The Web Soil Survey (WSS) is a free online resource operated by the USDA’s Natural Resources Conservation Service (NRCS). It is available at this link. Using a specific address or delineating an area on an interactive map, you can find a wealth of information based on soil surveys that have been conducted over the past century. Data on soil types include properties such as mean annual precipitation, temperature, frost-free days, pH, productivity, pasture stocking rates and pasture yields. These estimates can be used to estimate pasture lease rates.

Using the Web Soil Survey

While the WSS offers fairly specific estimates based on location and soil type, it is a general guide and won’t reflect management and other improvements. However, it is helpful as a starting point for evaluating a specific parcel of land as outlined below.

For most users, the easiest way to access this database is to enter an address. Starting from the home page, click on the green “start WSS” button. After the program has launched, click on “address” directly under the quick navigation options on the left. Type in your address, including the street address, town and state. Your property should appear with a small orange diamond in the center of the map.

Next, define an area of interest (AOI) by selecting the rectangular AOI icon above the image (see Figure 1). In this example, we have used an address of a ranch near Naples, Idaho (with permission from the owners). A cross hair will appear, and you can use your mouse to draw a rectangle around your area of interest. A box will be appear with blue diagonal lines that delineate the AOI.

Click on the image above to view a larger version.

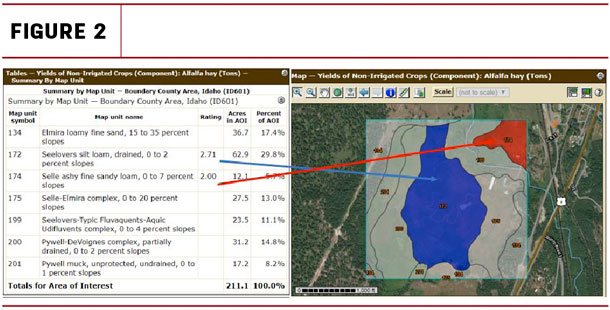

Now go to the “soil map” tab (see red arrow in Figure 2) and click on it. The AOI will now contain red numbers (map unit symbols) and orange lines that show how the AOI has been mapped. On the left, you will see names for each map unit symbol, with acreages and percentage of the total for your AOI. You can find detailed information for each soil type by clicking on its name.

Click on the image above to view a larger version.

To proceed to yield and pasture productivity data, choose the “soil data explorer” tab just to the right of the soil map tab. Choose “vegetative productivity” from the choices on the left. If you scroll down to “prod. index – alfalfa hay,” then choose “view rating,” you will see the productivity rating for that crop by map unit symbol (see Figure 2).

You can also explore “range production” (just below prod. index) for three conditions: favorable year, normal year and unfavorable year. Select “view rating” to create a map of your property by soil mapping unit with ratings in pounds per acre per year of range production. The description below the map explains that total range production is the amount of vegetation that can be expected to grow annually expressed in pounds per acre of air-dry moisture content. You could use these expected yields to determine a pasture lease rate based on the value of this production as described below.

If you would like to find pasture stocking rates by animal unit months (AUMs) for your AOI, choose “yields of non-irrigated crops (component)” toward the bottom of the list. Under “basic options,” click on the down arrow and choose “pasture.” If you click on “view rating,” yield units in AUMs by soil mapping unit will appear. For more information on how this information is calculated, click on “description.”

Using yields and AUM data to determine pasture rental rates

With information on estimated forage and pasture yields and stocking rates, you can use several formulas for determining rental rates. One method uses the forage yield multiplied by 25 percent of the price of grass hay during the grazing season. So if the forage yield is estimated at 1 ton per acre and grass hay is typically around $125 per ton during the growing season, the pasture rent would be $125 times 0.25, or $31.25 per acre (see “Computing a Pasture Rental Rate” for more information).

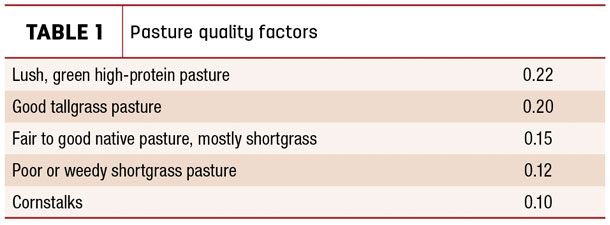

Another approach for calculating pasture rent would be to charge per AUM based on actual usage, based on current market rates. Another approach is to calculate the rental rate per AUM based on current hay prices and quality ratings of the pasture (see Table 1). If the market value of hay during the grazing season is $150 per ton, and it is a good tallgrass pasture, the charge per AUM would be $150 times 0.2, or $30 per AUM. ![]()

References omitted but are available upon request. Click here to email an editor.

-

Kathleen Painter

- Agricultural Extension Educator, Boundary County

- University of Idaho

- Email Kathleen Painter