For the week ending June 22, average carcass weights improved to 800 pounds, but weights were 5 pounds below the same week last year. Similar to last year, first-half 2019 was characterized by higher year-over-year cow and heifer slaughter, reducing the proportion of steers in the slaughter mix, pulling down the average cattle dressed weights.

The 2019 beef production forecast was reduced by 75 million pounds from the previous month to 27.1 billion pounds based primarily on lower expected cattle weights and slightly lower expected third-quarter fed cattle slaughter. The forecast for 2020 beef production was unchanged from the previous month’s forecast at 27.4 billion pounds.

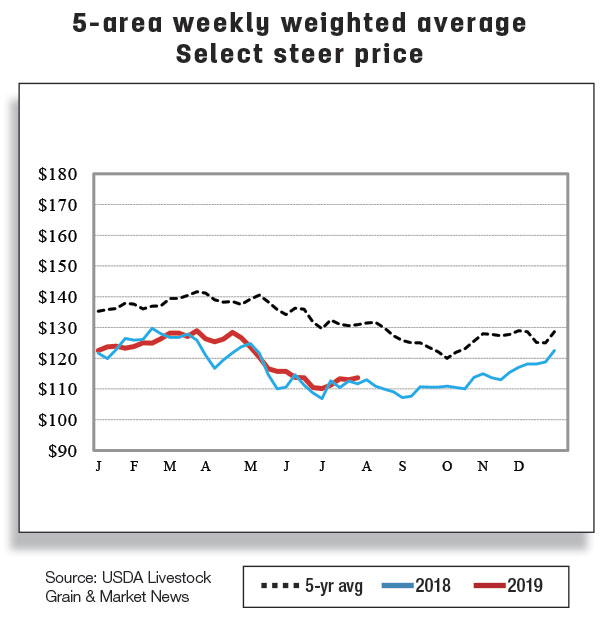

Cattle prices lower in second-half 2019

Since the spring peak of $128.96 the week of March 24, 2019, weekly average fed steer prices in the 5-area marketing region fell to $110.13 per hundredweight (cwt) for the week ending June 30, 2019, about a 15% decrease.

Based on recent price data, the price forecast for third-quarter 2019 was lowered $3 to $107 per cwt, and the price forecast for fourth-quarter 2019 was reduced by $4 to $110 per cwt. As a result, the average 2019 annual price is forecast at $115.50 per cwt, $1.50 lower than the previous month. The forecast for the 2020 annual price was unchanged.

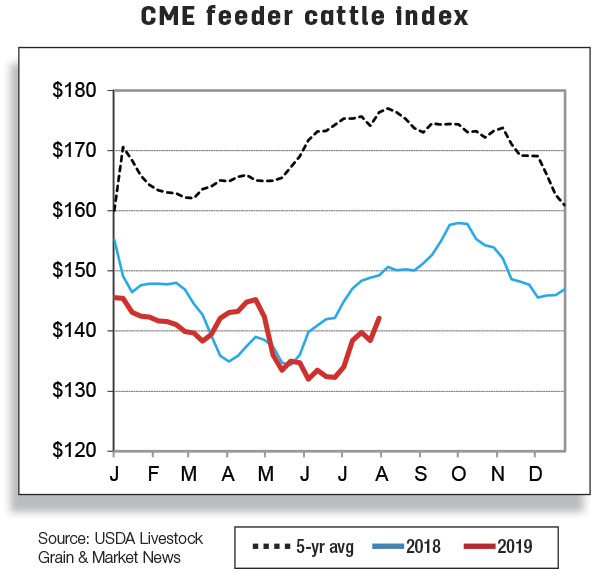

As the result of lower forecast fed cattle prices and higher feed prices relative to last year in second-half 2019, feedlots will likely be less willing to bid up prices for feeder cattle. Based on recent price data, the third-quarter 2019 feeder steer price was lowered by $2 to $143 per cwt, and the 2019 fourth-quarter price forecast was lowered $1 from the prior month to $141 per cwt. As a result, the month’s annual price forecast for 2019 was $1 lower at $141 per cwt. The 2020 annual price forecast was unchanged.

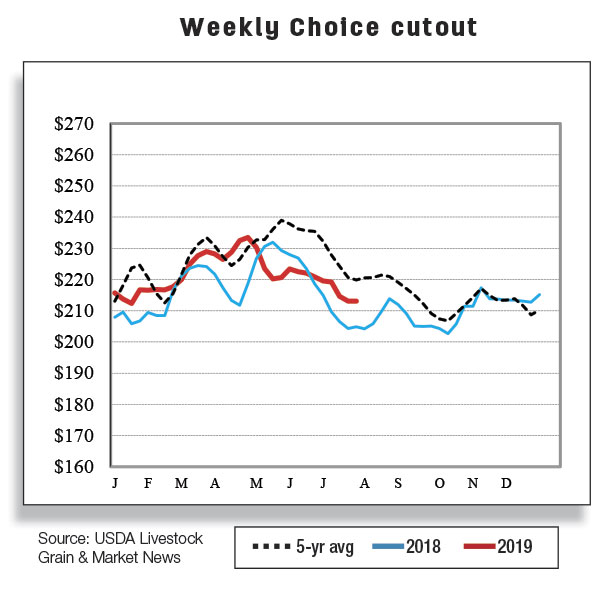

Beef imports rise because of strong lean beef prices

U.S. beef imports in May 2019 increased 6% from year-earlier levels to 296 million pounds. May shipments were higher from all major suppliers except New Zealand. New Zealand’s exports have pivoted toward Asian markets since the beginning of 2019. On the other hand, Australian shipments in May were 30% above year-earlier levels. U.S. beef imports from Australia in the first five months of 2019 were 14% higher compared to last year. Weather events have led to increased cattle slaughter in Australia in first-half 2019.

Prices of imported beef (90% lean) in the U.S. are indicating a strong demand for processing grade meat in the U.S. Based on year-over-year higher imports in April-May, the second-quarter import forecast was revised upward by 10 million pounds from the previous month’s forecast to 840 million pounds. As a result, the 2019 imports forecast totaled to 3.048 billion pounds. However, the 2020 imports were left unchanged from the previous month’s forecast at 2.96 billion pounds.

Beef exports lower than a year ago

In May 2019, U.S. beef exports were fractionally lower than May 2018 at 272 million pounds. Among major destinations, exports declined to Hong Kong, Japan and Canada while increases were to South Korea, Taiwan and Mexico. In Japan, the decline likely continues to reflect increased competition with other suppliers such as Australia, Canada and New Zealand, who have been granted tariff concessions under the implementation of the 11-member Pacific trade deal known as the Comprehensive and Progressive Trans-Pacific Partnership. Lower year-over-year exports to Japan in each month of 2019 resulted in January-through-May exports down almost 4% from year-earlier levels.

Based on year-over-year weaker exports in April-May and lower weekly estimates seen in the USDA Foreign Agricultural Service Export Sales reports for June, the second-quarter 2019 export forecast was revised downward by 10 million pounds from the previous month’s forecast to 790 million pounds. The 2019 beef export forecast totaled 3.151 billion pounds. The 2020 export forecast was left unchanged from the previous month’s forecast at 3.245 billion pounds.

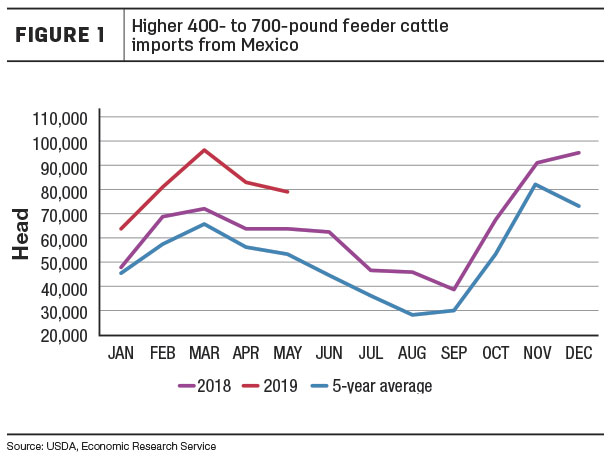

Total cattle imports higher because of stronger imports from Mexico

In May 2019, U.S. cattle imports were more than 20,000 head above year-ago levels at 190,006 head. Higher imports from Mexico more than offset the declines from Canada in May. Imports have been year-over-year higher in each month through May; this resulted in 170,000 head more for January-May than the same period of 2018.

Mexican herd expansion and higher calf crop production are likely to increase the availability of exportable feeder calves throughout the year. Based on stronger imports in the first five months of 2019 coupled with higher weekly imports reported for June from the USDA Agricultural Marketing Service, the 2019 cattle import forecast was revised upward by 55,000 head to 2.1 million head. The 2020 imports forecast was adjusted upward to 2.150 million head.

Mexico is a major source of imported 400- to 700-pound feeder cattle for the U.S., supplying about 90% of total U.S. feeder imports in 2018. In the first five months of 2019, 400- to 700-pound cattle imports from Mexico are 28% higher from year-earlier levels, which are also above the five-year average (see Figure 1).

Feeder imports from Mexico often go for backgrounding prior to entering U.S. feedlots. Better pasture conditions than a year ago in the U.S. are likely supporting increased imports. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a Market Analyst with the USDA – ERS. Email Russell Knight.