- Hilmar Cheese to build Kansas cheese, whey protein plant

- USDA declares drought emergency in 372 Western counties

- USDA to reopen comment on organic dairy cattle transition proposal

- April 2021 dairy sales continue to shift

- USDA buys dairy and seeks more

- Things you might have missed: 'free' school meal proposal, Mexico organic standards

Hilmar Cheese to build Kansas cheese, whey protein plant

Hilmar Cheese Company will build a new cheese and whey protein processing plant in Dodge City, Kansas.

Hilmar is expected to break ground on the facility in the summer of 2021 and be fully operational in 2024. When completed, the company anticipates sourcing milk from dairy producers in southwest Kansas, according to Denise Skidmore, Hilmar’s director of education and public relations. Milk processing capacity was not disclosed.

David Ahlem, Hilmar Cheese CEO and president, called Dodge City an “ideal choice” given its central location, critical existing infrastructure, proximity to the growing local dairy industry and business-friendly climate.

The facility will showcase sustainable solutions, incorporating technologies and sustainable practices to promote carbon neutrality, Ahlem said. The company has adopted the U.S. Dairy Stewardship Commitment and goal to achieve a net zero dairy industry by 2050.

The new facility is expected to create 247 new jobs and represents $460 million in capital investment.

Hilmar Cheese Company was established in 1984 by 12 local dairy farm families in the Central Valley of California. The company added a production facility in Dalhart, Texas, in 2007. It currently produces a variety of cheeses, including cheddar, Monterey Jack, pepper jack, colby, colby jack and mozzarella, as well as whey proteins and lactose. It markets products in 50 countries.

USDA declares drought emergency in 372 Western counties

The USDA has designated more than 370 counties in 12 states as natural disaster areas related to ongoing drought conditions. The designation makes agricultural producers in those and contiguous counties eligible for emergency loans.

Emergency loans can be used to meet various recovery needs including the replacement of essential items such as equipment or livestock, reorganization of a farming operation or the refinance of certain debts. The USDA Farm Service Agency (FSA) will review the loans based on the extent of losses, security available and repayment ability. Loan application deadline is Nov. 5, 2021.

According to the U.S. Drought Monitor, the counties suffered from a drought intensity value during the growing season of (1) D2 Drought-Severe for eight or more consecutive weeks or (2) D3 Drought-Extreme or D4 Drought-Exceptional.

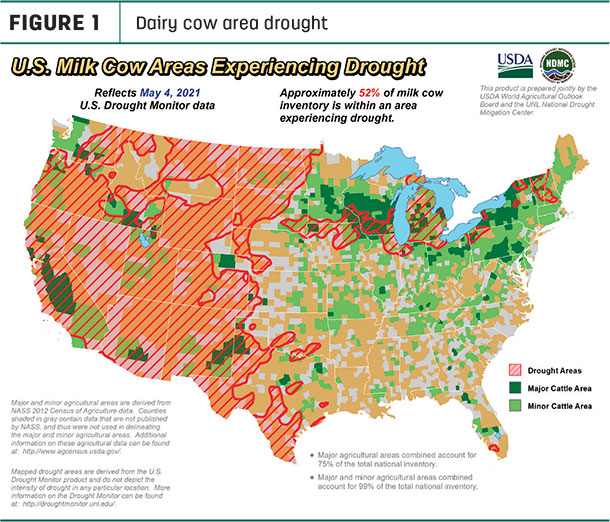

Drought maps updated as of May 4 estimate about 52% of U.S. dairy cows are within areas experiencing drought (Figure 1). In addition, 31% of U.S. hay-producing acreage and 55% of alfalfa acreage was under drought conditions.

States with counties identified as disaster areas on May 10 follow. For a list of individual counties, check the USDA Emergency Designation website.

- 15 counties in Arizona

- 50 counties in California

- 63 counties in Colorado

- One county in Hawaii

- 30 counties in Kansas

- 14 counties in Nevada

- 33 counties in New Mexico

- 10 counties in Oklahoma

- Two counties in Oregon

- 118 counties in Texas

- 17 counties in Utah

- 19 counties in Wyoming

USDA to reopen comment on organic dairy cattle transition proposal

The USDA’s Agricultural Marketing Service (AMS) is reopening the comment period on a 2015 proposed rule to amend the origin of livestock requirements for dairy animals under the USDA organic regulations.

As originally proposed, the rule clarifies requirements for organic dairy farms transitioning conventionally raised animals to organic production. After completion of a one-time transition, any new dairy animals a producer adds to a dairy farm would need to be managed organically from the last third of gestation or sourced from dairy animals that already completed their transition into organic production.

Advocates for changes to the rule charged inconsistent enforcement has plagued the transition of livestock from conventional to organic production. While some organic certifiers strictly adhere to the policy, others allowed farmers to remove calves from organic herds, raise them using conventional practices prohibited under organic regulations, and then transition them back to organic management when they are ready to be milked.

Read: Study finds loophole puts organic dairies at a disadvantage when raising heifers.

The rule was originally proposed in 2015 but withdrawn in 2018. The USDA had previously indicated that it planned to release a new rule in 2019, but then decided instead to reopen the older rule for public comment in October-December 2019.

The new comment period extends until July 12, 60 days beyond the announcement’s publication in the Federal Register, scheduled for May 12. For a link to the rule and comment procedures, click here.

April 2021 dairy sales continue to shift

COVID-19 vaccinations and relaxed travel and dining restrictions are causing a shift in the dairy supply chain balance between retail and food service sales, according to a monthly update from the International Dairy Deli Bakery Association (IDDBA). However, consumers continue to eat more meals at home, and retail dairy sales remain above 2019 pre-pandemic averages.

Retail sales had reached unprecedented heights in the early weeks of the pandemic in 2020, so it’s not surprising 2021 sales aren’t keeping pace, noted Eric Richard, IDDBA industry relations coordinator.

First, the negative numbers: April 2021 retail dairy product sales (dollar basis) were down about 15% from the same month a year earlier. Based on Information Resources Inc. (IRI) U.S. grocery store sales data, the value, unit and volume of sales were all down substantially in nearly all dairy product categories compared to April 2020. Among major product areas:

- Natural cheese sales: -17.9% (value); -17.5% (volume)

- Fluid milk: -11.7%; -15.2%

- Butter: -32.9%; -27.6%

- Process cheese: -24.4%; -24.3%

- Deli cheese: -2.2%; -6%

There were a couple of outliers. Compared to a year earlier, April 2021 yogurt sales were up 4.6% by value and up 3.8% by units and volume sold. Sales of cheese snack kits were up 20.1% by value and 27.1% by unit and volume, an indicator consumers may be moving around and taking cheese snacks with them.

The retail sales numbers look better when comparing April 2021 to April 2019. Overall dairy product sales were up 9% by value. Sales of fluid milk were up 6.9%, natural cheese sales were up 15.6% and yogurt sales were up 5.2%. Among individual dairy product categories, only butter sales were lower.

What’s ahead? Consumer mobility continues to trend up and is likely to result in a further shift from home-centric food spending to food service. According to the IRI survey of primary shoppers, in-person schooling continues to rise, with about 60% of the nation’s school-aged kids going to school at least part of the week, impacting breakfast and lunch. Look for increased demand for time-saving, convenience-focused food solutions and items tied to celebrations, according to the IDDBA report.

USDA buys dairy and seeks more

The USDA is seeking bids to deliver fresh fluid milk for use in federal food and nutrition assistance programs, with deliveries scheduled between July 5-Sept. 29. Bids close May 20. Bids are being sought for:

- Whole milk: 805,500 gallons in 1-gallon containers and 642,150 gallons in one-half gallon containers

- 2% milk: 1.359 million gallons in 1-gallon containers and 1.021 million gallons in one-gallon containers

- 1% milk: 831,600 gallons in 1-gallon containers and 470,700 gallons in one-half gallon containers

- Skim milk: 3,600 gallons in 1-gallon containers and 4,050 gallons in one-half gallon containers

In addition, the USDA is seeking bids to deliver 13.338 million pounds of print salted butter in cases of 1-pound packages, with deliveries scheduled between July 1-Sept. 30. Bids close May 25.

The USDA also awarded bids to for delivery of dairy products between July 1-Sept. 30:

- Byrne Dairy, Lafayette, New York, Industria Lechera DE, San Juan, Puerto Rico, for 12.4 million pounds of 1% milkfat ultra-high-temperature (UHT) pasteurized milk

- O-AT-KA Milk Products Cooperative, Batavia, New York, for 111,537 pounds of evaporated skim milk

- Miceli Dairy Products, Cleveland, Ohio, for 504,000 pounds of shredded mozzarella cheese and 151,200 pounds of mozzarella string cheese

Things you might have missed

-

Senate Democrats introduced the Universal School Meals Program Act of 2021, a proposal to permanently provide free breakfast, lunch, dinner and a snack to all school children regardless of income, eliminate school meal debt and incentivize local food procurement for school feeding programs. Find a bill summary here.

-

Mexico extended the deadline to accept USDA-certified organic products from the U.S. through 2021. Effective Jan. 1, 2022, U.S. organic products exported to Mexico must be certified to standards in Mexico’s Organic Products Law.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke