Here’s an update on interest rates from quarter four of 2023 and quarter one of 2024 as reported by four Federal Reserve districts that share data impacting dairy finances.

Interest rates improve slightly in first-quarter 2024

Quarterly lender surveys from Chicago, Dallas and Kansas City Federal Reserve districts indicate interest rates on all agricultural loans remain high in nominal terms. When adjusted for inflation, the rates are unchanged or improving slightly.

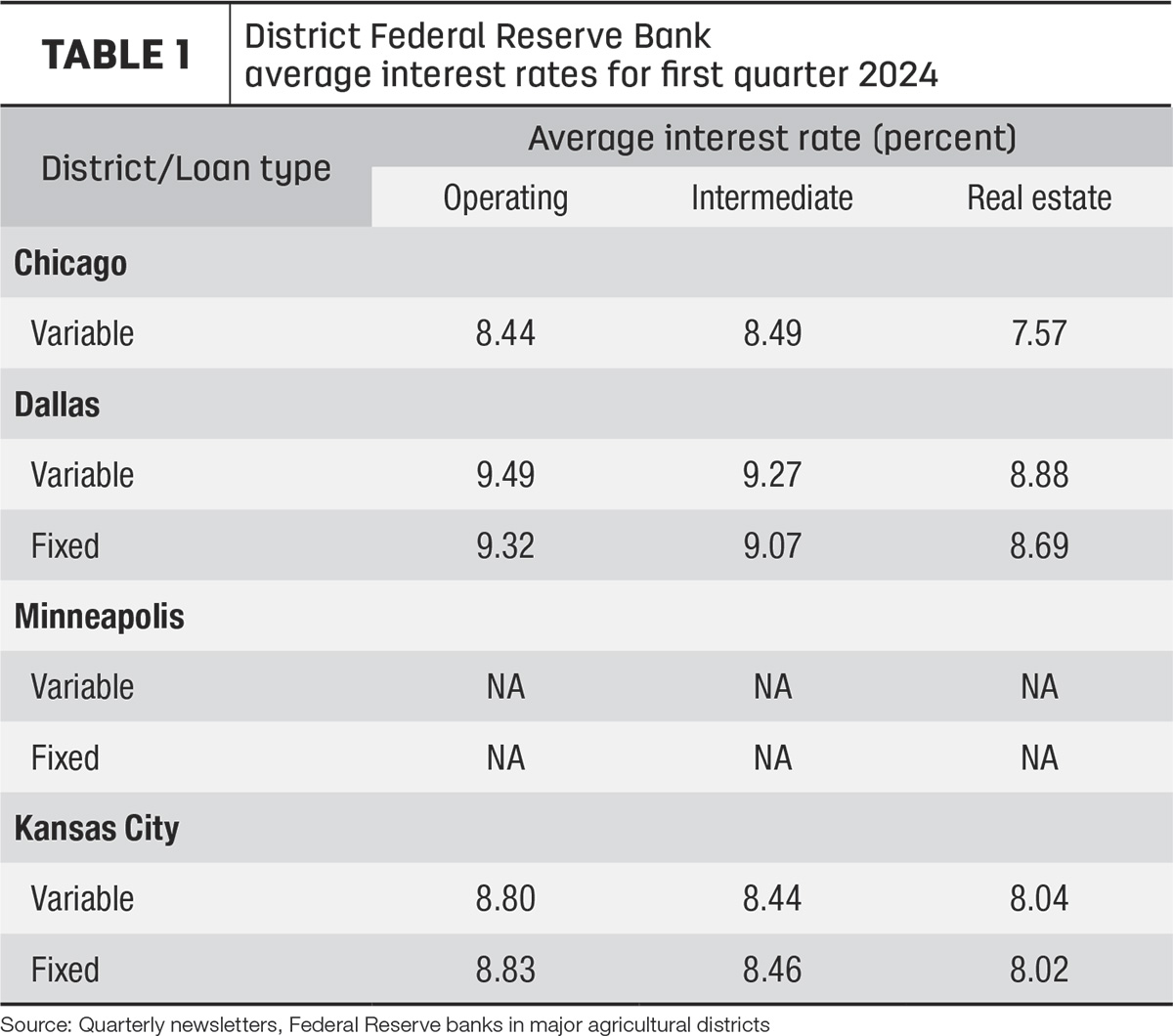

Changes in average agriculture loan interest rates in predominantly agricultural districts included (Table 1):

- Chicago: On average, variable-rate interest rates were down across the board. Operating and real estate loans were down 0.8% and 0.4%, respectively, while intermediate loans were unchanged from the previous quarter.

- Dallas: Interest rates were down on both fixed and variable loans from quarter four of 2023 to quarter one of 2024. The percentage change ranged from -0.3% on fixed operating loans to -2% on variable operating loans.

- Kansas City: Interest rates decreased, on average, from the previous quarter. Yet, fixed-rate operating loans increased 0.1% from quarter four of 2023, as well as variable-rate real estate loans at 0.2%.

Federal Reserve holds interest rates

Meeting on April 30 through May 1, the Federal Reserve Board’s Federal Open Market Committee (FOMC) held interest rates for federal funds steady at 5.25% to 5.5%. According to the committee, it does not expect it would be appropriate to reduce the target range until there is greater confidence that inflation is moving sustainably toward 2%. The FOMC meets eight times a year. The next meeting is scheduled for June 11-12.

May FSA interest rates up

Getting an early look into the second quarter of 2024, interest rates charged on loans through the USDA’s Farm Service Agency (FSA) were mostly higher in May 2024. Interest rates for operating and ownership loans (compared to April) were as follows:

- Farm operating loans (direct): 5.25%, up from 5.125%

- Farm ownership loans (direct): 5.5%, up from 5.375%

- Farm ownership loans (direct, joint financing): 3.5%, up from 3.375%

- Farm ownership loans (down payment): 1.5%, unchanged

- Emergency Loan (amount of actual loss): 3.75%, unchanged

FSA also offers guaranteed loans through commercial lenders at rates set by those lenders.

For more information, producers can contact their local USDA Service Center.

FSA provides more streamlined way for borrowing

For those producers who submit a direct loan application to the USDA’s FSA, there are various improvements underway. The digital changes include an online loan application that allows producers to provide a digital signature, as well as attach supporting documents; the loan assistance tool is an interactive guide to better understand the application process; and an online direct loan repayment feature bypasses the need to call, mail or visit a local office to pay a loan installment. Additionally, the paper application is reduced from 29 pages to 13 pages.

2024 forecast

Producers surveyed during April in Purdue University’s Ag Economy Barometer expressed shifting expectations in interest rates in the latest report published May 7. Only 24% of those respondents anticipate interest rates to rise over the next year, down from 32% in March. Yet, the improved interest rate outlook does not reflect in improved farmland values, highlighting producers’ concerns for the agriculture economy in 2024.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn and soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs.

According to the latest USDA Farm Sector Income Forecast posted Feb. 7, the forecast continues falling after record highs in 2022. Overall farm cash receipts are expected to decrease by $21.2 billion (4.2%) from 2023 to $485.5 billion in 2024. Total animal and animal product receipts are forecast to decrease by $4.6 billion (1.9%) to $239.8 billion this year; specifically, milk receipts are forecast to decrease about 2% due to lower prices.

In 2024, interest as expenses are expected to remain similar to 2023 levels with expenses increasing in nominal terms but falling once adjusted for inflation. Last year, interest as an expense grew $10.1 billion (41.8% greater than 2022 values) to $34.2 billion, reflecting both higher total debt levels and interest rates throughout 2023.

2023 fourth-quarter interest rates highest in 16 years

Quarterly lender surveys from major agricultural districts indicated interest rates on all agricultural loans increased throughout 2023 with fourth-quarter rates the highest in 16 years as several loan categories approached 9%. The last time interest rates were this high was in the second quarter of 2007.

Reports from the Federal Reserve Bank of Chicago acknowledged interest rates did not change much in the fourth quarter of 2023. Yet, when adjusted for inflation, those rates leapt. In some cases, the real interest rate was last higher in 2009.

The sentiment toward the economic conditions in the agriculture sector was similar across regions. One producer in western Oklahoma stated in the Federal Reserve Bank of Kansas report, “As interest rates have creeped higher, capital spending is still high for farmers. Farm income is not keeping pace with spending.” In the Minneapolis district, it was noted that producers paid over $840 million in interest expenses in 2023, an increase of $353 million from 2022.

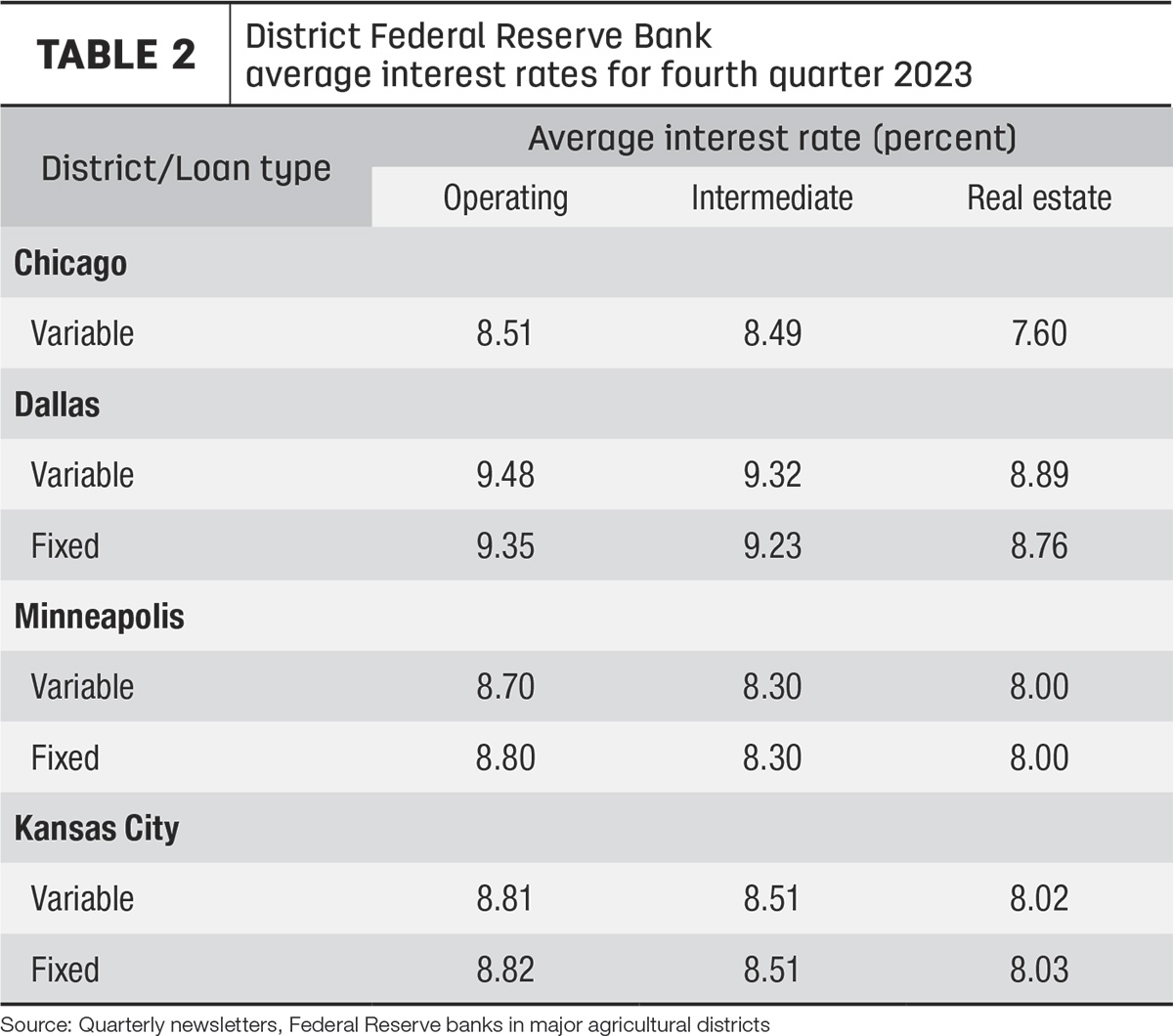

Reviewing quarterly lender surveys, average interest rates included (Table 2):

- Chicago: Interest rates on variable-rate operating and intermediate loans were up about 0.1% and 0.2%, respectively, compared to the previous quarter, while variable-rate real estate loans were down 1.3%.

- Dallas: Districtwide, interest rates on fixed and variable loans were all up. Fixed-rate operating, intermediate and real estate improved 1.4%, 2.7% and 1.2%, respectively. Likewise, variable-rate operating, intermediate and real estate rose 1%, 2.5% and 0.7%, respectively, from the previous quarter.

- Kansas City: The average interest rates on fixed operating and machinery loans were up 0.1% in the fourth quarter of 2023 as real estate loans were down 0.1%. Interest rates on variable-rate real estate loans were down 0.1% while rates for operating and machinery were up 0.1% and 1.4%, respectively.

- Minneapolis: Average fixed rates on operating, machinery and real estate loans were unchanged in quarter four from quarter three of 2023, but variable rates on those three loans were all up 1.2%.