• U.S. milk production up 1.2 percent in June • January-June cow slaughter total up • Semi-annual cow/heifer survey • August Class I base price falls • Trade tensions hurt early July dairy margins • Drought, transportation cloud cottonseed outlook

At a glance

June 2018 U.S. milk production, up a moderate 1.2 percent compared to a year earlier, should be bullish for prices. However, ongoing tariff wars with major export customers cloud the price picture. Reviewing the USDA estimates for June 2018 compared to June 2017:

• U.S. milk production: 18.3 billion pounds, up 1.2 percent

• U.S. cow numbers: 9.404 million, unchanged

• U.S. average milk per cow per month: 1,943 pounds, up 23 pounds

• 23-state milk production: 17.2 billion pounds, up 1.3 percent

• 23-state cow numbers: 8.745 million, up 12,000 head

• 23-state average milk per cow per month: 1,964 pounds, up 23 pounds

Source: USDA Milk Production report, July 20, 2018

A deeper dive

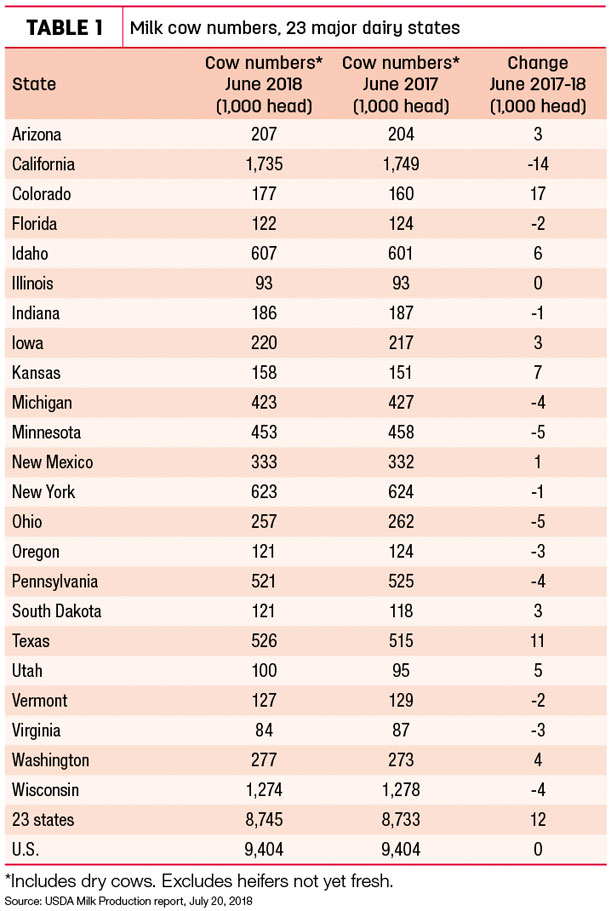

• Cow numbers: At 9.404 million head, U.S. cow numbers were unchanged from both May 2018 and June 2017, although cow numbers in the 23 major dairy states were up about 12,000 head from a year ago (Table 1).

Dairy producers in 10 of those major states had more cows than a year ago, led by Colorado (+17,000), Texas (+11,000) and Kansas (+7,000). Producers in 12 states had fewer cows than a year earlier, led by California (-14,000 head), Minnesota and Ohio (each -5,000 head) and Michigan, Pennsylvania and Wisconsin (each -4,000).

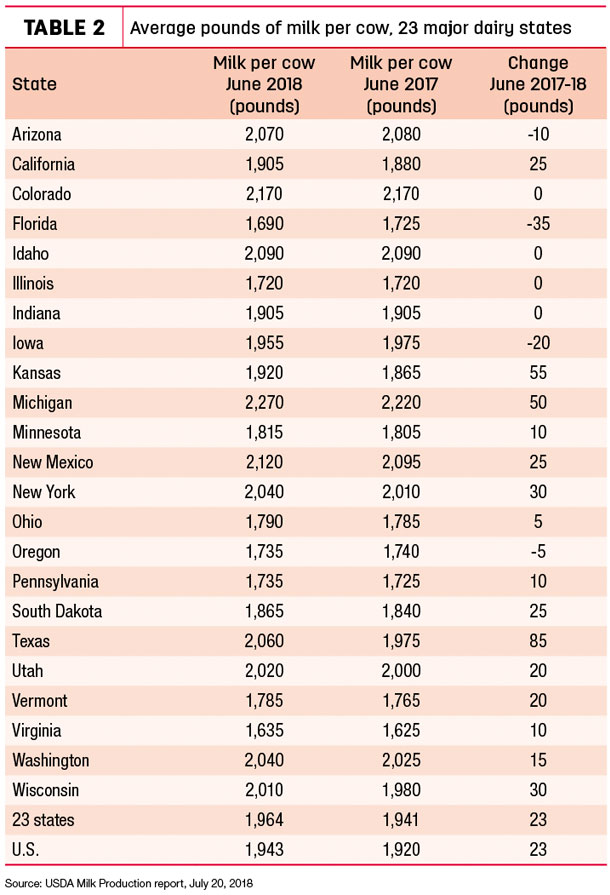

• Milk per cow: June’s steady cow numbers meant the monthly milk production increase came primarily from more milk per cow. Nationally, monthly milk per cow increased 1.2 percent compared to a year earlier (Table 2). June 2018 per-cow production was up 85 pounds in Texas and 55 pounds in Kansas, offsetting 20- to 35-pound declines in Iowa and Florida, respectively.

• Milk production: On a percentage basis, greatest year-over-year milk production growth was centered in three states: Colorado output was up almost 10.7 percent, Kansas was up about 7.4 percent and Texas was up about 6.6 percent. In contrast, eight states saw year-over-year declines, led by Oregon, Virginia and Florida.

Texas led all states for milk production growth on a volume basis in June, increasing production by 67 million pounds compared to a year earlier. That was more than the combined increases in Wisconsin, California and Idaho (61 million pounds).

Cropp-Stephenson outlook: Trade wars continue to cloud market

In their monthly podcast, Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, and Bob Cropp, dairy economics professor emeritus, reviewed the milk production numbers that should be somewhat bullish for prices.

Import tariffs are pulling some U.S. products out of their competitive price positions, which will hurt exports going forward. Some reports of cancelled orders have already surfaced. As a result, Cropp said he is more uncertain than ever in making longer-term milk price projections.

Cash cheddar barrels and butter prices continue to show weakness, with only dry whey providing any strength. Near-term, the July Class III price is likely to be around $14.20 to $14.25 per hundredweight (cwt).

Looking ahead, Cropp said, extreme heat hit many dairy states in July, which should keep the brakes on any large milk production increases. If prices continue to trend lower, cow numbers will be pushed lower, improving the price outlook for 2019. Getting there will be financially painful, however.

Quarterly milk output up slightly

U.S. milk production during the April-June quarter totaled 55.8 billion pounds, up 0.8 percent from the same quarter last year. The average number of milk cows during the quarter was 9.4 million head, 3,000 head less than the January-March quarter, but 4,000 head more than the same period last year.

January-June cow slaughter total up

The number of U.S. dairy cows sent to slaughter during June 2018 was down from May, but slightly higher than June a year ago, according to the monthly USDA Livestock Slaughter report released on July 19.

Federally inspected dairy cow slaughter was estimated at 237,500 head in June, 7,600 head fewer than May, but 800 more than June 2017.

So far, 2018 daily dairy cow slaughter is running about 400 head more than 2017. Through the first six months of 2018, the culling total is 1.569 million head, about 73,300 head more than the same period a year ago and the highest January-June total for any year dating back to at least 1985.

Based on the slaughter estimates, with 9.404 million cows in U.S. dairy herd in June 2018, about 2.5 percent of the herd was culled during the month.

Semi-annual cow/heifer survey

USDA’s semi-annual cow and heifer survey reflected what the milk production report shows for cow numbers – the herd size is steady.

As of July 1, USDA estimated the number of dairy cows calving in the past year at 9.4 million head, unchanged from both Jan. 1, 2018 and July 1, 2017.

Dairy replacement heifers weighing more than 500 pounds were estimated at 4.2 million on July 1, 2018, down 581,300 from Jan. 1, 2018, but unchanged from July 1, 2017.

With cow numbers unchanged, but heifer numbers down 581,300 head since the first of the year, that might suggest large numbers of heifers have entered the milking herd, offsetting higher cow slaughter.

The semi-annual USDA survey covers both beef and dairy cattle operations. It does not provide estimates for individual states.

Trade tensions hurt early July dairy margins

Nearby dairy margins weakened further during the first half of July as trade tensions continued to batter milk and feed prices, according to Commodity & Ingredient Hedging LLC.

Deteriorating milk prices across the board eclipsed favorable movement lower in corn and meal. July brought Chinese tariffs of 25 percent on a multitude of U.S. dairy imports, as well as a further phasing in of Mexican tariffs on U.S. cheese imports.

August Class I base price falls

The August 2018 Federal Milk Marketing Order (FMMO) Class I base price is $14.15 per cwt, down $1.21 from July and $2.57 less than August 2017’s price of $16.72 per cwt.

Through the first eight months of 2018, the Class I base average is just $14.54 per cwt, about $1.83 less than the average for the same period in 2017.

Drought, transportation cloud cottonseed outlook

Drought in major cotton-producing regions will likely lead to greater abandonment of cotton acreage, according to growers and USDA crop analysists.

Citing drought conditions in Texas and Oklahoma and increased dryness popping up in several areas of North Carolina, analysts with the USDA boosted expected 2018-19 acreage abandonment from 17 percent in the June crop outlook report to 22 percent in the July report.

Meeting for the Cottonseed Feed Association/National Cottonseed Products Association annual meeting earlier this month, cottonseed industry representatives said those numbers are likely to be much higher. Those close to the main affected areas in the Texas High Plains said acreage abandonment could end up closer to 35 percent.

Despite the optimism of increased acreage earlier this year, the National Ag Statistics Service’s July 15 crop progress report indicated 28 percent of the U.S. cotton crop was in poor or very poor condition. The cotton crop condition in trouble spots of Texas was rated 42 percent poor/very poor; Oklahoma was rated 41 percent poor/very poor; and North Carolina was rated 26 percent poor/very poor.

“It is looking increasingly like we will be trading a crop this coming year significantly smaller then the past year,” said Nigel Adcock, Cottonseed LLC.

Another common concern during the cottonseed industry’s annual meeting was transportation, Adcock said. Most companies continue to struggle with both availability of trucks and the rates they are being asked to pay. None see this situation easing anytime soon, and some fear it will worsen when ginning season hits. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke

.jpg?t=1687982885&width=640)