The 2023 Dairy Margin Coverage (DMC) program is entering its final months. Without a 2023 Farm Bill – or temporary extension of the 2018 Farm Bill – the program expires at the end of the calendar year.

One side note potentially affecting the risk management schedule: Congress averted a government shutdown on Oct. 1, approving a “continuing resolution” and establishing a new deadline to negotiate appropriations bills to keep the federal government – including the USDA – operating. The continuing resolution is set to expire on Nov. 17. Lack of approval of USDA funding could impact administration and/or availability of risk management programs. The ongoing Federal Milk Marketing Order (FMMO) modernization hearing, set to resume on Nov. 27, could be affected by any government shutdown. Check the Progressive Dairy website for updates.

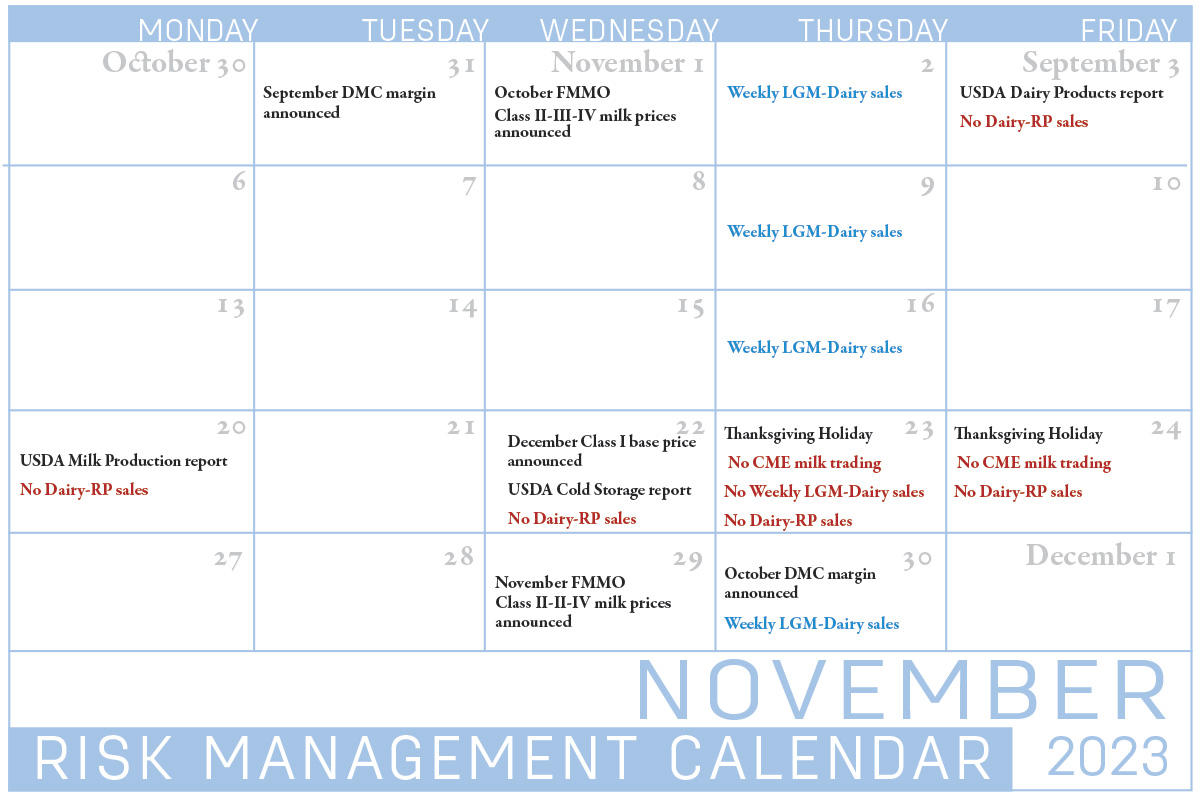

For now, here’s Progressive Dairy’s look ahead at important dates, reports and advice affecting risk management decisions, as well as other information impacting your milk check in November.

DMC program

The September 2023 DMC margin and indemnity payments will be announced on Oct. 31, with October data released on Nov. 30.

At $6.46 per hundredweight (cwt), the August DMC margin triggered Tier I and Tier II indemnity payments at all coverage levels of $6.50 per cwt and above. The top payment was $3.04 per cwt at the maximum Tier I $9.50 coverage level.

September DMC numbers are expected to continue to improve, combining a small recovery in milk prices and a slight decline in projected feed costs. As of Oct. 20, the DMC decision tool forecast the September margin at $8.46 per cwt and the October margin at $9.17 per cwt.

Through Oct. 2, DMC indemnity payments for the first eight months of 2023 had reached nearly $1.24 billion, a new annual record high, surpassing 2021.

Dairy Revenue Protection (Dairy-RP)

Producers managing risk through Dairy-RP are eligible to cover revenue from the first quarter of 2024 (January-March) through the first quarter of 2025. Dairy-RP quarterly endorsements are available for sale until about the 15th of the month preceding the quarter to be covered. That means coverage availability for the first quarter of 2024 closes on Dec. 15.

The market changes daily and Dairy-RP endorsements must be purchased between the Chicago Mercantile Exchange (CME) market closing and the next CME opening. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when CME trading is closed due to holidays. In November, that includes the Thanksgiving holiday (see Calendar).

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports are released that could impact markets, including Milk Production, Cold Storage and Dairy Product reports.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency (RMA).

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of October contains the months of December 2023 through October 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

September milk production

U.S. milk production fell below year-ago output for a third consecutive month. The USDA adjusted U.S. cow estimates and milk production totals back to April, putting the U.S. herd at its smallest number since January 2022. Average year-over-year milk production per cow is stagnant. Contributing to the smaller milking herd, about 2.38 million head of dairy cull cows were marketed through U.S. slaughter plants during January-September 2023, up about 101,500 from the same period in 2022. (Read: September milk production lower as cow numbers decline)

FMMO data

Administrators of the 11 FMMOs reported September 2023 prices and pooling data, Oct. 11-14. The calendar has turned to autumn and with it brought some seasonal changes in milk production, components and prices. Something that hasn’t changed much is the depooling of Class IV milk volumes, a situation that might last for years to come. (Read: September milk checks should improve)

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released Oct. 12. The milk production forecast for 2023 was raised from last month on slightly more milk output per cow, while the forecast for 2024 was unchanged. Price outlooks were mixed. (Read: USDA forecast offers mixed outlook for milk prices)

Check the Progressive Dairy website for updates affecting milk prices as they become available.