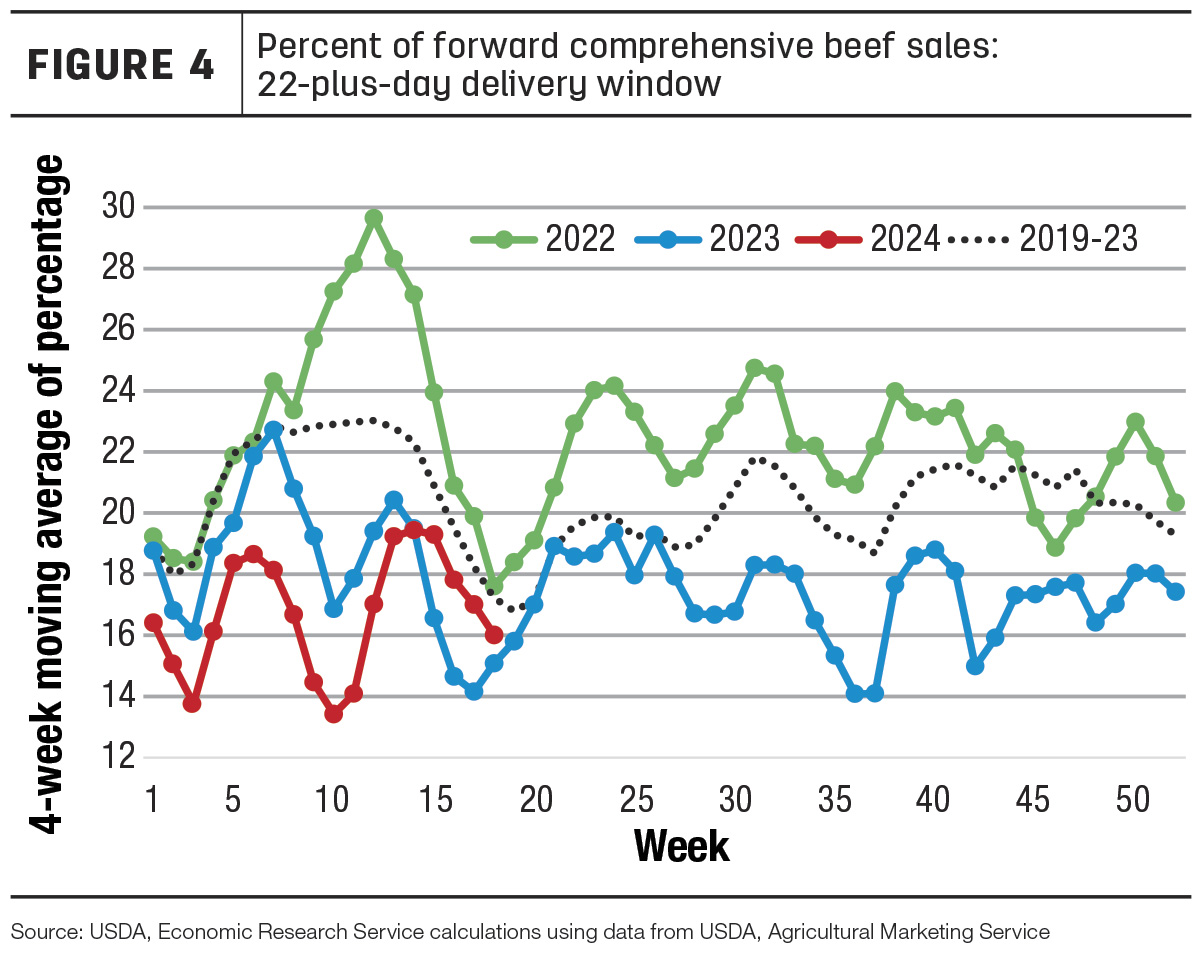

Figure 4 shows the four-week moving average for comprehensive beef sales for delivery 22 weeks and out as a percent of total sales of beef. For all last year and early 2024, the percent of these sales has lagged previous years' levels. However, over the last four weeks, the percentage increased above last year. This may have been driven by the simultaneous declines in wholesale beef prices, which dropped below year-ago levels; if so, it may require relatively low wholesale prices going forward to sustain this momentum. However, this scenario does not bode well for the cattle price outlook.

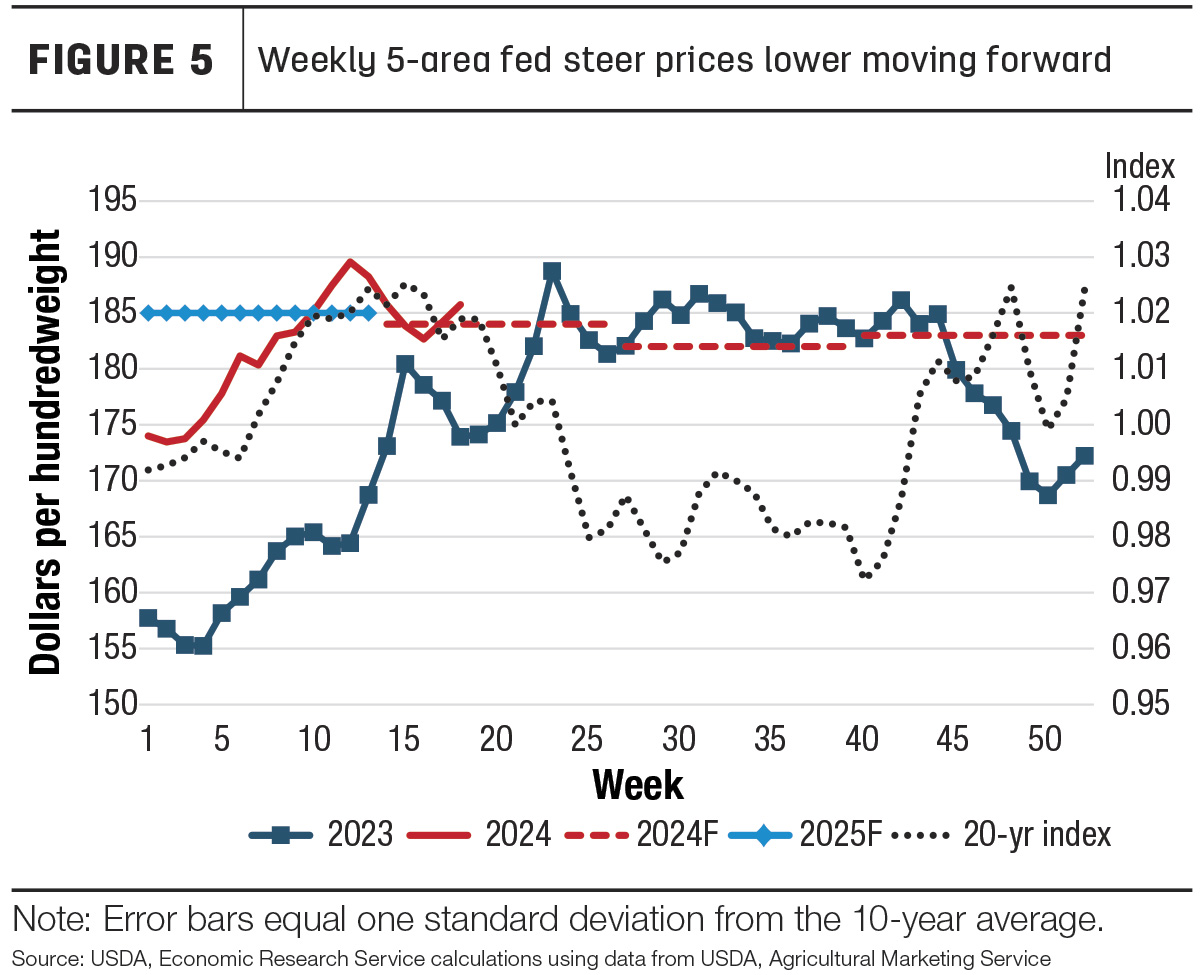

Regarding fed steer prices in the 5-area marketing region, the combination of continued large supplies of market-ready cattle in feedlots and uncertainties about the strength of beef demand has pushed demand for slaughter-ready cattle slower than previously expected. Recently, weaker-than-expected wholesale beef prices put pressure on packers’ margins, as well as on weekly prices for fed cattle, as shown in Figure 5.

The April average price for fed steers in the 5-area marketing region was $184.21 per hundredweight (cwt), roughly $7 above last year. In the first week of May, prices averaged $185.74 per cwt, almost $12 above the same week last year. Based on recent price data and softer expected demand, the 2024 price forecast is adjusted $1.50 lower from last month, with the annual price projected at $153.51 per cwt, over 4% higher than 2023.

Demand for feeder calves has shown significant strength this spring. In April, the weighted-average price for feeder steers between 750 and 800 pounds at the Oklahoma City National Stockyards was recorded at $254.15 per cwt, about $56 above April 2023. The feeder steer price reported on May 6 reached $254.98 per cwt, over $50 above the same week last year. Based on recent price data, assumed adequate forage supplies and declines in forecast corn season average prices, the second-quarter forecast is raised by $5 to $255 per cwt and the third quarter is raised by $2 to $263 per cwt. However, the fourth quarter was pulled down from last month to $264 per cwt for an annual feeder steer price of $255.46 per cwt, a 17% increase from 2023.

First-quarter beef trade

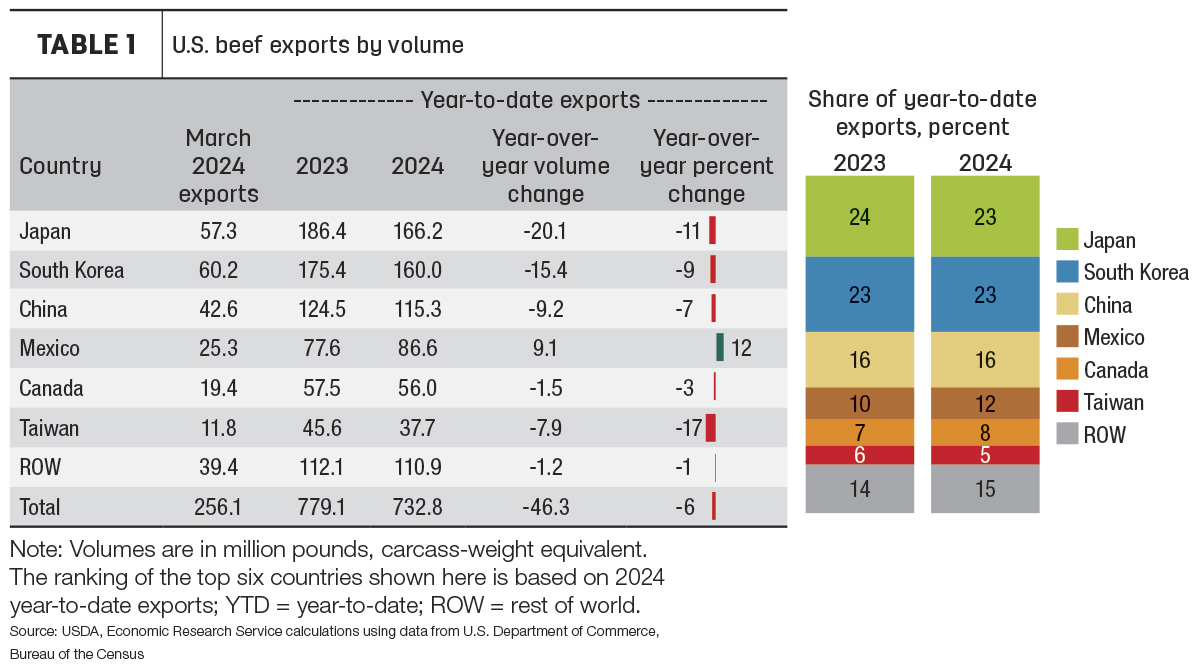

March trade data was published in early May, rounding out the first quarter without any major surprises. Total exports in March were down about 10% year over year. Exports to all of the top seven markets were lower. The largest decrease was in exports to South Korea, down about 10 million pounds, or 14% year over year. Monthly exports to Taiwan were down about 6 million pounds, or 33% from a year ago (Table 1).

Total first-quarter exports were 733 million pounds, a year-over-year decrease of about 6%. Of the major markets, only exports to Mexico and Hong Kong were higher year over year for the quarter, up 12% and 14%, respectively. By volume, the largest decrease was in exports to Japan, over 20 million pounds (11%) lower year over year, followed by exports to South Korea which were down 15 million pounds (9%) from the same time last year. Despite sales contraction, Japan and South Korea remained the top two markets for U.S. beef in the first quarter of 2024, followed by China. Exports to China during this period were down just over 7% from a year ago.

While the volume of exports fell, the total value of first-quarter exports increased about 6% year over year, due to a 12% increase in unit values. The total value of exports to Canada, Mexico and South Korea showed year-over-year increases, while the value of exports to China, Japan and Taiwan decreased. With limited production in the U.S., beef prices have risen, driving up the value of exports. By contrast, the unit value of exports from Australia in the first quarter of this year has decreased about 8%. Australia’s exports to Japan, China and Taiwan during that period increased year over year by 25%, 6% and 21%, respectively. U.S. beef exports will likely continue to face challenges with price competition on the global scale as tight supplies are expected to keep beef prices elevated.

On April 15, Colombia imposed a ban on imports of U.S. beef and beef products originating from states where dairy cattle have tested positive for highly pathogenic avian influenza (HPAI). No other countries have imposed trading restrictions on beef from the U.S. related to HPAI. In 2023, exports to Colombia accounted for 0.4% of total U.S. exports.

The beef export forecast for the second half of 2024 is raised marginally by 20 million pounds, reflecting relative strength of several markets in the first quarter. The annual forecast is 2.818 billion pounds, a 7% decline from the previous year.

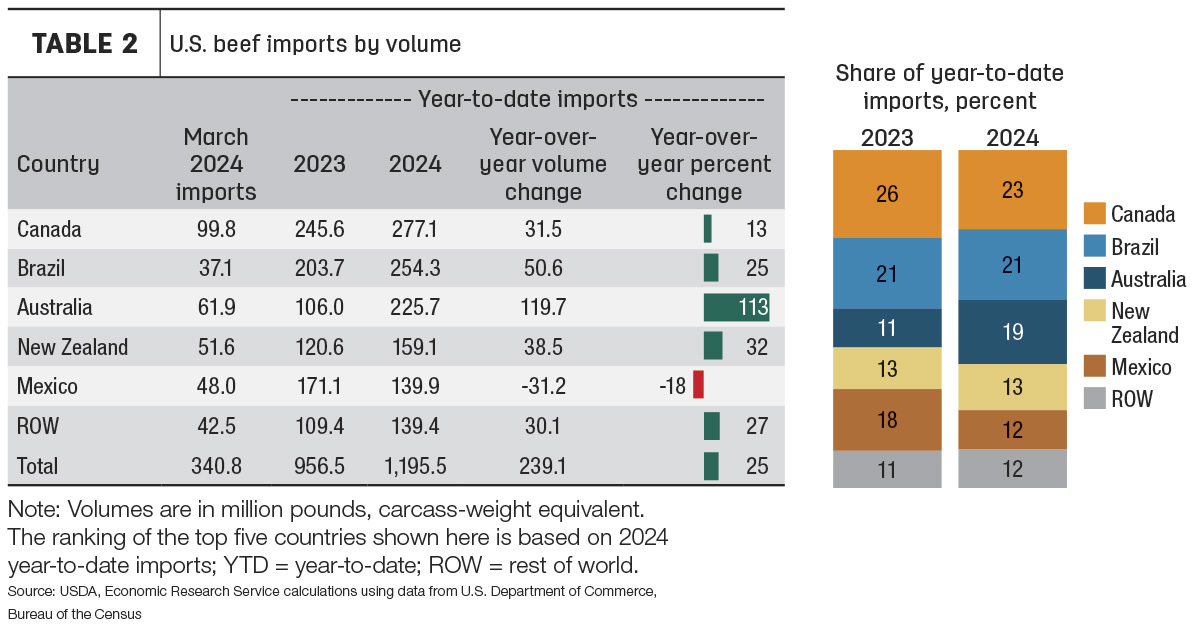

On the import side, March data came in at 341 million pounds (Table 2). This topped off a record first quarter at 1.196 billion pounds, 25% higher year over year and 44% higher than the five-year average. The majority of the increase in imports for the quarter was due to imports from Australia more than doubling from last year. Also showing strong year-over-year increases were imports from Uruguay (+68%), New Zealand (+32%), Brazil (+25%) and Canada (+13%). Of the top five suppliers, only imports from Mexico decreased, down 18% from the same time last year. The increased exports to and decreased imports from Mexico are likely driven in part by the exchange rate, as the Mexican peso has strengthened against the U.S. dollar compared to last year.

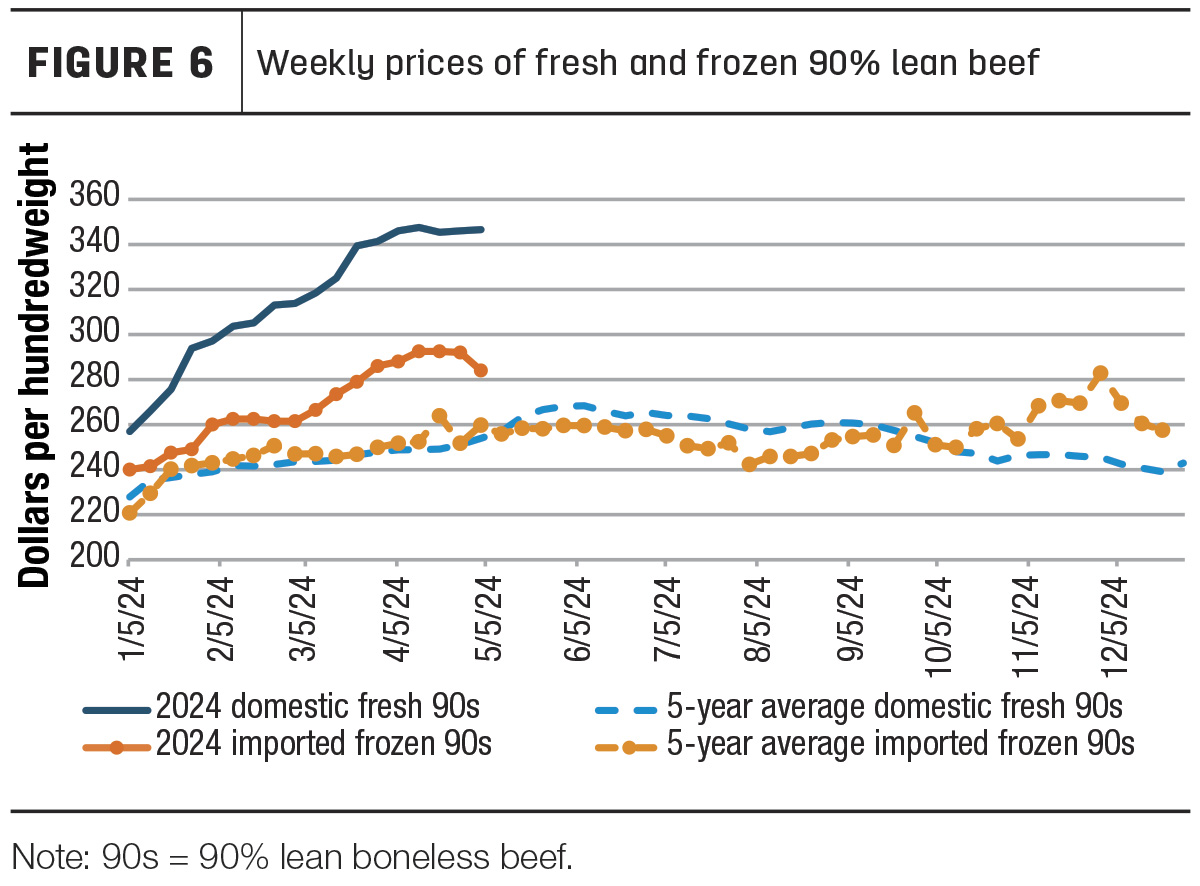

Nearly 80% of the increase in total imports in the first quarter were frozen boneless trimmings. The U.S. demand for lean beef trimmings is evidenced by exceptionally strong prices for domestic imported 90% lean beef (“90s”). Large supplies of 50% lean trimmings increased demand for lean beef at the same time first-quarter cow slaughter (which results in mainly lean trimmings for grinding) was more than 13% lower year over year. As a result, the price for fresh 90s has increased by over $90 per cwt from the start of the year (see Figure 6). The price of imported frozen 90s has risen about $45 per cwt since the beginning of the year.

The import forecasts for the remaining quarters of 2024 are unchanged from last month. The 2024 annual forecast is 4.171 billion pounds. If realized, this would be a 12% increase year over year and the first time beef imports have exceeded 4 billion pounds.

Exports lower, imports higher in 2025

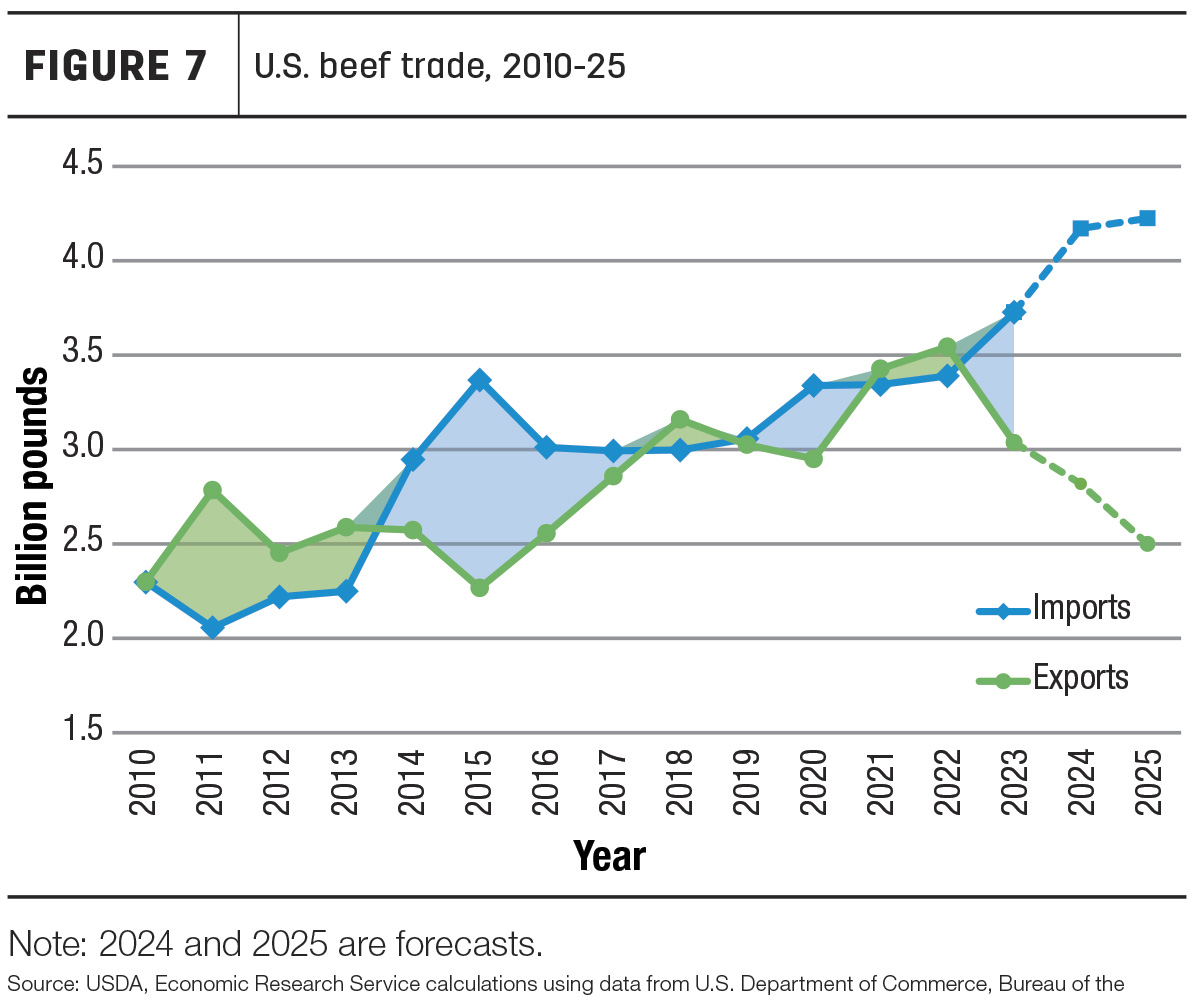

The U.S. beef trade balance is expected to show a widening deficit (imports higher than exports) in 2024 and 2025. Figure 7 shows the beef trade balance from 2010 to 2025. With domestic beef production expected to fall about 6% in 2025, annual exports are forecast at 2.5 billion pounds, representing an 11% decrease year over year. As a percent of production, 2025 exports would represent about 10%. For 2024, exports as a percent of production are forecast at just under 11%, while the average from 2019-23 was around 12%. The combination of fewer supplies available to export, higher beef prices in the U.S. and increased competition from Oceania will continue to create challenges for the expansion of U.S. beef exports.

The expected growth in beef imports into 2025 is more muted compared to the forecast increase in 2024. With much lower cow slaughter expected in 2025, the demand for imported lean trimmings will be high. However, for a number of major beef suppliers, tariff-rate quotas (TRQs) may constrain the ability for imports to grow year over year compared to large expected imports in 2024. Through the last week in April 2024, imports under the TRQs have already reached nearly 35% of the cumulative total for all quotas. Imports from Brazil and other countries without a specific quota or free trade agreement are limited by a quota that was filled in February of this year; imports from Brazil have dropped off since then. Imports from Australia are also subject to a TRQ that has not been filled since 2015. In 2024, the fill rate of the quota through the last week in April is only about 11% behind the same period in 2015, indicating a stronger fill rate relative to recent years. Further increases in imports in 2025 may be limited by these quotas. High prices for beef imports in the U.S. may partially offset the higher out-of-quota tariff; however, the TRQ is expected to largely limit over-quota imports from any countries that fill their quota before the end of the year and alternative destinations become more price competitive.

The seasonal pattern of imports over the last three years has been heavily front-loaded. The first quarter has accounted for an average of 28% of total annual imports as countries rush to fill the TRQ when it resets in January. This seasonal pattern is carried into 2025, with the first-quarter forecast at 1.2 billion pounds. The annual import forecast is 4.225 billion pounds, a year-over-year increase of just over 1%. The ratio of imports as a percent of total disappearance is expected to be around 16%. For 2024, the ratio of imports as a percent of disappearance is forecast at just under 15%, while the average from 2019-23 was around 12%.

U.S. live cattle trade

The U.S. cattle import forecast for 2024 is 2.1 million head. Total live cattle imports in the first quarter were about 6% higher than the same period last year. Imports from Canada are up 10%; imports from Mexico are up about 4% year over year. The forecast for cattle imports in 2025 is 2.05 million head, a moderate year-over-year decrease driven by relatively tight supplies of cattle in Canada and Mexico rather than by a lack of U.S. demand for the cattle. Live cattle exports in 2024 are forecast at 250,000 head, while 2025 is forecast to fall to 150,000 head.