The relatively slow pace of slaughter in the first four months of 2024 contributed to the number of cattle on feed longer than 150 days on May 1 being the highest since May 2012. According to industry participants, some packers are foregoing typical discounts on cattle above certain weights, further incentivizing feedlots to keep cattle on feed longer, especially as they maintain feedlot capacity utilization in the face of slowing placements.

As a result, weekly steer and heifer carcass weights remain at record highs for this time of year. For the week ending May 25, steer and heifer carcass weights were 37 and 29 pounds, respectively, above the same week a year ago. This additional weight is enabling packers to partially offset the impact of having fewer cattle to process than a year ago, as carcasses are yielding about 4% more product year over year.

The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), estimated the May 1 feedlot inventory at 11.554 million head, about 1% below 11.65 million head in the same month last year. Feedlot net placements in April were 6% lower year over year at 1.6 million head. April had two extra slaughter days in the month compared to last year, which was reflected in marketings in April at about 10% above a year ago to 1.87 million head. As a result, on May 1 the number of cattle on feed over 150 days declined month over month but was 12% above year-ago levels. As a percent of total cattle on feed, this grouping is the largest for the month since May 2020, a time when packers were limited in their ability to process cattle.

Despite the high number of cattle on feed over 150 days, there are fewer total cattle on feed than a year ago. Although the heavier weights implied by the increased number of cattle on feed over 150 days have partly offset lower cattle numbers, expected declines in both on-feed numbers and the proportion of cattle on feed for longer periods point toward declining supplies of beef.

2024 beef production unchanged; 2025 production raised

The projection for 2024 beef production is slightly lower than last month’s forecast at 26.59 billion pounds (-5 million). This small change is the result of much heavier expected cattle carcass weights, mostly offsetting a slower expected pace of fed cattle marketings for the remainder of 2024. More specifically, the forecast for second-quarter 2024 beef production is updated on reported slaughter counts and carcass weights through early June. The third- and fourth-quarter production forecasts are raised on heavier expected average carcass weights that more than offset a slower pace of marketings.

In 2025, beef production is projected higher than last month’s forecast by 245 million pounds to 25.37 billion pounds. Heavier cattle weights are expected to carry over into early 2025, along with a faster-than-expected pace of marketings in early 2025 as marketings are shifted from late 2024.

Cattle prices steady with heavier cattle weights

Demand for feeder cattle remains steady, supported in part by improved forage and pasture conditions from a year ago across most of the country. This has enabled cattle to go on grass rather than into feedlots, particularly as feedlots are limiting placements in response to high feeder prices.

In May, the weighted average price for feeder steers weighing 750-800 pounds at the Oklahoma City National Stockyards was $253.90 per hundredweight (cwt). This was a decline of 25 cents from April but more than $48 higher than May 2023. In the first two weeks of June, the weighted average price was $253.25 per cwt, a slight decline from the May average. Accounting for recent price data in June, the price forecast for the second quarter is lowered by $1. The fourth-quarter forecast is also lowered by $1, resulting in a decrease to the 2024 forecast to $254.96 per cwt. The outlook for 2025 feeder steer prices is unchanged from last month at $258.50 per cwt.

As noted, the heavier cattle weights are partially offsetting the tight cattle supplies. Fed steer prices have gained in recent weeks thanks to wholesale prices moving counter-seasonally, which has improved packers’ margins, likely making them more willing to pay higher prices for these heavy cattle. In fact, the weekly weighted-average fed steer prices in the 5-area marketing region hit a new record for the week ending May 26 of $190.09 per cwt.

The average price for May was $187.88 per cwt, 33 cents above the record set in March and $12 higher than last year. Based on recent data in early June, the second-quarter 2024 fed steer price forecast is raised by $2 to $186 per cwt. The third quarter is raised by $1 to $183, and the fourth quarter is lowered by $1 to $186 per cwt on the slower-than-previously-expected pace of marketings in the fourth quarter. As a result, the forecast for 2024 is raised by 50 cents to $184.01 per cwt. The outlook for 2025 fed steer prices is raised 25 cents from last month at $188.50 per cwt, based on a faster than previously expected pace of slaughter in the first quarter.

Beef trade forecasts unchanged from last month

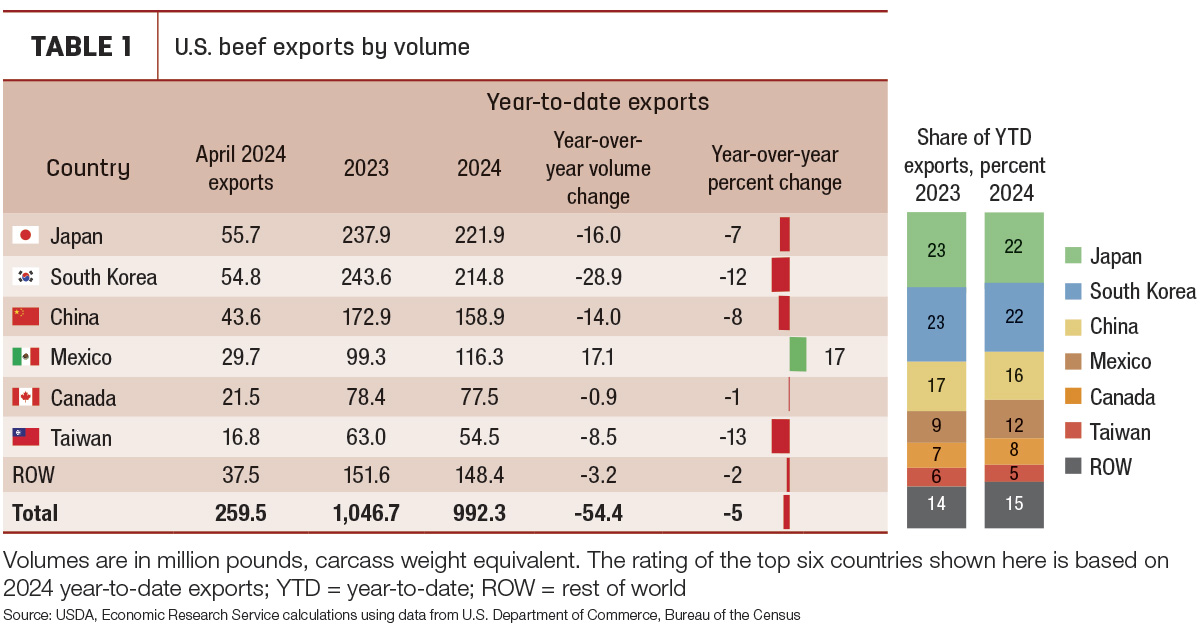

Monthly beef exports have climbed through the first four months of the year and in April were 260 million pounds. This was about 3% below a year ago. Monthly exports to several markets were slightly higher year over year, including Mexico (37%), Japan (8%) and Canada (3%). Exports to South Korea, China and Taiwan were smaller than a year ago by 20%, 10% and 3%, respectively.

Year-to-date exports are shown in Table 1. Exports are down to most major markets except for Mexico. Total year-to-date exports are down 5% year over year. With a few exceptions, the ranking of the top six markets and the percentage of shares to each country have stayed relatively unchanged from a year ago. The export share to Mexico has increased to 12%, taking some shares away from other markets. Japan and South Korea remain the top markets for U.S. beef, though they have traded places compared to last year, with Japan the top market for exports so far in 2024.

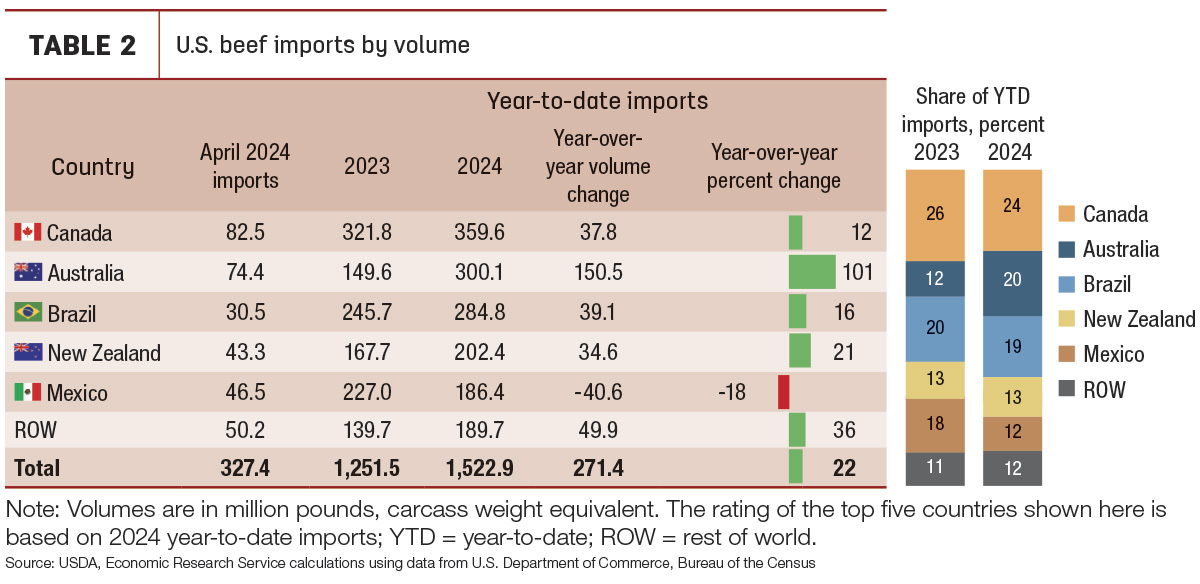

Australia is both a competitor with U.S. beef in the global market and a supplier of imported lean trimmings (a complementary product to domestic beef production) to the U.S. Through April, total year-to-date exports from Australia were 22% higher than in the same period last year. Australia’s beef exports to Japan are up about 21%, while exports to China and South Korea are lower year over year. Australia’s reported exports to the U.S. through April of this year were up 84% year over year, and shipments to the U.S. accounted for nearly a quarter (24%) of aggregate Australian beef exports compared to about 16% for the same period in 2023.

Monthly 2024 U.S. beef imports have fallen since January; total imports through April were about 11% higher year over year at 327 million pounds. Table 2 shows year-to-date imports. Canada remains the top supplier of beef to the U.S., while Australia has moved up to the second-largest supplier. The share of imports from Australia through April has risen to 20% compared to 12% for the same period last year. There were also significant increases in imports during April from suppliers not in the top five, including Uruguay (80%), Argentina (62%) and Nicaragua (31%). Demand for lean beef trimmings remains strong as domestic cow slaughter remains low, and heavier steer and heifer carcass weights have bolstered the supply of fat trimmings for blending into ground beef.

The 2024 and 2025 export and import forecasts are unchanged from last month. Exports in 2024 are forecast at 2.82 billion pounds, which would be a year-over-year decrease of 7%. The 2025 export forecast is 2.5 billion pounds, a further decrease of 11%. The annual import forecast for 2024 is 4.17 billion pounds, a forecast year-over-year increase of 12%; the 2025 forecast is 4.23 billion pounds, an increase of 1% over the expected record imports in 2024.