As the weather warms up, the demand for hay is also warming. While producers anxiously await the ability to turn cattle out to graze, the slow exit of winter weather is demanding more hay to be bought. Producers are eager for the growing season to take off as the new crop begins to take shape across the country. Here’s the Progressive Forage monthly outlook at hay markets and conditions, assembled in early May.

Moisture conditions relatively unchanged

Despite reports of some March showers, overall U.S. Drought Monitor Maps indicate drought areas to be relatively unchanged. As of May 2, approximately 25% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, the same percentage that was reported a month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions dropped to 26% from 27% the month prior.

While that percentage is relatively the same, the acreage considered under drought is still at a multiyear low.

Many states are hoping to see an increase in late spring showers to continue to bring the percentage of area under drought even lower in the coming month.

Hay prices tracked

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

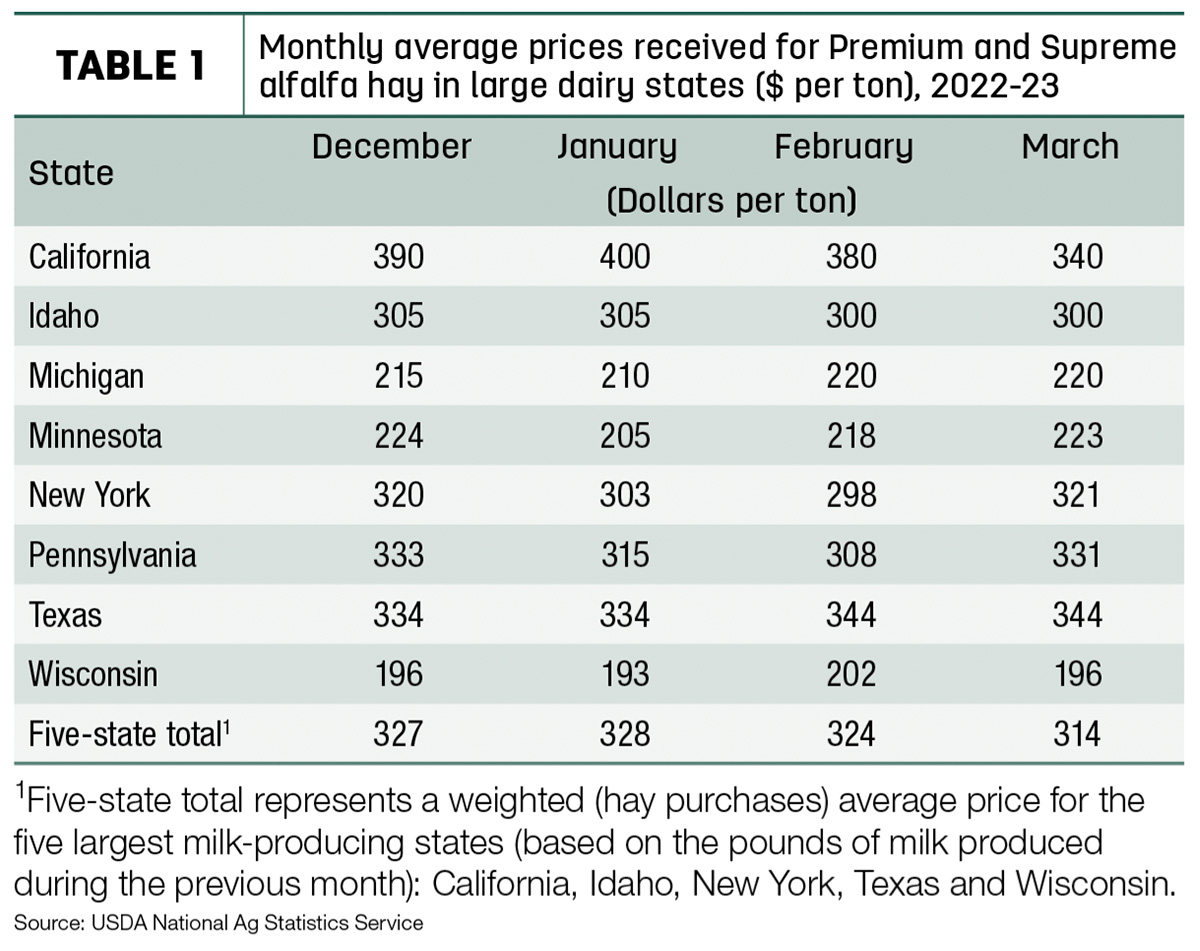

Dairy hay

The top milk-producing states reported a price of $314 per ton of Premium and Supreme alfalfa hay in the month of March, a $10 decrease from February of this year. The price is $45 higher than what was reported in March 2022 (Table 1). The largest difference across the country was the contrast between Wisconsin ($196 per ton) and Texas ($344 per ton) – a $148-per-ton difference.

Alfalfa

The U.S. average price fell $23 in March to $243 per ton versus February’s $266. Prices increased across 16 of the 28 reporting states, led by a $13 increase in both Pennsylvania and New York and a $10 increase in Iowa, Kentucky, Montana, Nebraska, New Mexico, Oklahoma, South Dakota and Washington. The biggest decrease in prices was a $30 decrease in Nevada (previously $310) and California, which had a $25 price decrease from $345 to $320.

Other hay

With a $185 per ton average, the March 2023 average U.S. price for other hay was up from February of 2022, which was reported at $172 per ton. Prices increased in 13 states, with the biggest jumps happening with a $10 increase in Colorado, Iowa and Montana. Ten other states saw an increase in price between $1 and $9.

Hay exports on the rise

Coming off a slow start to the year for exports, total export metric tons (MT) continue to increase as we progress into 2023, and March continues that trend.

Exports of alfalfa hay were estimated at 176,590 MT, an increase of around 13,622 MT from February of this year. While exports to China dropped from 85,072 MT to 72,813 MT, exports to Saudi Arabia increased from 22,114 MT to 37,203 MT. Japan had a minor increase of around 2,745 MT. Several other countries had minor increases in alfalfa hay exports as well.

March exports of alfalfa cube stayed fairly consistent in March, with an estimated 188 MT decrease reported.

Other hay exports increased from 76,363 MT to 83,452 MT in the month of March. Japan’s exports decreased slightly from 49,017 MT to 43,156 MT. South Korea saw a slight increase from 12,461 MT to 16,191 MT. The biggest increases came from Taiwan and China, which increased from 9,205 MT to 13,047 MT and 1,248 MT to 3,874 MT, respectively.

Regional markets

- Midwest: In Nebraska, demand was solid and steady for forage products across the board. Sales heated up this week as the phone lines stayed busy. New customers are having a hard time finding hay, as existing customers are filling the entirety of the contracts. Summer grass turnout could be delayed due to slow-to-grow forage in the topsoil due to drought, keeping the demand for hay high. New-crop alfalfa is being negotiated on the western side of the state in the $230- to $240-per-ton range. Many pivots are running either immediately before or after planting.

In Kansas, demand remains good while prices hold steady. Trade numbers are still reported to be slow. Rains in the last month have improved the stress of drought severity. Although much more rain is needed, the moisture has helped new growth prosper.

In South Dakota, the warmer weather has allowed for some fieldwork to begin. Corn is beginning to be planted while the seasonal weather takes hold. The clock is ticking to get the fieldwork done, as rain is forecast over the next few weeks. While greenup has begun, alfalfa is taking a bit of a slow start to recover from the winter. More rain is still needed, specifically in the drier regions of the state. Demand for all types of hay remains very good.

In Missouri, the hay supply is very light, while demand stays moderate. Prices hold steady, and the biggest concern remains the drought. Over half of the state is now appearing on the drought monitor. Reports of early cutting and wrapping to stimulate supply are coming in some areas. Fescue and orchardgrass should be cut in the coming weeks to help supplement the supply, but the rain the state desperately needs is still being awaited.

- East: In Alabama, hay prices hold steady, while trade remained with moderate demand and light supply.

In Pennsylvania, alfalfa sold slightly weak, as did alfalfa/grass mix. A weaker undertone was noted for all products sold despite buyer demand remaining moderate.

- Southwest: While the record-high snowpacks recorded in March are beginning to melt, the lack of overall moisture in other areas creates a drastic difference between the drought-stricken areas of the Southwest and those with moisture to share.

In California, retail hay demand with steady prices was reported as good, while overall trade and activity remained moderate. Dairy-quality and hay for export demand held steady with an overall moderate tone. Due to a period of warm and dry weather, pesticide and herbicide applications proceeded, and corn emergence began. A portion of winter forage crops was harvested, while others are continuing to be irrigated and maturing in the field. Hay began to be cut for haylage or cut and raked in preparation for baling.

In New Mexico, trade is reported to be very active with very good demand. Alfalfa prices remain steady, with some growers finished with the first cutting. Conditions are mostly dry, with a few scattered showers reported across the state. Hay prices are reportedly high compared to last year due to the increase in input cost.

In Oklahoma, moisture is still in high demand across the western side of the state, while the new crop has been put on hold due to moisture in other parts of the state. The pricing of hay is still unreported due to the large number of bales still unaccounted for. That number will help determine the cost of production and therefore the price of the hay.

In Texas, first-cutting alfalfa and grass hay has been cut or is being laid down. There are no reported trades to base prices off of. Hay prices hold steady across all regions, as well as hay movement. Supplemental feeding continues, while producers continue to cull livestock due to a shortage of last season's hay. Hay demand is very good statewide.

- Northwest: Snow drought concerns still remain in northern Washington, northern Idaho and northwestern Montana for April.

In the Columbia Basin, weather permitting, a new start on crop harvest should begin this week. Trade is slow, with a light-to-moderate demand. Not enough sales are reported for accurate price trends to be estimated.

In Montana, hay sales hold steady, while demand for hay comes in at moderate to good. Demand fell slightly over the month, as many cattle were turned out early due to high hay costs. Reports of small and single-load quantities being let go came in. Some growers are taking lower prices than advertised, as hopes for the new crop remain high. Hay is being sold to the Southwest, as prices reported in those states are higher. Backhauls to these states are being used to cut shipping costs.

In Idaho, not enough new sales were reported to declare an accurate trend, but a steady undertone was noted across all hay. Trade is slow with light-to-moderate demand.

In Colorado, few trades were reported on horse and grinder hay, while the overall trade activity was very light on good demand. No contracts have been finalized yet, but growers are beginning to negotiate prices on the new crop. Contracts on dairy green-chopped triticale are beginning to be finalized.

In Wyoming, reported hay sales are steady. Demand remains good with livestock owners still looking to buy. Some producers are beginning to irrigate, but overall, the state is behind schedule in most areas. The southwest corner remains dry and in need of moisture.

Other things we’re seeing

- Dairy: With April Federal Milk Marketing Order (FMMO) milk class prices mixed and the price of Class III moving above the price of Class IV for the first time since May 2022, potential pooling in the FMMO could take place. At $19.20 per hundredweight (cwt), the April Class II milk price is down 32 cents from March and $6.51 less than April 2022. At $18.52 per cwt, the Class III milk price rose 42 cents from March but is $5.90 less than April 2022. At $17.85 per cwt, the April 2023 Class IV milk price declined 43 cents from March and is $7.36 less than April 2022. It’s the lowest Class IV price since October 2021. In addition to Class II-III-IV prices listed above, the April 2023 advanced Class I base price was previously announced at $18.85 per cwt, down 14 cents from March and $5.53 less than April 2022.

- Cattle: The annual fed steer price was raised by about $2.50, for an overall projection of $164.50 per cwt in 2023. This is an increase of around 14% from a year ago. The outlook for second-quarter beef production could reflect a shift of fed cattle slaughter out of the first quarter and into the second quarter, as the first-quarter beef production outlook was lowered by around 25 million pounds. Beef production from cattle and calves dropped 1% in 2022 to 45.7 billion pounds. In contrast, the total production of cattle, calves, hogs and pigs jumped up to 86.3 billion pounds.

- Fuel: Fuel prices decreased slightly across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.53 per gallon, a decrease of 6 cents from the week earlier, 79 cents lower than a year ago. The average U.S. retail diesel price was around $3.92 per gallon, which is down 9 cents from the previous week and $1.70 cheaper than May 2022.

- Trucking: Spot flatbed prices fell slightly over the month of April, with a decrease in average price from 1.6%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.78, Midwest – $2.86, South – $2.69, Northeast – $2.63 and West – $2.29.

- Other costs: The Federal Reserve Board met on May 2-3 to raise interest rates another 0.25%, making the overall federal funds rate 5.25%, a record high since August 2007. This increase was the 10th increase since March of 2022. A Purdue University/CME Group Ag Economy Barometer survey reported that ag producer sentiment is improving slightly. Many producers believe the Federal Reserve rates may finally be nearing their peak, while discussions of the next farm bill are providing optimism for change.

In contrast to that optimism is the hesitation of 70% of polled producers about making large investments, referring to overall price increases – specifically in machinery and labor.