Farming as a way of life can be a tough business. Farm for profit, or you won’t be farming for long. Such catchphrases have become common on agriculture-focused podcasts, and they may contain a grain of truth. So should you move from working “in” the business to spending time working “on” the business?

When I was early in my career, I just wanted to make cows better. I didn’t have much training in finances or managing people, and I didn’t much care. I just wanted to get better at fixing cows. This is common in many businesses – electricians, bakers, veterinarians and dairy producers.

We start our careers because we love our technical skills – and sometimes, before long, we end up running our own business providing technical services. But we may not be very good at running that business. In the book The E-Myth, author Michael Gerber suggests being our own boss sounds easy, but the myth is running a successful business will take more skills than what helped us become great technicians. Running the finances and managing people requires time, new skills and the interest to do it correctly.

The average farm size in Canada is now 100 cows. What would a farm of this size sell for in your neighbourhood as an ongoing operation? Many companies of this size would have a team of executives to run the company – someone for finance, another for human resources and operations, and a chief executive officer (CEO) who oversees the whole operation. You are the CEO of your farm by default, but do you feel equipped for the task? What about the other roles? Are you wearing those hats as well?

Canadian research findings

As part of my master's project, we have investigated three crucial questions about the financial aspects of Canadian dairy farms. I will discuss the first question in this article and the others in upcoming issues of Progressive Dairy.

You may be able to guess what the first question was based on the opening paragraphs: Canadian dairy producers are technically advanced, but is your financial knowledge at the same level?

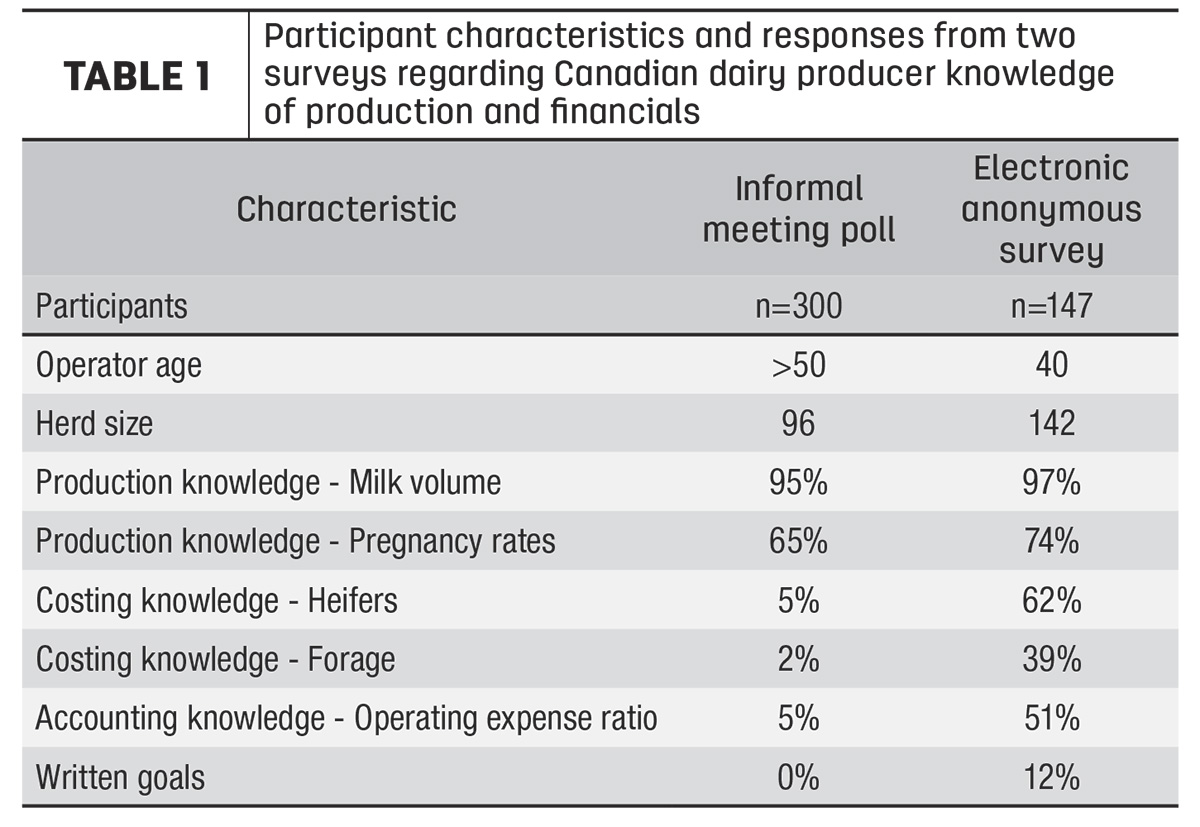

We started to test producer knowledge of production and financial metrics using informal polls. These were conducted in Ontario during in-person producer meetings (see Table 1). The participants were close in age and farm size to the average producer.

Unsurprisingly, most knew their daily milk production per cow and their 21-day pregnancy rate (reproduction knowledge). When we asked about financial metrics, few knew their cost to raise replacements or forages, and fewer had heard the term "operating expense ratio."

A study by Farm Management Canada found operators with a written business plan had 525% higher return on assets than their peers, so we also asked how many had written goals, and none had (0%).

Informal polls may not be accurate, so we expanded our efforts using a national anonymous electronic survey. The Dairy Farmers of Ontario, Manitoba Milk and Alberta Milk shared the link with producers, and 147 completed the survey. This group's knowledge of production metrics was very high, and their understanding of financial metrics was much higher than that of the informal poll. The respondents were younger than those in the previous group and owned larger farms, which may imply that business interest or access to training differs with farm size and age.

What can you do about it?

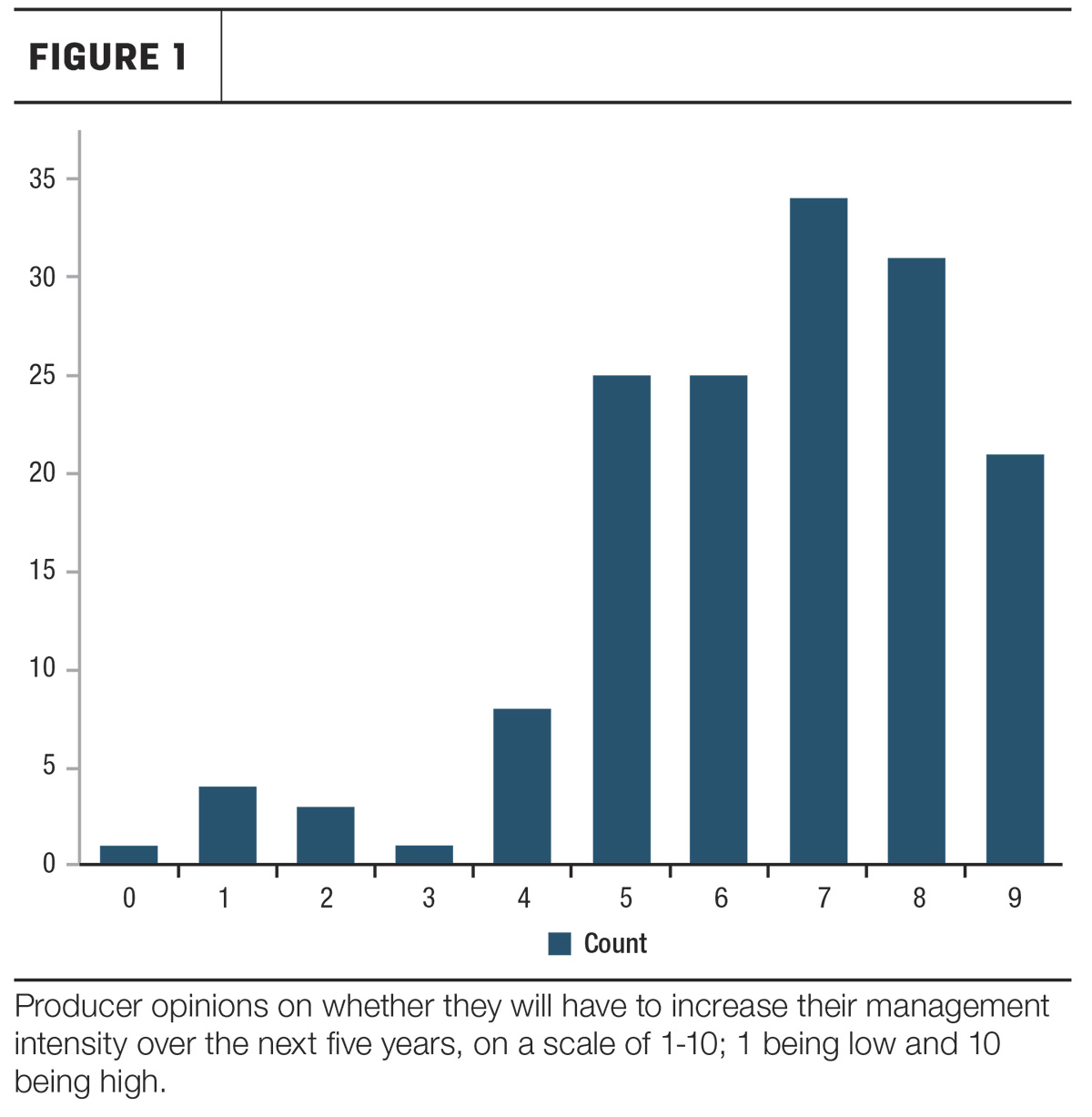

Distributing an electronic survey also allowed us to ask more questions. Although the anonymous group appeared more financially knowledgeable, we asked for their opinions on future training. The outcomes to "How do you feel about the suggestion, 'You will have to improve your level of management intensity over the next five years’" (on a scale of 1-10, with 1 being low and 10 being high) are shown in Figure 1. Their scores varied from 0 to 9, but the median replied with a 7 out of 10.

I can relate to the participants. Twenty-one years after finishing my veterinary degree, I wanted to learn more about farm finance and management and decided to return to the University of Guelph for a master's degree. Few people will want to go to this length, but luckily, other options are available.

The University of Guelph has partnered with RBC and FCC to offer a course called Foundations in Agricultural Management. This free online course consists of eight modules spanning business planning, financial literacy and transition planning. In our survey, the producers revealed that they prefer to learn in a peer group setting, so I have listed some resources that offer in-person teaching in Table 2.

Dairy focus

In the fall of 2022, a veterinary colleague approached me with an idea. He had purchased an ongoing dairy farm and continued to practice full-time while learning how to manage the farm. He was searching for courses that were tailored for dairy producers and asked me to work on building a pilot program. We led the "Young Dairy Executive Club" with a small group of producers during 2023. Topics included communication, financial literacy, and linking production and profit. Participants provided feedback on what they appreciated and gave thoughts on improvements.

While they were satisfied with the teaching, the highlight was, “Networking and being inspired to improve by like-minded people.” The group also encouraged us to expand this course to other producers regionally. Future cohorts will be planned in cooperation with dairy veterinary clinics, so if you are interested in attending, please have your veterinary adviser contact us about organizing one in your area.

Speaking of advisers, if you have specific questions regarding managing your farm, don’t forget to ask your accountant, lender, veterinarian and feed adviser for input. They all bring different training and perspectives and interact with many operations. In the next issue, we will discuss research on how best to encourage communication between your advisers.