In no particular order, here are the stories that made headlines this past year. 400,000 SCC doesn’t pass at NCIMS; divides industry Progressive Dairyman Editor Emily Caldwell reported a proposal to lower the somatic cell count (SCC) limit from 750,000 to 400,000 was discussed at the National Conference on Interstate Milk Shipments (NCIMS) in late April.

Proponents of the proposal, including author Jamie Jonker of the National Milk Producers Federation, pointed out that several states had or are attempting to pass their own regulations for lowering SCC, leaving inconsistency in regulations between states.

Doug Metcalf of the Indiana State Board of Animal Health brought up concerns that while many dairymen are already achieving the 400,000 cell count, especially in Indiana, the industry has some work to do in achieving a higher level of milk safety and avoiding drug residues.

A 400,000 limit could help enforce that, and NCIMS was the appropriate organization to regulate SCC on a national level, Metcalf said.

Opponents of the proposal, like Lewis Ramsey of the Kentucky Milk Safety Branch, Commonwealth of Kentucky, expressed their distress that such regulation could drive out many small farms, particularly those in the Southeast and in Kentucky.

The motion to pass the proposal failed on April 23, with a vote of 22 for, 28 against and one abstention.

The following day, toward the end of the conference, NCIMS delegate George Blush of the Kansas Department of Agriculture made a motion to reconsider the SCC proposal.

By just one vote, the motion to reconsider the proposal failed, leaving the author and supporters of the proposal with the challenge to try again at the next conference – to be held in 2015.

Aspartame in milk

In February, the FDA published a petition in the Federal Register that was filed nearly four years prior by the International Dairy Foods Association (IDFA) and the National Milk Producers Federation requesting a modification of the standards for milk and other dairy products to allow the use of non-nutritive sweeteners. In addition, the agency requested public comments, due by May 21.

According to IDFA, the petition is a direct attempt to keep flavored milks in school cafeterias. The current standard requires processors to use special labeling, such as “reduced-calorie chocolate milk,” for milk made with non-nutritive sweeteners.

This phrase, according to market research, doesn’t appeal to children and has contributed to the overall decline in milk consumption in schools, the petition states. Allowing milk processors to use any “safe and suitable” sweetener in flavored milk and still label it “milk” would help to stem the drop in consumption.

There are at least five non-nutritive sweeteners approved by FDA for use in foods and beverages, including aspartame and sucralose.

The agency has already updated the ice cream standard to allow these sweeteners. In addition to milk, the petition asks FDA to modify the standards for 17 other dairy products, including sour cream and yogurt.

Dave Wilkins, a freelance writer based in Twin Falls, Idaho, mentioned in Progressive Dairyman that more than 40,000 comments were filed during the public comment period.

Wilkins wrote, “a cursory look at the public comments on the FDA’s website suggests that the vast majority are indeed strongly in opposition to the proposal.”

The FDA is in the process of reviewing the comments and will then “further evaluate the need for, and appropriateness of, the amendments requested by IDFA and NMPF and decide what further actions are appropriate.”

According to Wilkins, the agency did not indicate when a decision might be made, but considering that the original petition was filed more than four years ago, it probably won’t be any time soon.

Corn price falls

When we entered 2013, the price of near-term corn futures was settling around $7.37. Projections into December 2013 were for lower prices with futures selling near $6.50 per bushel.

Due to three consecutive years of smaller U.S. corn harvests driving inventories to a 39-year low, the Goldman Sachs Group Inc. predicted at the time that prices would rise near record highs.

“While futures fell 14 percent since reaching a record $8.49 a bushel on Aug. 10, 2012, tightening supply before next year’s harvest will drive prices to an average of $8.25 in the next six months, 14 percent higher than today,” Goldman said in a Dec. 5 report.

That never happened. As the USDA reports began to show a greater corn inventory than anticipated, futures into July slowly declined to the $6 range throughout the first half of the year. By mid-summer, December 2013 corn futures were settling at $5.50 per bushel.

According to a University of Illinois report, the recent (five-year) period of growth in the U.S. corn industry appears to have peaked. The domestic ethanol market has hit the E10 blend wall and will be dependent on consumption of higher blends in order to expand total domestic consumption and to increase corn consumption.

The domestic livestock industry is also mature and may require larger exports for production growth. Finally, the corn export market has become a lot more competitive in the past several years as high corn prices have stimulated an increase in world production.

If the size of the U.S. corn market has peaked, a period of lower prices and reduced acreage may be required.

Meanwhile, a corn shortage in Iowa was causing the state to seek crops from other states. Flooding delayed spring planting and last year’s drought knocked down corn yields, according to Ross Korves, economic policy analyst of Michigan-based ProExporter Network, as quoted in an article by Perry Beeman in the Des Moines Register .

Korves spoke to an audience attending the Iowa Farm Bureau Federation’s Economic Summit at Iowa State University. It is estimated the state will have to purchase about 221 million bushels of corn to meet demand from ethanol plants and livestock operations, he said.

Corn forecasts for the state are about 149 bushels per acre, better than last year but lower than the state’s regular output. Iowa is expected to come in below the projected national average of 152 bushels per acre.

In the most recent issue of Progressive Dairyman ( Nov. 21, 2013 ) it was reported corn futures fell to their lowest in more than three years, thanks to the dry weather that improved U.S. harvest prospects. Experts predict global corn inventories will jump 24 percent to a 12-year high, according to an article by Jeff Wilson for Bloomberg.

The USDA has forecast that output will increase 28 percent this season from last year, when drought damaged fields across the Midwest.

U.S. corn reserves were projected to total 1.855 billion bushels at year-end, up from 1.837 billion forecast in August, the USDA said on Sept. 12.

Prices in Chicago have plunged 49 percent from last year’s record. Corn futures for December delivery fell 2.1 percent to close at $4.3075 a bushel on the Chicago Board of Trade, the biggest drop since Sept. 30. Earlier, the price touched $4.3025, the lowest for a most-active contract since Aug. 26, 2010.

Farm bill advances, but not yet complete

After Congress failed to pass a new farm bill in 2012, it resurfaced in 2013.

In early June, the Senate passed Agriculture Committee Chairwoman Debbie Stabenow’s 2013 farm bill by a wide bipartisan margin, 66-27. This bill was similar to the one passed by the Senate in 2012.

On June 20, the U.S. House of Representatives voted to remove the Dairy Market Stabilization Program from the dairy reform provisions proposed in the farm bill on a 291-135 vote.

At first, the vote seemed like a defeat for those who had advocated for the Dairy Security Act for more than two years. But then the chamber surprised most everyone by failing to pass the broader farm bill legislation to which dairy reforms were attached on a 234-195 vote.

Then in order to pass a farm bill in July, the House of Representatives resorted to stripping out the nutrition title, which was later passed on its own in September.

The bills were sent to a conference committee, where select members of the House and Senate work together to resolve differences between the bills.

However, as of press time, it looked as if the four principal members of the committee were struggling to reach an agreement and that it would be unlikely for them to meet the schedule of having a final agreement on the House floor by Dec. 13.

Failure to meet that deadline means the farm bill will once again be punted into the following year and another short-term extension will be necessary to keep from reverting to 1949 law.

Immigration reform – was hot, now is not

Talk of immigration reform was growing louder due to a rather significant shift in political attitudes by the new Congress that took office after the November 2012 election.

Knowing this topic was on the horizon, a number of agricultural interest groups came together to form the Agriculture Workforce Coalition (AWC).

The coalition put forward a framework that includes both an earned adjustment in status for current experienced farm workers and a program to ensure that producers continue to have access to a workforce as current agricultural employees move on to other jobs.

“We have tried to retrofit the H2A visa program for dairy farmers, but that effort was a more limited approach.

Now, we have the opportunity to do something bigger and comprehensive with a unique coalition that together will be able to do more than each of our groups alone could do,” said Jaime Castaneda, senior vice president of strategic initiatives and trade policy for NMPF, one of the founding members of AWC.

Meanwhile, Congress was beginning to address immigration reform with February hearings held by both the House Judiciary Committee and the Senate Judiciary Committee.

In March, Ryan Miltner, attorney at The Miltner Law Firm, reported the president has made comprehensive reform a priority and was urging Congress to act quickly on the issue.

The Senate responded in April with S. 744, a bill titled ““Border Security, Economic Opportunity, and Immigration Modernization Act.” This broad-based proposal was written by a bipartisan group of eight senators, known as the “Gang of Eight.”

Six months later, Democrats in the House of Representatives proposed H.R. 15, based largely on S. 744 (which was passed by the Senate in June) but with some differences in border security.

However, as of press time, that is as far as the bill has gone. Despite calls for the House to begin debate on the bill, it has yet to be brought up in committee, let alone on the House floor.

Even though President Obama has stated he would accept a piecemeal approach, the Washington Post reported: “Conservatives have worried for weeks that passing smaller pieces of immigration reform legislation out of the House – as Republicans have moved to do – would lead to a House-Senate conference committee in which the larger Senate immigration bill might win out.”

The Post went on to note, “House Speaker John Boehner (R-Ohio) said that the House will not enter negotiations with the Senate to hash out differences between its immigration plans and the Senate immigration bill – dealing a significant blow to the prospects of comprehensive immigration reform this Congress.”

California’s price increases not enough for producers

In 2012, California dairy farmers claimed they were being shortchanged by the undervaluation of the state’s Class 4b whey factor.

In January, the California Department of Food and Agriculture (CDFA) released its much-anticipated announcement on the Dec. 21, 2012 milk pricing hearing, saying it would temporarily increase Class 1, 2, 3, 4a and 4b prices by approximately $0.251 per hundredweight (cwt) for the period of Feb. 1 to May 31, 2013.

In June, as a result of another hearing in May, CDFA Secretary Karen Ross extended a temporary price increase across all classes of milk but did not increase the adjustment requested by producers.

Ross had put up a monthly price increase of $0.125 per cwt. On the other hand producers, in a signed petition, said they wanted to increase the price of Class 4b milk and proposed a modification to the sliding scale that determines the dry whey factor in 4b milk.

The producers’ petition, which used 2012 data, would have raised the Class 4b price by about $0.67 per cwt, or an increase of about $0.28 per cwt to the overbase price.

In July, California’s Class 4b price was significantly below the Federal Order Class III price, the benchmark price for milk sold to cheese plants around the country.

Producers attended a hearing Sept. 12, hoping an agreement containing the petitioned increases between producers and processors would stick, negotiated by Assemblyman Richard Pan (D-Lodi) and supported by several legislators, according to an article by Carol Ryan Dumas in Capital Press .

The producers were disappointed. Instead, CDFA decided to extend the same $0.125 per cwt temporary price adjustments on the Class 1, 2, 3, 4a and 4b pricing formulas, implemented as a result of the May 20, 2013 hearing, through June 30, 2014.

A five-month study, commissioned by California Dairies Inc., Dairy Farmers of America Inc. and Land O’Lakes Inc. and conducted by Drs. Mark Stephenson of University of Wisconsin – Madison and Chuck Nicholson of Penn State University, indicated that a properly written federal milk marketing order for California would provide a regulatory structure that would potentially result in higher farm-gate prices.

After reviewing the study results, including possible consequences and opportunities, the three cooperatives agreed to continue working toward a change in the regulatory structure. They intend to have a petition ready to file with the USDA by early 2014.

Bills have been introduced in both the U.S. House and Senate to allow California to voluntarily enter the FMMO system. These bills would designate the state of California as a separate order under the federal system.

They would give California the “right to ‘reblend’ or distribute FMMO receipts to recognize quota value” and permit the state order to retain California’s quota system, which grants producers who own “quota” to receive a higher value for a specified portion of their milk.

Dairy hit by sequestration, government shutdown

In order to meet budget reductions required by sequestration, the USDA suspended a couple of items that had a direct impact on the dairy industry.

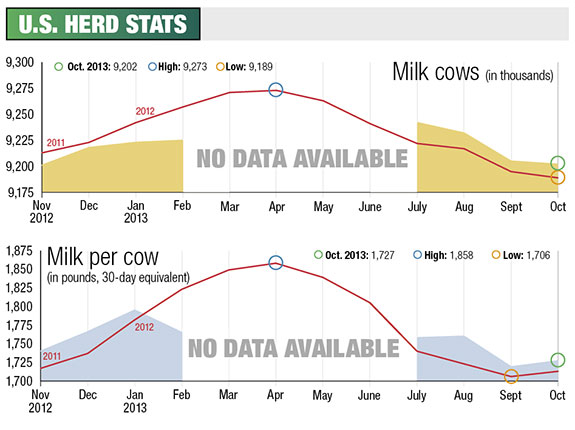

The USDA’s National Agricultural Statistics Service (NASS) announced a suspension of a number of statistical surveys and reports beginning in April and continuing for the remainder of the fiscal year.

The suspended reports include milk production reports including production, disposition and income reports.

Some industry groups strongly objected, saying that elimination of the reports would reduce market transparency and make marketing decisions more difficult.

The USDA reconsidered and on April 3 announced that NASS would continue to issue monthly milk production estimates through the remainder of the fiscal year ending Sept. 30.

However, the reports would be based on “various administrative data,” not on actual producer surveys as before. That meant dairy cow numbers and milk-per-cow statistics would not be available.

NASS was scheduled to resume milk-production quarterly producer surveys in the new federal fiscal year, which began on Oct. 1. However, due to the government shutdown and lapse in federal funding, the surveys could not begin until mid-October. A new release date of Nov. 1 was set for the milk production report.

As the quarterly surveys resume, the dairy cow and milk-per-cow statistics will once again be available. These are critical data points for interested parties to forecast future milk supply.

Farm Service Agency (FSA) farm payments were also temporarily suspended in order to assess the impact of sequestration and determine the least-disruptive process possible for carrying out required cuts.

This included payments for the Milk Income Loss Contract Program (MILC), 2011 Supplemental Revenue Assistance Payments Program (SURE) and the Noninsured Crop Assistance Program (NAP). These payments began again in May.

In terms of the government shutdown, the International Dairy Foods Association said, “In addition to its many other effects, including a freeze on USDA reports and updates, the government shutdown put a damper on current U.S. trade negotiations in the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP).”

U.S. participation in trade talks for both negotiations were hindered due to the lack of federal funding. PD

Karen Lee

Editor

Progressive Dairyman

.jpg?t=1687979285&width=640)