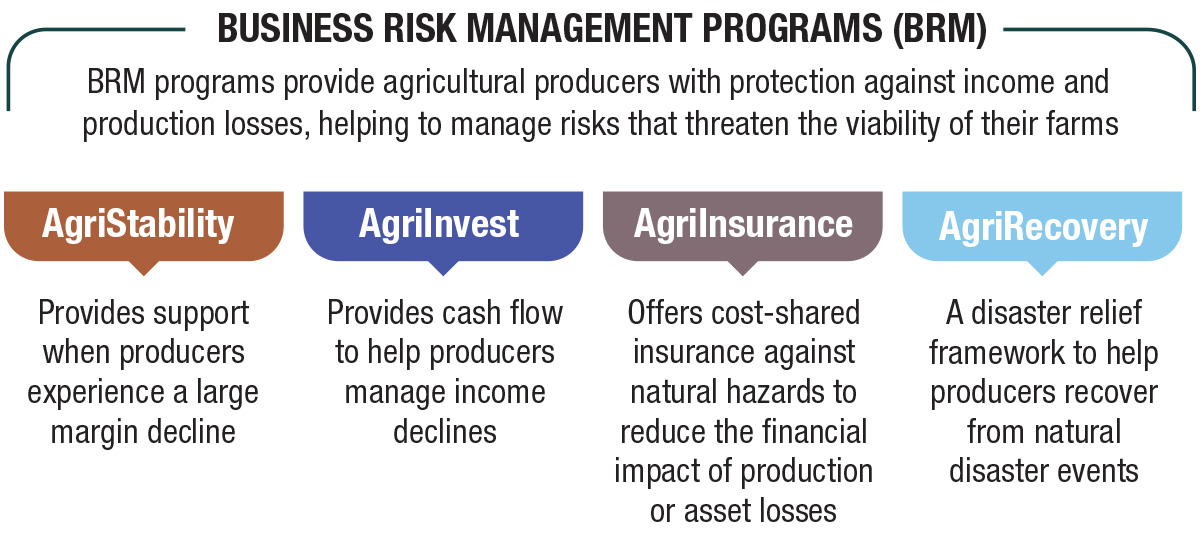

As part of Agriculture and Agri-Food Canada’s programs and activities, AAFC offers a suite of business risk management (BRM) programs. These BRM programs are designed to support producers in managing risks to their operations. As such, producers need to consider what each program offers individually and in conjunction with each other to determine how best to use the suite to complement their risk management strategies.

AgriStability is one of the mainstays of BRM programs. Under the Sustainable Canadian Agricultural Partnership (Sustainable CAP) – a five-year agreement and multibillion-dollar pledge among the federal, provincial and territorial governments to strengthen the competitiveness, innovation and resiliency of Canada’s agri‐food sector – some changes have been introduced to enhance the program.

Updates to AgriStability

The federal, provincial and territorial governments have worked together over the past number of years to make AgriStability more straightforward, timely and predictable. Under Sustainable CAP, program administrators have access to new program features, which will provide additional coverage, allow for easier filing and estimate the amount of a potential payment.

Producers can choose their reference margin calculated on the same accounting basis as their tax filing. This means participants who file to the Canada Revenue Agency (CRA) using cash accounting will no longer need to submit up to five years of historical accrual information, significantly reducing the information requirement. Participants who file to CRA using accrual accounting will continue to have their reference margins based on the five years of historical accrual income and expense information they report to CRA for tax purposes. Program deadlines for AgriStability will also change to June 30 for submitting program forms (or Sept. 30 with penalty).

Another feature to enhance the predictability of the program includes a coverage notice to qualifying producers that lets them know what their estimated production year coverage will be. This will help producers better determine if they experienced a margin loss sufficient to trigger an AgriStability payment. Producers who believe they will not be in a payment position do not need to submit a final application, further simplifying the program and saving money on accounting fees.

These program features have been introduced through Sustainable CAP in jurisdictions where AAFC delivers the program (Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia and Yukon) beginning in 2024 and in other jurisdictions that choose to offer them starting in 2025.

Demystifying the application process

A common misconception about this program is that the application process to participate in AgriStability is too complex and requires the support of an accountant. In most cases, producers should be able to provide the information needed to participate in AgriStability without the support of an accountant. Administrators are also available to help producers complete the necessary forms or walk them through the application process.

Integrate climate risk management and readiness with AgriInvest

The AgriInvest program is also evolving to integrate climate risk management and climate readiness into BRM programs. This remains a top priority of federal, provincial and territorial governments. Starting in the 2025 program year, AgriInvest participants with average Allowable Net Sales (ANS) of $1 million or more will be required to have a valid agri-environmental risk assessment in place to receive matching government contributions.

The $1 million threshold will be based on the average ANS calculated over the three years preceding the program year. A list of eligible agri-environmental risk assessments is currently being developed and will be in place for 2025. Given that supply-managed commodities are not eligible for AgriInvest, producers will need to have some non-supply-managed production to be eligible.

Once in place, producers who meet the $1 million threshold will need to provide a certificate or proof that they completed one of the eligible agri-environmental risk assessments for the program year upon request.

Federal, provincial and territorial governments provide roughly $250 million, on average, in matching contributions to AgriInvest accounts every year.

Sustainable CAP represents a shared commitment to enhance sector resiliency so producers can better anticipate, mitigate and respond to risks through a robust suite of BRM programs. The Government of Canada will continue to collaborate with producers to ensure they have a suite of programs they can rely on when facing extraordinary situations.

This article was written by Agriculture and Agri-Food Canada, a department of the Government of Canada.

For more information, visit the BRM programs website.

AgriStability: An overview

AgriStability protects enrolled producers against large declines in farming income for reasons such as production loss, increased costs and market conditions. AgriStability is a margins-based program, centred on the producer's whole-farm program margin for the year (eligible income minus eligible expenses). If the program-year margin has declined by more than 30% compared to their historical average, the producer receives 80 cents for every dollar lost past that point.

AgriStability provides essential support to protect producers' livelihoods against threats beyond their control, such as unpredictable weather, crop or animal disease, or poor yields. It also helps producers manage their farms during periods of market downturn, such as low commodity prices, market volatility or rising input costs.

The program is tailored to each individual producer to ensure affordability and accessibility. For example, the cost of AgriStability protection is very affordable at only $3.15 for every $1,000 of reference margin protected. A producer with a $100,000 reference margin would only pay $315 to participate in the program each year. AgriStability is a low-cost way for producers to protect against significant declines that impact their whole operation. This is especially true now, as the compensation rate under the program was increased from 70% to 80% beginning in 2023.